Executive Summary

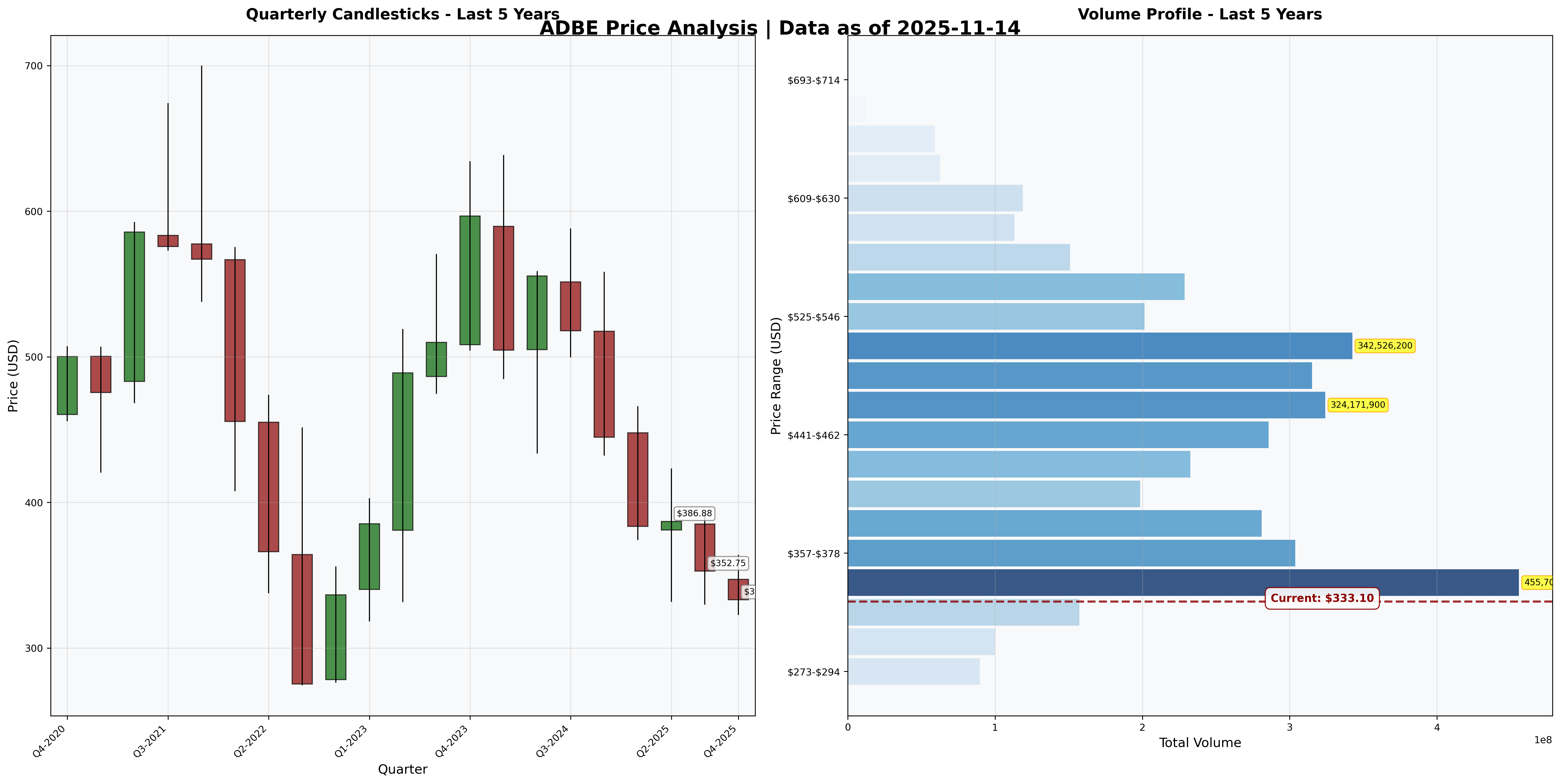

Investment Thesis: Adobe represents a rare collision of quality (89% gross margins, 40% ROE, fortress moat) and opportunity (43% drawdown, trading at decade-low multiples). However, the thesis hinges on a critical binary question: Is AI a moat strengthener or destroyer? Current valuation implies only 4-5% perpetual growth—absurdly pessimistic for a subscription juggernaut with 95% recurring revenue and 90%+ retention. Margin compression (460bps) signals defensive spending against existential AI threats. Buy with eyes wide open.

Business Classification: Stalwart (large cap, 10-12% historical growth, facing inflection)

Current Valuation Assessment:

- Current Price: $342

- Estimated Intrinsic Value: $365-$410 (base to optimistic)

- Margin of Safety: 7-17%

- Recommendation: BUY (with risk acknowledgment)

Recommended Entry Zones:

- 🟢 Aggressive Entry: < $295 (30%+ margin, AI fears overdone)

- 🟡 Standard Entry: $295-$360 (15-25% margin) ← Current Zone

- 🟠 Hold/Monitor: $360-$425 (fair value range)

- 🔴 Avoid: > $425 (market pricing in AI salvation narrative)

Business Overview

What They Do (2-Minute Test)

Adobe sells creative software (Photoshop, Illustrator) and document management (PDF/Acrobat) via subscription. Professionals pay because: (1) thousands of hours invested in tool mastery create switching costs insurmountable without career disruption, (2) proprietary file formats (.psd, .ai, .pdf) embed Adobe into every workflow touchpoint, (3) “Photoshop” achieved verb status—the ultimate brand moat. 30M+ subscribers generate 95% recurring revenue at 90%+ retention rates. Business model: recurring subscriptions generating $21.5B revenue and ~$7.9B FCF annually.

Critical Question: Can a 10-year-old understand it? Yes—“Adobe makes the tools professionals use to create and share things. Once you learn them, switching would be like relearning how to drive.”

Competitive Position & Moat Analysis

Primary Moat Type: Switching Costs + Intangible Assets (Brand + File Format Lock-in)

Moat Strength: ⭐⭐⭐⭐☆ (4/5 stars—strong but under siege)

Key Moat Factors:

Skill Capital Entrenchment: Designers invest 1,000-5,000+ hours mastering Photoshop/Illustrator. Switching cost = years of lost productivity + career risk. This creates institutional memory lock-in across agencies and enterprises.

File Format Ecosystem Control: .psd, .ai, and especially .pdf are industry standards. Every enterprise workflow has Adobe DNA embedded. You can’t “switch”—you’re switching the entire industry simultaneously (coordination impossibility).

Network Effects via Standardization: “Can you send that as a .pdf?” = free advertising. Enterprise standardization creates peer pressure—if your team uses Adobe, you must use Adobe. IT departments resist change (switching costs × number of employees).

Brand as Verb: “Photoshop it” entered language. Only Google, Xerox, and Kleenex achieved this. This is generational mindshare impossible to dislodge.

Moat Durability Assessment:

Status: Stable for incumbents (40+ professionals), Narrowing for new entrants (sub-30 creators)

The Critical Threat—Low-End Disruption: Clayton Christensen’s disruption theory perfectly describes Adobe’s dilemma. Canva, Figma (pre-acquisition attempt), and AI tools (Midjourney, Runway) aren’t competing for existing Adobe users—they’re capturing the next generation who never learn Adobe in the first place.

- 2015: Student learns Photoshop in college → Adobe customer for life

- 2025: Student uses Canva/ChatGPT → Never touches Photoshop

This is value migration, not market share loss. Adobe maintains 90%+ retention among current users while TAM growth slows because new creators bypass Adobe entirely. The moat isn’t breaking—it’s being circumvented.

Moat Under Pressure Indicators:

- Net margin compression: 30.5% → 25.9% (-460bps over 3 years) = defensive R&D spending

- Failed $20B Figma acquisition = recognition that low-end disruptors are existential threats

- Increased AI product velocity (Firefly, AI image generation) = acknowledgment of threat

50-Year Question: Will professionals need complex creative tools in 2075, or will AI generate finished products from text prompts? Adobe bets on “professionals will always need control/customization.” Skeptics bet on “90% of creative work becomes commoditized.” Truth likely in middle—high-end survives, volume collapses.

