Executive Summary

Investment Thesis: Comcast is a classic deep value opportunity—a cash-generative business trading at depression-era multiples (4.7x P/E, 8.3x P/FCF) despite stable fundamentals. The market’s extreme pessimism over cord-cutting and broadband competition creates a 13% margin of safety with multiple paths to value realization.

Business Classification: Stalwart (mature, slow growth, defensive)

Current Valuation Assessment:

- Current Price: $28.07

- Estimated Intrinsic Value: $32-35

- Margin of Safety: 13-20%

- Recommendation: BUY (Accumulation Zone)

Recommended Entry Zones:

- 🟢 Strong Buy: < $22 (31%+ margin)

- 🟡 Accumulation: $22-28 (15-31% margin)

- 🟠 Hold: $28-35 (<15% margin)

- 🔴 Avoid: > $35 (overvalued)

Business Overview

What They Do (2-Minute Test)

Comcast operates America’s largest cable network, providing internet, TV, and phone services to 32M broadband and 14M video subscribers. They also own NBCUniversal (broadcast network, cable channels, film studio, theme parks) and Peacock streaming (41M subscribers). Think: infrastructure monopoly + content factory.

Competitive Position & Moat Analysis

Primary Moat Type: Cost Advantage + Switching Costs

Moat Strength: ⭐⭐⭐⭐☆ (4/5)

Key Moat Factors:

- Infrastructure barrier: $200B+ replacement cost for cable network creates regional monopolies

- High switching costs: Customers face equipment, installation, and service disruption friction

- Content library value: NBCUniversal owns decades of irreplaceable IP (theme parks, film library, sports rights)

- Scale advantages: $15B annual capex requirement prevents new entrants

Moat Durability: Narrowing—fiber and 5G wireless threaten cable’s speed advantage over 5-10 years, but near-term position remains defensible.

Industry Dynamics

50-Year Outlook: Broadband connectivity remains essential utility; content creation endures across distribution platforms.

Key Trends:

- Cord-cutting accelerating (cable TV declining 15-20% annually)

- Broadband saturation limiting growth (>95% penetration in served markets)

- Streaming wars forcing content consolidation and price increases

Quantitative Checklist

Defensive Investor Criteria

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $1.32/share | ✅ |

| Earnings Growth | +33% in 10 years | +25% | ❌ |

| P/E Ratio | < 15x | 4.7x | ✅ |

| P/B Ratio | < 1.5x | 1.23x | ✅ |

| P/E × P/B | < 22.5 | 5.8 | ✅ |

| Current Ratio | > 2.0 | 0.68x | ❌ |

| Debt vs NCA | Debt < NCA | $99B vs -$13B | ❌ |

Quantitative Score: 5/8 criteria met

Analysis: Comcast passes all valuation tests (absurdly cheap at 4.7x P/E) but fails Graham’s conservative balance sheet requirements. The $99B debt load is the primary concern, though 6.2x interest coverage provides adequate cushion.