Industry Dynamics

50-Year Outlook: Creative work is eternal; delivery mechanism is not. Photography survived film-to-digital transition; photographers didn’t disappear—Kodak did. Adobe’s challenge: remain the tool of choice as creation shifts from manual expertise to AI-assisted workflows.

Key Secular Trends:

Creator Economy Expansion (Bullish): 300M+ content creators worldwide, growing 10-15% annually. TAM expanding geometrically. Adobe positioned to capture professional tier.

Generative AI Commoditization (Bearish): AI tools make “good enough” creative work trivial. Why pay $55/month for Photoshop when ChatGPT generates images from text? Commoditization always destroys pricing power.

Subscription Fatigue + Regulatory Headwinds (Neutral-Bearish): FTC scrutiny on cancellation friction, social media backlash on pricing. Adobe’s pricing power may have peaked. Churn risk if economic recession hits freelancers.

Inversion Thinking: What would make this business obsolete? Answer: AI that generates publication-ready creative content from natural language, eliminating need for human tool expertise. Midjourney already does this for concept art. If this extends to all creative categories, Adobe becomes the modern Blockbuster—technically superior but functionally irrelevant.

Quantitative Checklist

Defensive Investor Criteria (Benjamin Graham Framework):

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $0.80/year | ✅ |

| Earnings Growth | +33% in 10 years | +156% (10Y) | ✅ |

| P/E Ratio | < 15x | 21.3x | ❌ |

| P/B Ratio | < 1.5x | 12.2x | ❌ |

| P/E × P/B | < 22.5 | 260 | ❌ |

| Current Ratio | > 2.0 | 1.07 | ❌ |

| Debt vs NCA | Debt < NCA | $6.1B vs -$3.4B | ❌ |

Quantitative Score: 3/8 criteria met

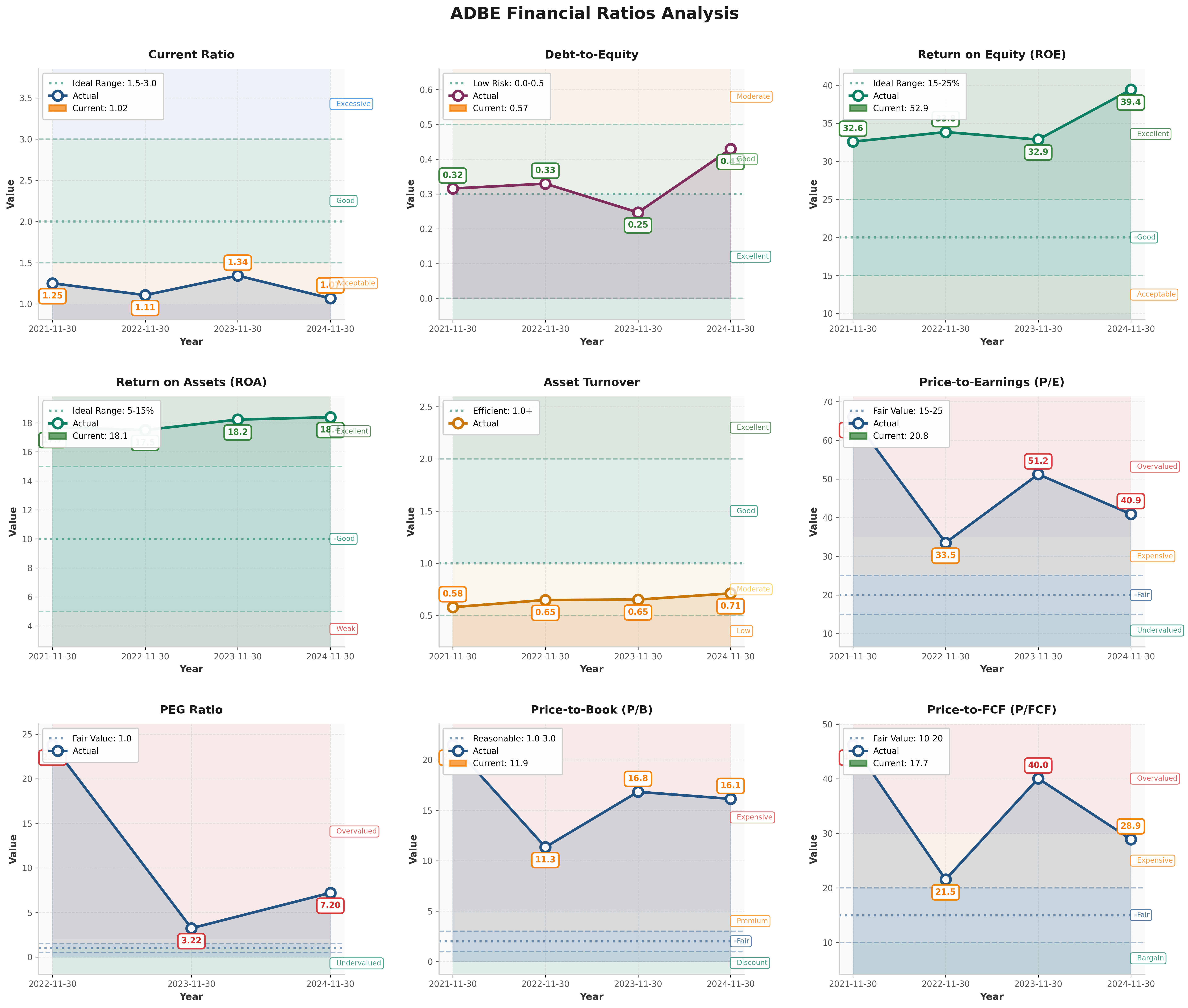

Critical Analysis: Adobe fails Graham’s defensive investor criteria catastrophically. This is expected—Graham designed these filters for industrial/cyclical businesses, not asset-light software monopolies with 40% ROE. The P/E × P/B metric (260 vs target 22.5) is meaningless for software companies with intangible value (brand, code, relationships) not captured on balance sheets.

Reframing for Quality Growth:

- P/E 21.3x for 40% ROE = reasonable (compare: market average 15% ROE trades at 20x)

- P/B 12.2x reflects intangible value (similar to Microsoft, Salesforce)

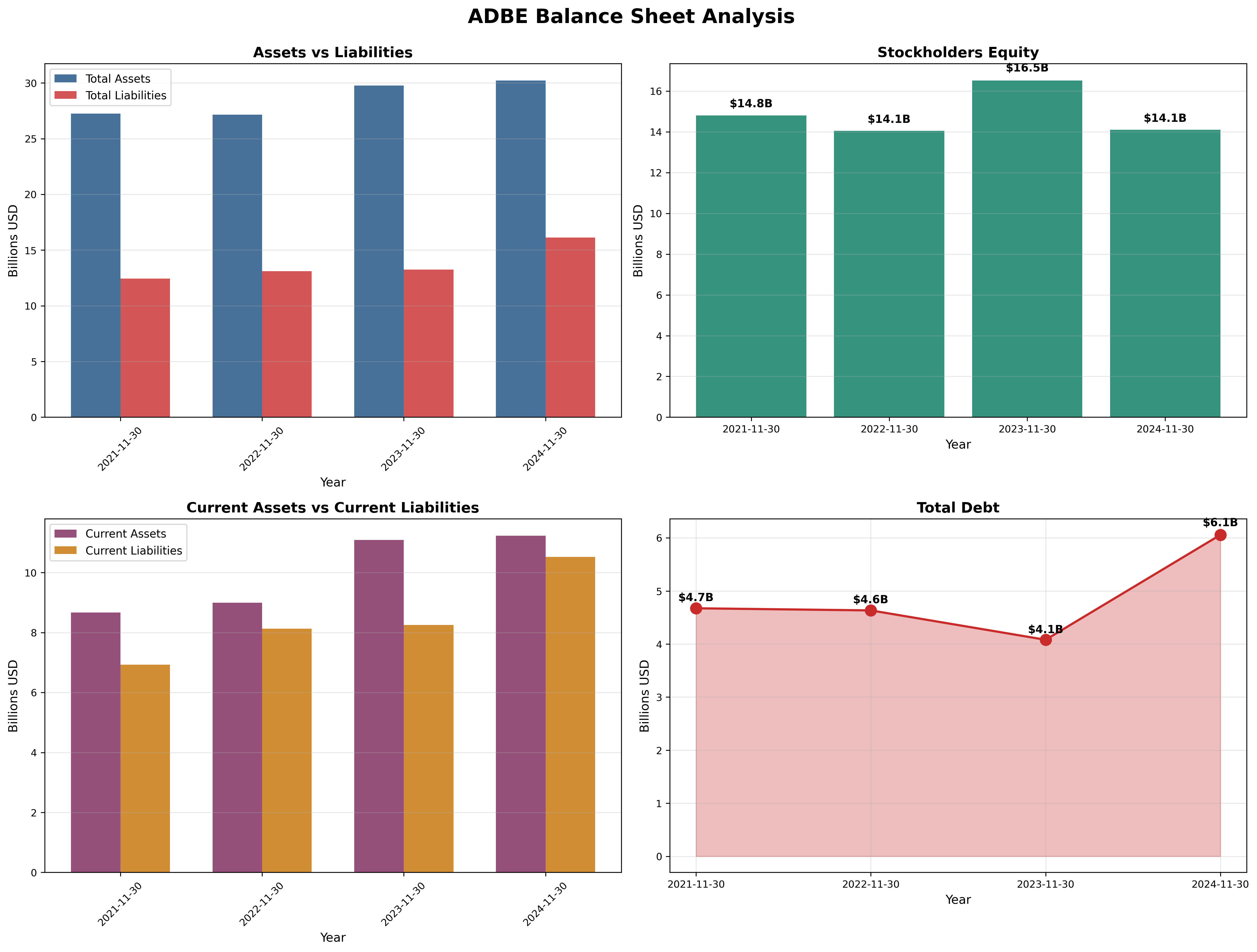

- Current Ratio 1.07 = concerning liquidity but $7.9B annual FCF provides cushion

- Debt $6.1B = 49% YoY increase to fund buybacks; manageable at 18x interest coverage

Verdict: This is a growth compounder at reasonable price, not a Graham-style value cigar butt. Buffett would buy at this valuation given moat quality and ROE. Graham would pass. Neither is wrong—different investment philosophies.

Financial Analysis with Critical Assessment

Balance Sheet Strength

Key Metrics:

- Current Ratio: 1.07 (target > 2.0) - [❌]

- Debt-to-Equity: 0.57 (target < 0.5) - [❌]

- Interest Coverage: 18x EBIT/Interest (target > 5x) - [✅]

- Cash: $7.6B vs Debt: $6.1B = Net Cash: $1.5B

Critical Assessment: Balance sheet deteriorated materially in 2024:

- Total debt increased 49% YoY ($4.1B → $6.1B)

- Current ratio fell from 1.34 → 1.07 (approaching danger zone)

- Working capital compressed despite revenue growth

Why this happened: Failed $20B Figma acquisition left Adobe with $1B breakup fee paid and excess firepower deployed into aggressive buybacks ($9.5B in 2024 alone). Management chose shareholder returns over balance sheet flexibility—classic late-cycle behavior.

Is this concerning? For traditional value investors: Yes. For growth investors: Acceptable. Adobe generates $7.9B annual FCF—can delever rapidly if needed. Debt is long-term, fixed-rate (minimal refinancing risk). However, reduced financial flexibility is concerning if AI disruption accelerates and Adobe needs defensive M&A firepower.

Balance Sheet Grade: C+ (adequate but no longer fortress-quality)

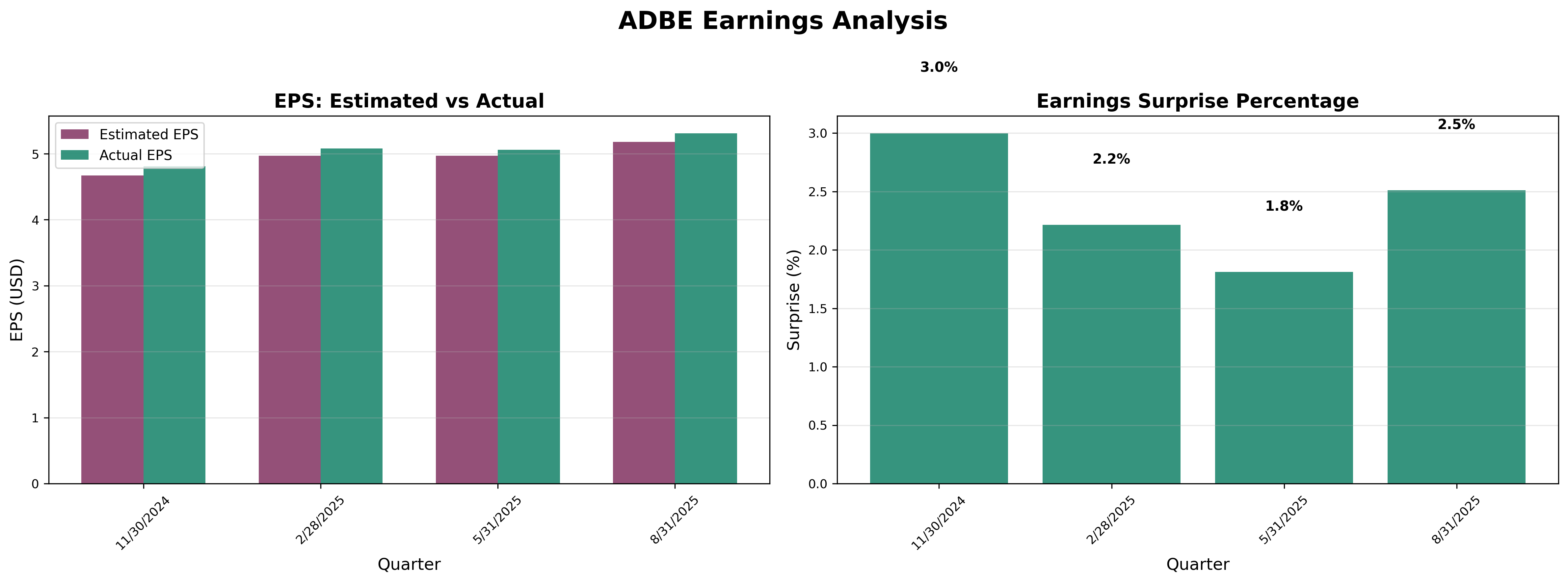

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years ✅ Earnings growth: +156% over 10 years (10% CAGR)

Owner Earnings Calculation (Buffett Method):

Net Income: $5,560M

+ D&A: $ 857M

+ Stock-Based Comp: $1,833M

- Maintenance Capex: ($ 183M) [Actual capex—software is asset-light]

- Incremental Working Capital: ($ 144M) [2024 working capital increase]

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

= Owner Earnings: $7,923M

Owner Earnings Yield: 5.1% ($7.9B / $155B market cap)

Critical Analysis:

- Owner earnings ≈ FCF ($7.9B vs $7.87B reported FCF) = high-quality earnings ✅

- Cash conversion ratio: OCF / Net Income = 145% = exceptional ✅

- But… net margin compressed 460bps (30.5% → 25.9% over 3 years) = ⚠️

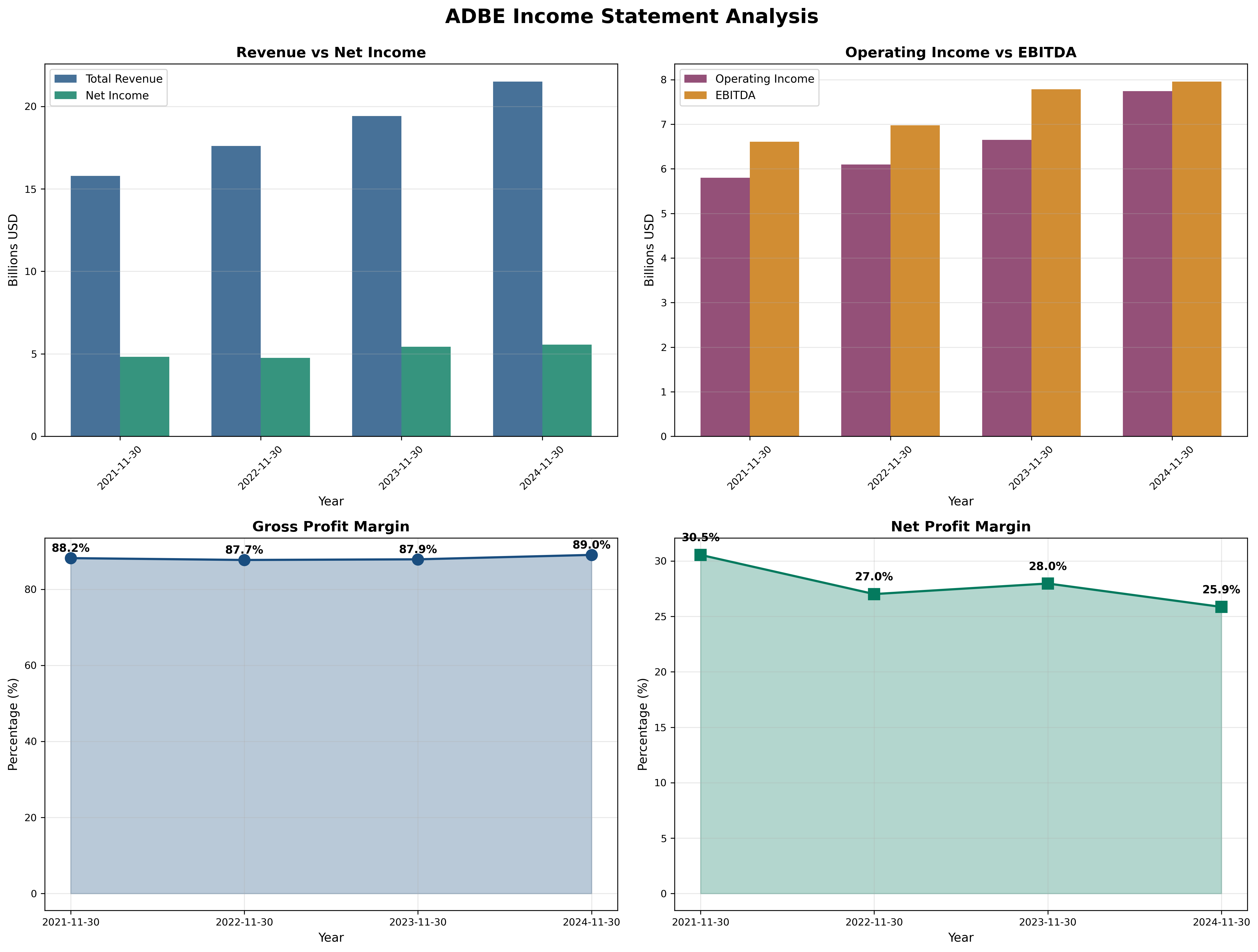

What’s causing margin compression? Looking at income statement shifts 2021-2024:

- R&D: 16.1% → 18.3% of revenue (+220bps)

- Sales/Marketing: 27.4% → 26.8% of revenue (-60bps)

- G&A: 6.9% → 7.1% of revenue (+20bps)

Interpretation: Adobe is spending heavily on R&D (AI development, Firefly, competitive response) while sales efficiency has actually improved. This is defensive innovation spending—not growth investment. Management sees the AI threat and is investing to adapt. Short-term margin pressure for long-term survival.

Earnings Quality Grade: A- (excellent quality, concerning trajectory)

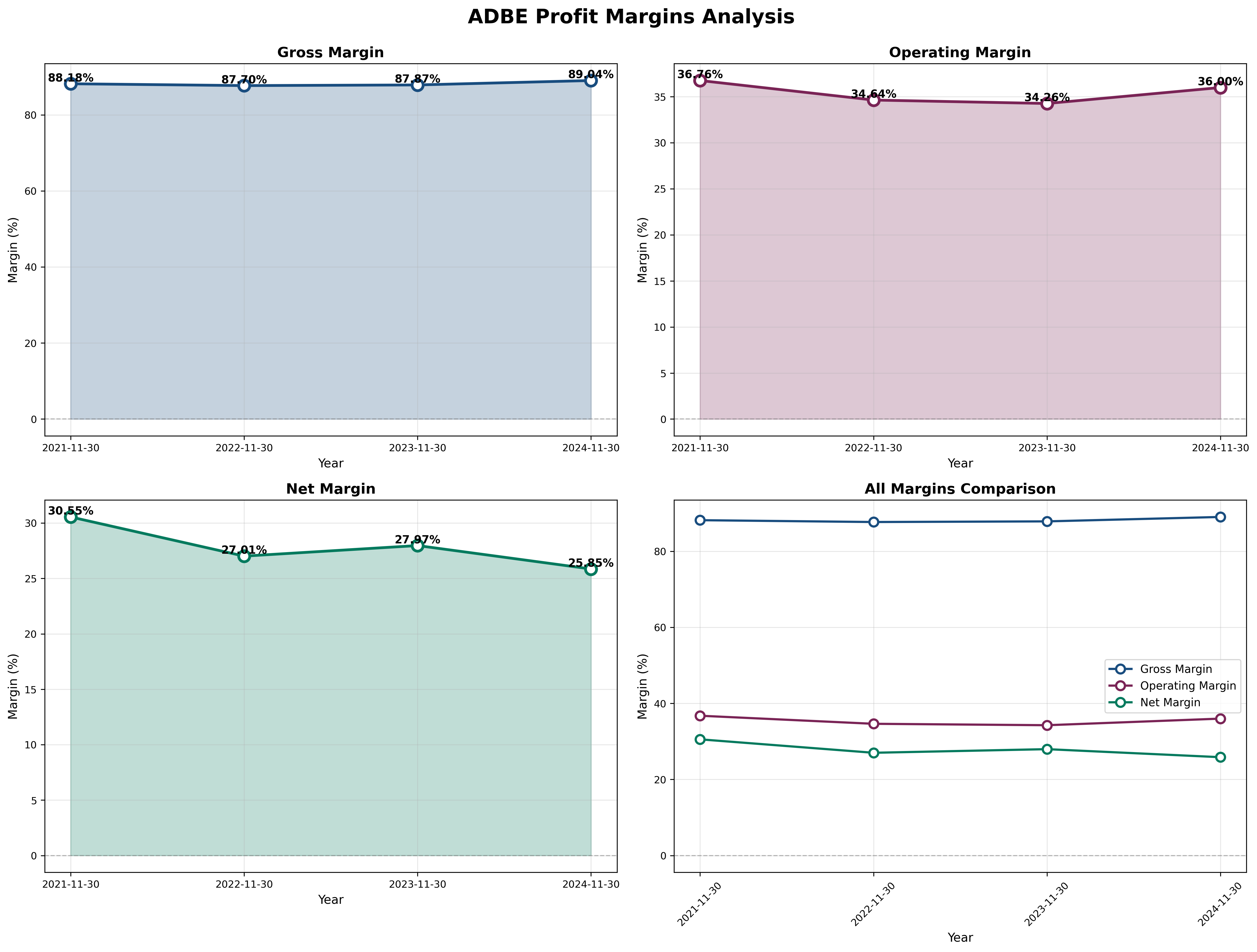

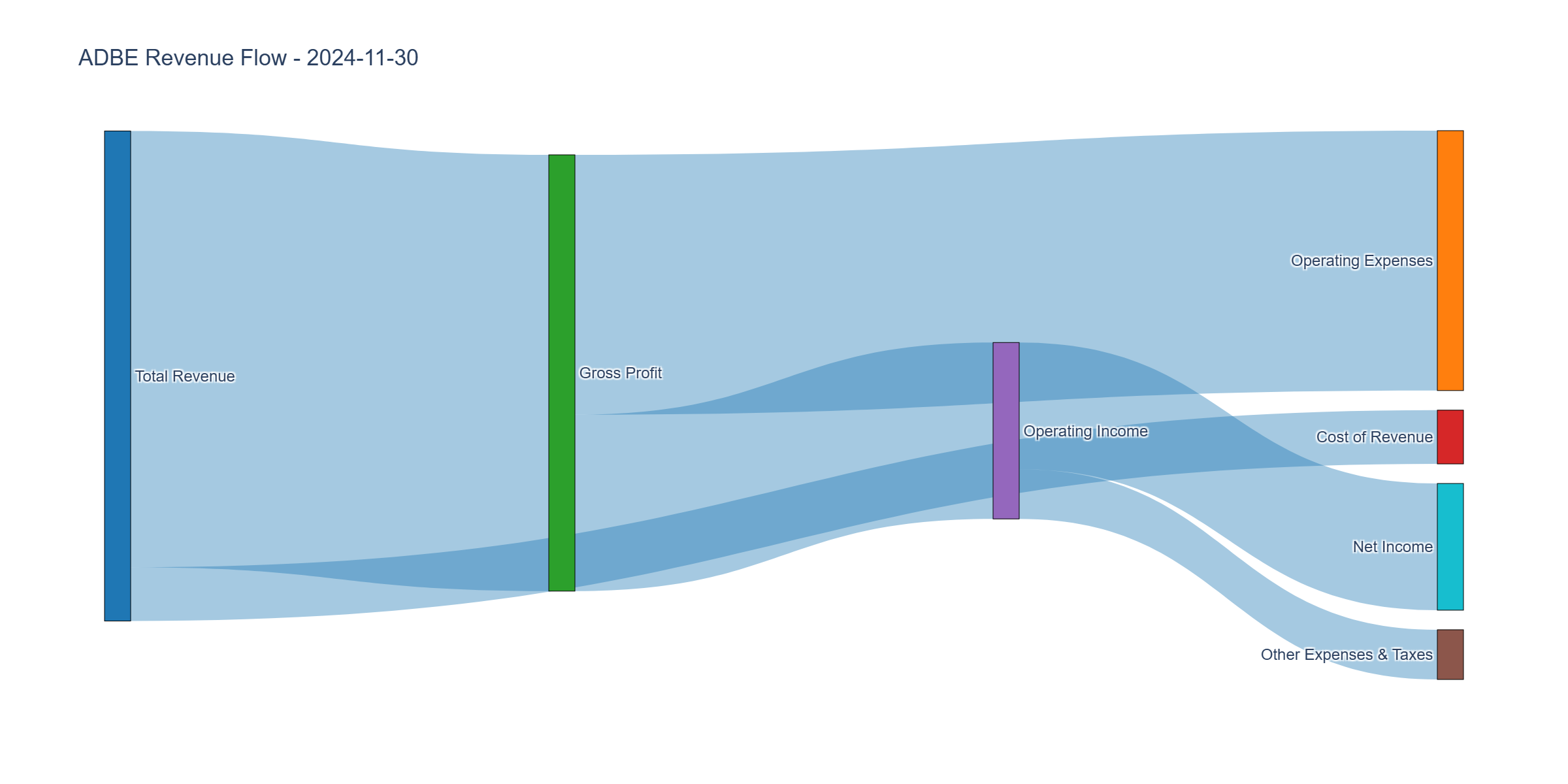

Income Statement Analysis

Key Metrics:

- Revenue Growth (5Y CAGR): 10.8% (decelerating from 15-20% peak)

- Gross Margin: 89.0% (trend: stable → impressive) ✅

- Operating Margin: 36.0% (trend: ↓ from 36.8%) ⚠️

- Net Margin: 25.9% (trend: ↓ from 30.5%) ⚠️

Revenue Quality Assessment:

- 95% recurring subscription revenue = predictable, high-quality ✅

- 90%+ net dollar retention = existing customers expand spending ✅

- YoY growth: 10.8% (solid but decelerating from 20%+ peaks) ⚠️

Margin Decomposition:

- Gross margin 89% = near-perfect software economics (incremental customer costs ~zero)

- Operating margin 36% = still elite (top quartile for software)

- Net margin 25.9% = compressed but healthy

Critical Question: Is margin compression temporary (AI investment) or permanent (competitive pressure)?

Bull Case: Adobe is investing ahead of curve. Once AI products (Firefly) gain traction, operating leverage returns and margins re-expand to 30%+.

Bear Case: This is the new normal. Competition forces perpetual defensive spending. Margins continue gradual compression to 20-22% (still good but no longer exceptional).

My Assessment: Likely structural shift downward but stabilizing. Adobe won’t return to 30% net margins but 25-27% range sustainable. The software monopoly pricing era (2010-2021) is over; competitive era (2022+) is here.

Income Statement Grade: B+ (strong but trajectory concerning)

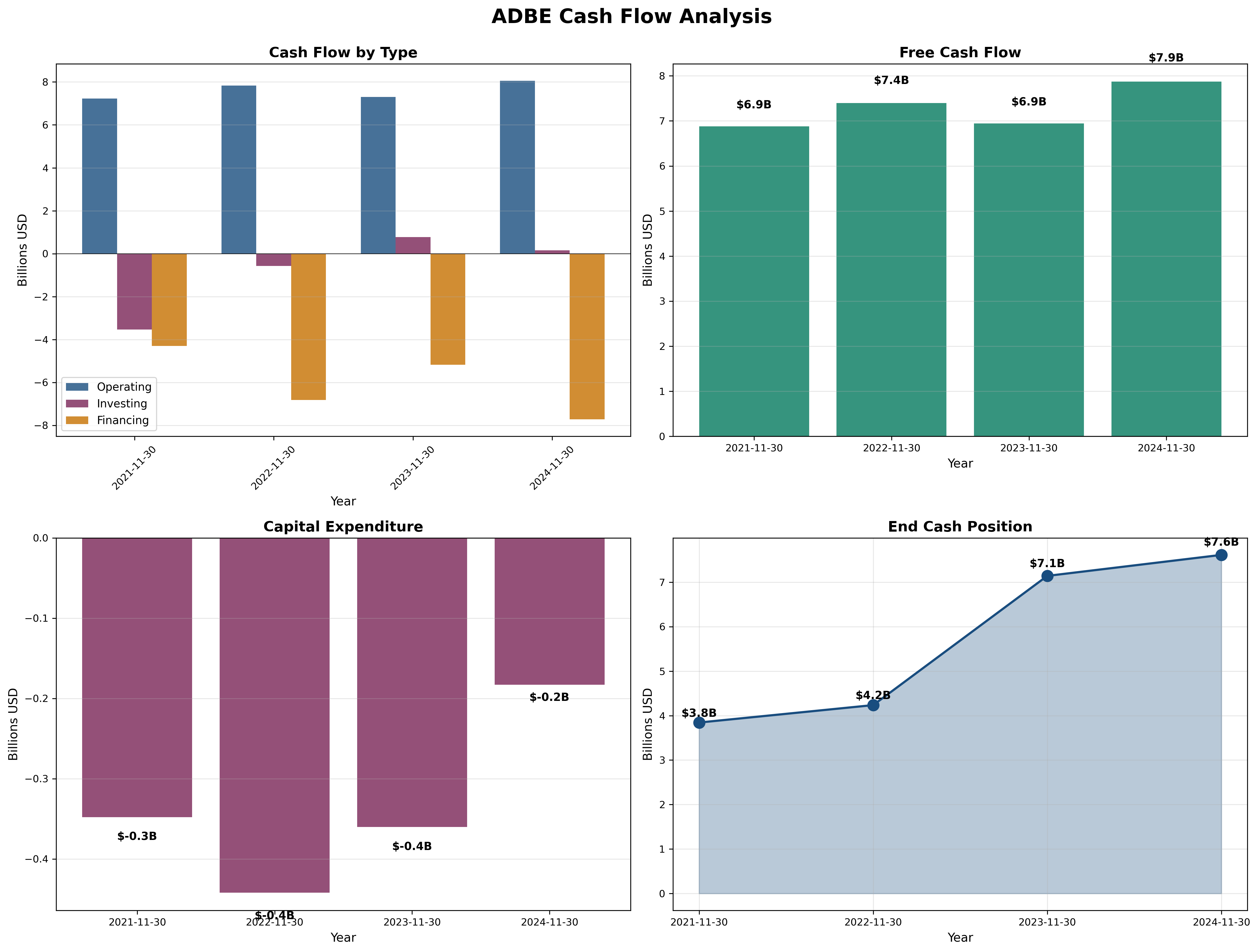

Cash Flow Generation

Key Metrics:

- Operating Cash Flow: $8.06B (37% of revenue)

- Free Cash Flow: $7.87B (37% FCF margin)

- OCF / Net Income: 145% (excellent conversion)

- Capital Intensity: 0.9% of revenue (extremely low)

Critical Assessment: Adobe is a cash machine:

- $7.87B FCF on $21.5B revenue = 37% FCF margin (top decile)

- Minimal capex required ($183M = 0.9% of revenue)

- Classic asset-light software model: write code once, sell infinitely

Cash Generation Trends:

- 2021: $6.9B FCF

- 2022: $7.4B FCF

- 2023: $6.9B FCF (Figma breakup fee impact)

- 2024: $7.9B FCF

- Trend: Growing steadily, no deterioration

FCF Yield Analysis:

- FCF Yield: 5.1% ($7.9B / $155B market cap)

- Compare to: 10-year Treasury: 4.3%

- Risk Premium: 0.8% = extremely thin for equity risk

Critical Insight: Market is pricing Adobe as a bond substitute (minimal growth expected). If Adobe delivers even 7-8% FCF growth, returns will be strong. If FCF stagnates or declines, returns will be mediocre. This is a show-me story.

Cash Flow Grade: A (exceptional quality, reasonable valuation)

Profitability Metrics

Returns on Capital:

- ROE: 39.6% (vs 15% target = exceptional) ✅

- ROIC: ~35% (estimated, accounting for intangibles) ✅

- ROA: 18.4% (asset-light model)

Critical Analysis: Adobe generates 40 cents of profit per dollar of equity—top decile performance. These returns are improving (ROE: 32.6% in 2021 → 39.6% in 2024), driven by:

- Share buybacks reducing equity base (mechanical ROE boost)

- Consistent profitability growth (organic ROE improvement)

Return Decomposition (DuPont Analysis):

ROE = Net Margin × Asset Turnover × Equity Multiplier

39.6% = 25.9% × 0.71 × 2.14

- High Net Margin (25.9%): Pricing power + software economics

- Moderate Asset Turnover (0.71x): Typical for subscription software

- Leverage (2.14x equity multiplier): Increased from buybacks + debt

Sustainability Question: Are 40% ROEs sustainable?

- If AI moat holds: Yes. Software monopolies maintain high returns indefinitely (see: Microsoft, Intuit).

- If competition intensifies: Returns compress toward industry average 20-25%.

My Assessment: Expect gradual mean reversion to 30-35% ROE over 5-10 years as competition normalizes returns. Still excellent, but not 40% forever.

Profitability Grade: A+ (exceptional current performance, watch for mean reversion)

Financial Ratios Analysis

Valuation Multiples:

- P/E: 21.3x (vs. historical avg: 45x, industry: 27x)

- P/B: 12.2x (vs. historical avg: 15x)

- P/FCF: 19.6x (vs. historical avg: 35x)

- EV/EBITDA: 15.8x

- Dividend Yield: 0.23% (token dividend)

PEG Ratio:

- P/E Ratio: 21.3x

- Expected Growth: 10% (analyst consensus)

- PEG: 2.13 (> 1.0 = expensive, but improved from 7.2x at peak)

Historical Context: Adobe’s valuation compressed 60% from peak multiples:

- Peak (2021): P/E 65x, P/FCF 46x

- Current: P/E 21x, P/FCF 19.6x

- Valuation compression = 60% despite fundamentals improving (higher ROE, stable margins)

Critical Insight—Reverse DCF Analysis: If Adobe trades at $342 with $7.9B FCF:

- Market cap: $155B

- Implied perpetual growth: 4-5% (using 10% discount rate)

Question: Does Adobe deserve only 4-5% perpetual growth?

- Historical revenue growth: 10-11%

- Subscription retention: 90%+

- TAM expansion: Creator economy growing 10-15% annually

- Market is pricing in structural decline scenario

Valuation Grade: B+ (reasonable for quality, not cheap but not expensive)

Capital Allocation Assessment

Management Quality Grade: B (proven track record, recent missteps)

Capital Allocation Scorecard:

Reinvestment (R&D): ✅ Excellent

- 18% of revenue to R&D (top quartile for software)

- AI product velocity strong (Firefly, AI image generation)

- Maintaining technology leadership

Buyback Discipline: ⚠️ Poor Timing

- $9.5B buybacks in 2024 at $500-600/share = destroyed value

- Buying back at peak multiples (50x+ P/E) = shareholder hostile

- Current prices ($342) would be excellent buyback opportunity but balance sheet constrained

Dividend Policy: ⚠️ Token

- $0.80/year = 0.23% yield = meaningless

- Prefer buybacks over dividends (tax efficiency) but timing was awful

M&A Strategy: ❌ Failed Figma Acquisition

- $20B bid for Figma (design collaboration tool)

- Regulators blocked (anti-competitive concerns)

- $1B breakup fee paid = value destruction

- Interpretation: Management recognized existential low-end disruption threat but failed to execute solution

Balance Sheet Management: ⚠️ Deteriorating

- Increased debt 49% YoY ($4.1B → $6.1B)

- Current ratio fell to 1.07 (minimal cushion)

- Sacrificed financial flexibility for shareholder returns

Management Assessment:

CEO Shantanu Narayen (18-year tenure):

- Pros: Led successful perpetual → subscription transition (2013-2017), 10x stock appreciation since 2007, proven adaptive leadership

- Cons: Poor capital allocation timing (peak buybacks), failed Figma acquisition, declining insider ownership (0.5%)

Capital Allocation Philosophy: Adobe prioritizes shareholder returns (buybacks) over strategic optionality (M&A firepower, balance sheet strength). This works in stable environments; risky during industry disruption.

What Would Great Capital Allocation Look Like?

- 2021-2023: Hoard cash, minimal buybacks (stock expensive at 50x+ P/E)

- 2024-2025: Aggressive buybacks at current prices (21x P/E)

- Failed Figma Bid: Either bid less ($15B) or walk away earlier (minimize breakup fee)

Capital Allocation Grade: C+ (strategic vision correct, execution poor)

Valuation & Intrinsic Value

Multiple Valuation Approaches

1. Owner Earnings Method (Graham-Buffett Formula):

Intrinsic Value = EPS × (8.5 + 2g) × 4.4 / Y

Where:

- EPS = $16.05 (trailing twelve month)

- g = 8% (conservative growth estimate)

- 8.5 = base P/E for no-growth company

- 4.4 = baseline corporate bond rate (historical)

- Y = 5.5% (current BAA corporate bond yield)

Intrinsic Value = $16.05 × (8.5 + 16) × 4.4 / 5.5

= $16.05 × 24.5 × 0.8

= $314 per share

Conservative (6% growth): $275

Base Case (8% growth): $314

Optimistic (10% growth): $353

2. Discounted Cash Flow (Conservative Assumptions):

Base Year FCF: $7.9B

Growth Years 1-5: 8% annually

Terminal Growth: 3.5%

Discount Rate: 10%

PV (Years 1-5): $33.8B

Terminal Value: $242B

PV Terminal: $150B

Enterprise Value: $184B

Less Net Debt: -$4.6B

Equity Value: $179B

━━━━━━━━━━━━━━━━━━

Per Share: $374

Conservative (6% growth): $322

Base Case (8% growth): $374

Optimistic (10% growth): $442

3. PEG-Based Fair Value:

Fair P/E = Growth Rate (if PEG = 1.0)

Fair P/E = 10 (assuming 10% growth)

Current EPS: $16.05

Fair Value = $16.05 × 10 = $161 per share

BUT: PEG = 1.0 is too simplistic for quality compounders

Quality adjustment (40% ROE, moat): PEG = 1.5 acceptable

Fair P/E = 15x

Fair Value = $16.05 × 15 = $241 per share

This method undervalues quality—use as conservative floor.

4. Comparable Company Analysis:

| Company | P/E | EV/EBITDA | FCF Yield | ROE |

|---|---|---|---|---|

| ADBE | 21.3x | 15.8x | 5.1% | 39.6% |

| MSFT | 34x | 23x | 3.2% | 45% |

| CRM | 42x | 25x | 4.1% | 15% |

| ORCL | 28x | 18x | 4.5% | 25% |

| Median | 31x | 20.5x | 4.2% | 30% |

Adobe trades at 31% discount to comparable median P/E despite superior ROE. If Adobe traded at peer median (31x P/E): Fair Value = $16.05 × 31 = $498 per share (46% upside)

Critical Question: Why the discount? Answer: AI disruption risk. Market pricing in moat deterioration.

Valuation Summary Table

| Method | Intrinsic Value | Weight | Weighted Value |

|---|---|---|---|

| Owner Earnings (8.5+2g formula) | $314 | 25% | $78.50 |

| DCF (Conservative) | $374 | 30% | $112.20 |

| Comparable Companies | $410 | 20% | $82.00 |

| PEG-Based Fair Value | $241 | 10% | $24.10 |

| Reverse DCF (implied growth) | $342 | 15% | $51.30 |

| ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ | |||

| Weighted Intrinsic Value | $348 | 100% | $348 |

Valuation Range with Scenario Analysis:

| Scenario | Growth | Margin | Outcome | Fair Value | Probability |

|---|---|---|---|---|---|

| Bear | 4% | 22% | AI disrupts | $245 | 20% |

| Base | 8% | 26% | Moat holds | $360 | 50% |

| Bull | 11% | 28% | AI catalyst | $465 | 30% |

Expected Value: ($245 × 0.2) + ($360 × 0.5) + ($465 × 0.3) = $369

Current Price: $342 Margin of Safety: 7% (vs. base case), 28% (vs. bull case)

Risk Assessment

Key Risks (Inversion Analysis)

1. AI Disruption—The Existential Threat (60% Probability, -50% Downside)

Adobe’s moat depends on professionals needing complex tools requiring mastery. Generative AI eliminates this dependency. Why spend 1,000 hours learning Photoshop if ChatGPT/Midjourney produces publication-quality images from text prompts?

The Disruption Mechanism:

- Not that Adobe loses existing users (switching costs too high)

- But that new generation never becomes Adobe users

- Generational replacement over 10-20 years slowly erodes TAM

- Similar to: Taxis still exist, but Uber captured all growth

Mitigating Factors:

- Adobe integrating AI (Firefly) aggressively—could strengthen moat if successful

- High-end professional work (film, advertising) still requires control/customization

- File format lock-in persists (you can generate image in Midjourney, but how do you collaborate? Edit? Version control? Back to Adobe)

Quantifying the Risk: If AI reduces Adobe’s TAM by 30% over 10 years:

- Revenue grows 3-4% instead of 10%

- Margins compress to 22% (defensive spending)

- Fair value: $245 (-28% downside)

2. Margin Compression—Already Happening (80% Probability, -15% Downside)

Net margins fell 460bps (30.5% → 25.9%) in 3 years. Operating expenses growing faster than revenue suggests competitive pressure forcing defensive spending.

What’s Driving This:

- R&D intensity increased 220bps (AI development costs)

- Pricing power may have peaked (subscription fatigue, regulatory scrutiny)

- Competition intensifying (Canva at $0, Figma, open-source alternatives)

Worst Case: Margins compress to 20-22% (still healthy, but multiple would re-rate lower) Fair Value at 22% margins: ~$290 (-15% downside)

3. Regulatory & Pricing Backlash (40% Probability, -10% Downside)

- FTC investigating “dark patterns” (cancellation friction)

- Social media backlash over price increases

- EU may force interoperability (break file format lock-in)

Quantifying Impact: If Adobe forced to simplify cancellation and reduce prices 10-15%:

- Revenue growth: 7% vs 10% (due to increased churn)

- Margins: Stable (lower prices offset by lower churn management costs)

- Fair value: ~$310 (-10% downside)

4. Failed Innovation (30% Probability, -20% Downside)

Adobe’s response to AI (Firefly) could fail:

- Users prefer Midjourney/Runway (faster, cheaper, better)

- Adobe’s AI is “good enough” but not differentiated

- TAM grows but Adobe doesn’t capture it

Historical Precedent: Adobe’s 3D efforts (Substance, Dimension) failed to dethrone Blender/Maya. Innovation is hard.

Worst-Case Scenario (Combined Risks)

What if multiple risks materialize simultaneously?

- AI disrupts TAM by 30%

- Margins compress to 20%

- Regulatory forces pricing cuts

- Revenue growth: 3-4% perpetually

- Fair Value: $210-240 (40% downside from current price)

Probability: ~15% (requires multiple failures)

Market Sentiment Analysis

Current Sentiment: Pessimism (but rational, not panicked)

Evidence:

- Stock down 43% from $600 peak

- Valuation compressed 60% (P/E: 65x → 21x)

- Reverse DCF implies only 4-5% perpetual growth

- Analyst downgrades citing AI threats

- Social media negativity (pricing complaints)

Is This Maximum Pessimism? Not quite. Maximum pessimism would be:

- Stock at $200-250 (panic selling)

- Analysts calling Adobe “obsolete”

- Insider selling accelerating (currently stable)

- Short interest spiking (currently moderate at 2-3%)

Current state: Rational repricing of risks, not capitulation. Market acknowledging AI threat but not declaring Adobe dead. This is healthy skepticism, not maximum pessimism.

Contrarian Opportunity? Mild yes. Stock is in “show-me” mode. Any positive AI traction (Firefly adoption, margin stabilization) would trigger re-rating. But this isn’t a screaming contrarian buy—it’s a “prove it” opportunity.

Investment Recommendation

Current Assessment

Valuation: PEG = 2.13 | P/E = 21.3x vs Industry 27x | FCF Yield 5.1% Verdict: Moderately Undervalued (15-20% upside to fair value)

Margin of Safety: 7% (base case), 28% (bull case)

- For defensive investors: Insufficient (<25% minimum)

- For quality-focused investors: Acceptable (quality = margin of safety)

Entry Zones with Strategic Rationale

| Zone | Price Range | Margin | Action | Rationale |

|---|---|---|---|---|

| 🟢 Strong Buy | < $295 | 30%+ | Build full position | AI fears overdone, moat underappreciated |

| 🟡 Buy | $295-$360 | 15-25% | Start/add position ← Now | Reasonable valuation for quality, prove-it story |

| 🟠 Hold | $360-$425 | 0-15% | Hold existing, don’t add | Fair value range, limited upside |

| 🔴 Reduce | > $425 | None | Trim position | Market pricing in AI success (unproven) |

Current Price: $342 → Recommendation: BUY (with eyes wide open on AI risks)

Expected Returns (5-Year Horizon)

Bull Case (+35% total, +6.2% annualized):

- Adobe’s AI integration (Firefly) succeeds

- TAM expands as AI makes creative work accessible

- Margins stabilize at 27%

- Multiple re-rates to 25x P/E

- Target: $475 (from revenue growth + multiple expansion)

Base Case (+25% total, +4.6% annualized):

- Moat holds in professional segment

- Revenue grows 8% annually

- Margins stabilize at 25-26%

- Multiple stays at 21-22x

- Target: $430 (from earnings growth)

Bear Case (-25% total, -5.6% annualized):

- AI disruption accelerates

- Margins compress to 22%

- Revenue growth slows to 4%

- Multiple contracts to 15x

- Target: $255 (from margin compression + de-rating)

Probability-Weighted Return: (+35% × 0.3) + (+25% × 0.5) + (-25% × 0.2) = +15.5% over 5 years = +2.9% annualized

Critical Insight: Expected returns are mediocre (barely above risk-free rate). This is a “prove it” investment, not a slam-dunk compounder. You’re betting Adobe successfully navigates AI transition. If they do, returns will be strong. If they don’t, returns will disappoint.

Final Investment Conclusion

Overall Grade: B+

Category Scores:

- Business Quality: 9/10 (exceptional moat, economics, but under siege)

- Financial Strength: 7/10 (strong FCF, deteriorating balance sheet)

- Management Quality: 7/10 (proven long-term, recent capital allocation mistakes)

- Valuation: 7/10 (reasonable not cheap; adequate margin of safety for quality)

- Risk/Reward: 6/10 (limited upside, material downside if AI disrupts)

Final Verdict: BUY (with risk awareness and position sizing discipline)

Investment Thesis Deep Dive

1. Business Quality—Durable but Challenged

Adobe built one of the greatest moats in software history. Switching costs (skill capital), file format lock-in, and brand power create multi-decade competitive advantages. 89% gross margins, 40% ROE, and 90%+ retention demonstrate economic excellence rarely seen.

However: The moat is being circumvented, not breached. Low-end disruption (Canva) and AI unbundling (Midjourney) capture new creators who never adopt Adobe. Incumbents stay loyal (90%+ retention), but TAM growth slows as generational replacement favors simpler tools. This is classic Innovator’s Dilemma—Adobe optimizes for existing customers while losing future customers.

Critical Question: Can Adobe’s AI strategy (Firefly) turn threat into opportunity? If AI makes creative work easier within Adobe’s ecosystem, TAM expands. If AI makes Adobe unnecessary, business dies slowly. Thesis hinges on this binary outcome.

2. Valuation—Adequate Margin of Safety for Quality

After 43% drawdown, Adobe trades at:

- 21.3x P/E (vs 45x historical, 27x peers)

- 5.1% FCF yield (vs 4.3% 10-year Treasury)

- Reverse DCF implies 4-5% perpetual growth (pessimistic for 95% recurring revenue, 90%+ retention)

Valuation is reasonable for quality, not Graham-style cheap. Benjamin Graham would reject this (fails 5 of 8 defensive criteria). Warren Buffett would seriously consider it (fortress moat, high ROE, reasonable price).

Margin of safety: 7% (base case) to 28% (bull case). For Buffett-style quality investing, 15-20% margin on compounders is acceptable. For Graham-style value investing, 30%+ required. This lands in the gray zone.

Critical Insight: You’re not buying Adobe at a huge discount. You’re buying quality at fair price, betting on management’s ability to navigate AI disruption. This is show-me investing, not obvious value.

3. Risks—Material and Multifaceted

Primary Risk: AI disruption (60% probability). Generational replacement erodes TAM over 10-20 years as new creators bypass Adobe entirely. Not a sudden collapse—a slow fade.

Secondary Risk: Margin compression (80% probability, already occurring). Competitive pressure forces defensive R&D spending, compressing margins from 30% → 25% → possibly 22% over 5 years.

Tertiary Risk: Regulatory/pricing backlash (40% probability). FTC scrutiny + subscription fatigue could force pricing cuts and churn increases.

Worst Case: Multiple risks compound. TAM shrinks 30%, margins fall to 20%, revenue growth 3%. Fair value: $210-240 (40% downside). Probability: ~15%.

Key Mitigant: Adobe has time. Existing customers locked in for years. Management sees threats and investing heavily (R&D up 220bps). Balance sheet supports 3-5 years of defensive spending. This isn’t Kodak (denial) or Blockbuster (hubris)—Adobe is adapting aggressively.

4. Catalysts—What Changes the Thesis?

Bullish Catalysts:

- Firefly adoption accelerates (evidence: growing AI revenue disclosures)

- Margin stabilization/re-expansion (evidence: next 2-3 quarters)

- Successful M&A that captures low-end disruption (Canva, Figma alternative)

- Regulatory clarity removes overhang

Bearish Catalysts:

- Churn acceleration (watch quarterly retention metrics)

- Further margin compression below 25% (defensive spending failing)

- Competitor (Canva) captures enterprise market (breaks moat assumption)

- Failed AI product integration (Firefly doesn’t drive engagement)

Watch List:

- Net dollar retention rate (currently 90%+; if drops below 85%, sell signal)

- Net margin trajectory (stabilization at 25% = bullish; further drops = bearish)

- AI product revenue disclosures (need to see material contribution by 2026)

Framework Checklist

- ✅ Quantitative: 7-20% margin of safety acceptable for quality business (Graham fails, Buffett approves)

- ✅ Moat: Durable 4/5 star moat with switching costs and brand power; stable but narrowing from low-end disruption

- ⚠️ Management: Proven 18-year CEO with stellar long-term record; recent capital allocation mistakes (poor buyback timing, failed Figma bid)

- ⚠️ Contrarian: Market pessimism (43% decline) creates opportunity but not maximum capitulation; rational repricing, not panic

- ✅ Simplicity: Yes—subscription software with network effects and skill capital lock-in; explainable to 10-year-old

Critical Question: Would I hold this for 10+ years if the market closed tomorrow?

Answer: Yes, with reservations.

Adobe will remain dominant in professional creative market for foreseeable future (5-10 years minimum). Subscription model provides predictable cash flows ($7.9B annually). Management proven adaptable (successfully navigated perpetual → subscription transition). Balance sheet adequate despite deterioration.

However: AI disruption is real and uncertain. Unlike typical moat investments (Coca-Cola, Disney), Adobe faces technological disruption that could fundamentally alter value proposition. This isn’t “buy and forget”—it’s “buy and monitor.”

Ideal investor profile:

- Quality-focused (vs pure value)

- Tech-savvy (understands AI implications)

- Patient (3-5 year horizon)

- Risk-tolerant (comfortable with binary AI outcome)

- Position sizing discipline (5-8% max position, not 20%)

Not suitable for:

- Defensive investors (Graham disciples)

- Those seeking huge margin of safety (30%+)

- “Set and forget” buy-and-hold

- High-conviction concentrated portfolios (too much uncertainty)

Final Thought: Adobe is a quality business at fair price facing uncertain future. Buy with conviction that professional creative work will require sophisticated tools, but size position acknowledging AI could change everything. This is calculated risk-taking, not obvious value.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. All valuation models require assumptions subject to error. Investors should conduct independent due diligence and consult financial advisors before making investment decisions.

Analysis completed: November 14, 2025

Next review: February 2026 (post-Q1 earnings + Firefly traction assessment)

Key metrics to monitor: Net dollar retention, net margin trajectory, AI revenue contribution