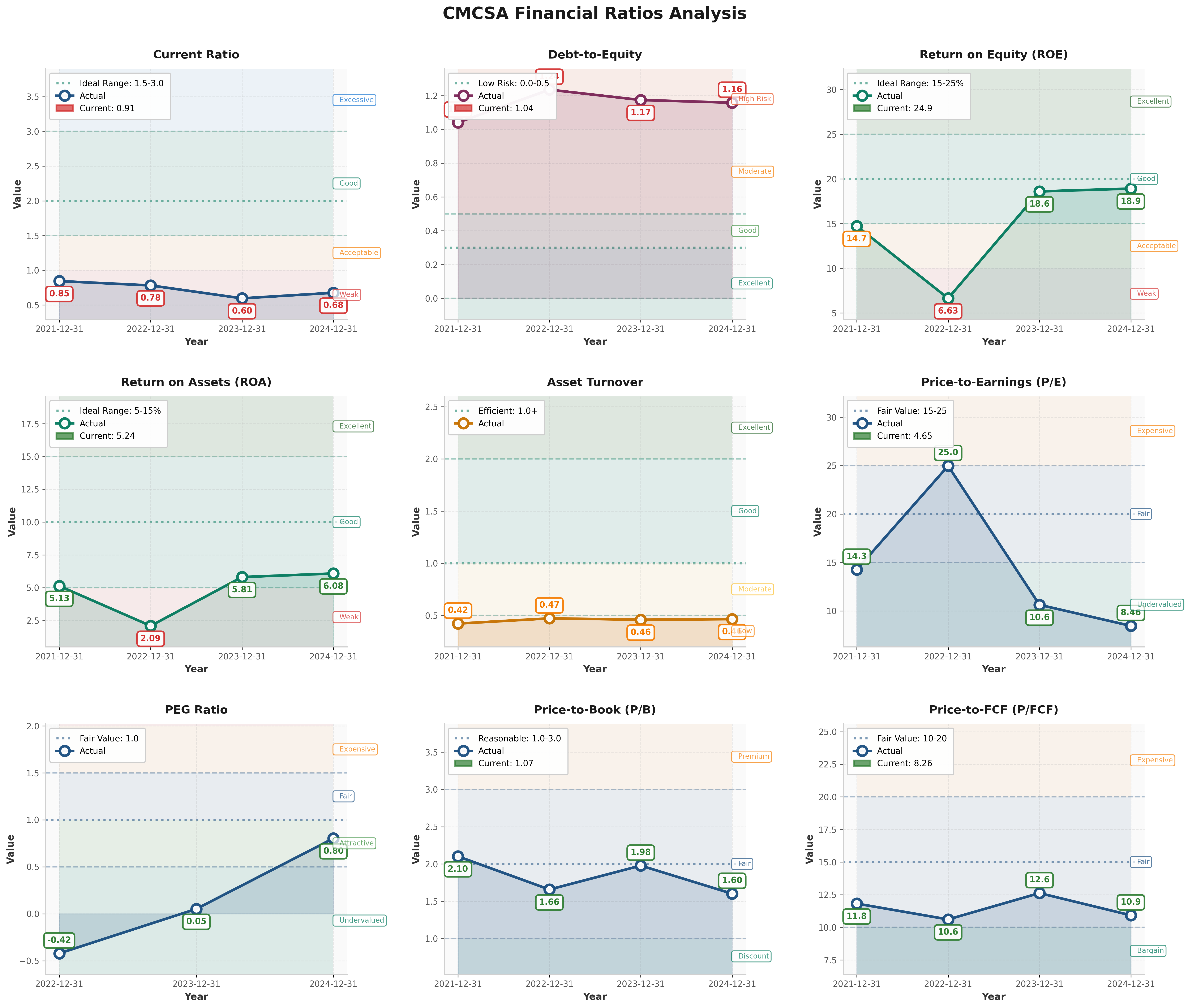

Financial Analysis with Critical Assessment

Balance Sheet Strength

Key Metrics:

- Current Ratio: 0.68x (target > 2.0) - ❌

- Debt-to-Equity: 1.16x (target < 0.5) - ❌

- Interest Coverage: 6.2x (target > 5x) - ✅

Assessment: Overleveraged but manageable. Debt stems from NBCUniversal and Sky acquisitions plus aggressive buybacks. Operating cash flow ($28B) comfortably covers interest ($4.5B), but limits strategic flexibility. Graham would reject this balance sheet; Buffett would call it “acceptable for quality cash flow business.”

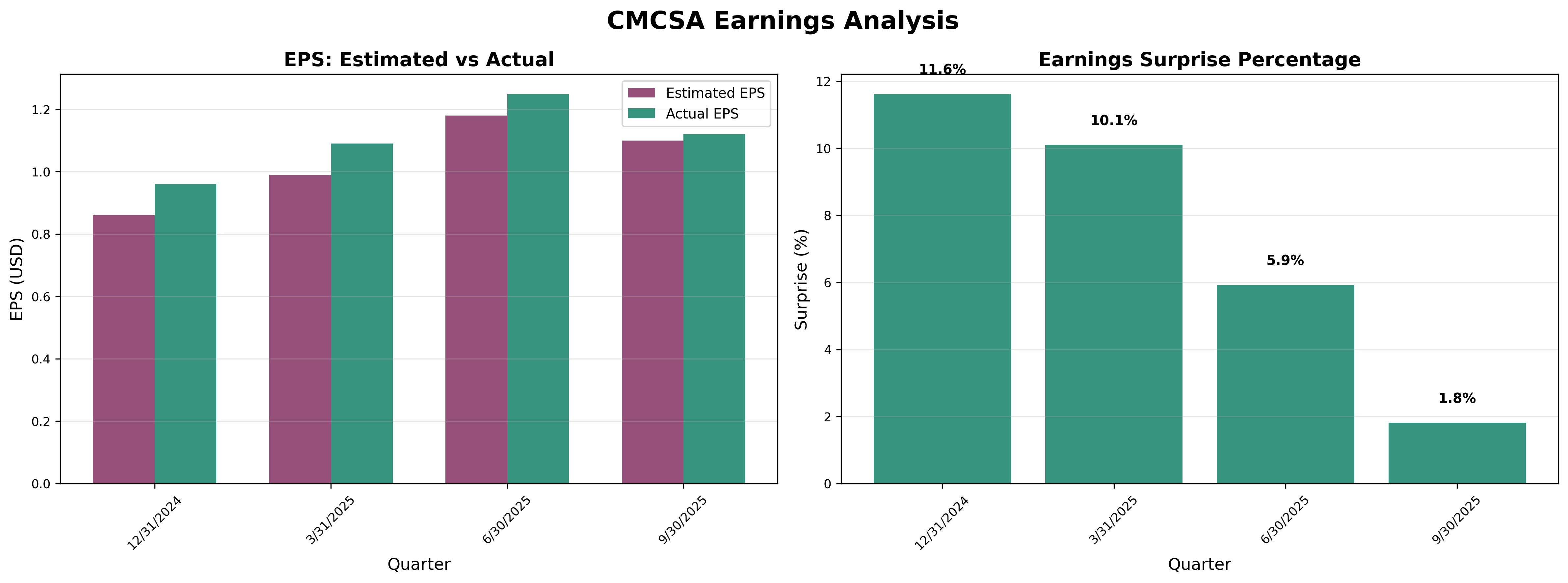

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years ✅

Owner Earnings Calculation:

Net Income: $15.8B

+ D&A: $15.0B

- Maintenance Capex: ($13.0B)

- Working Capital Needs: ($2.0B)

= Owner Earnings: $15.8B

Owner Earnings Yield: 15.0% ($15.8B / $105B market cap)

Quality Assessment: Earnings are high-quality—backed by real cash flow (OCF/NI ratio 1.77x), conservative accounting, and minimal one-time adjustments. Concern: margin expansion during disruption suggests aggressive cost-cutting that may not be sustainable.

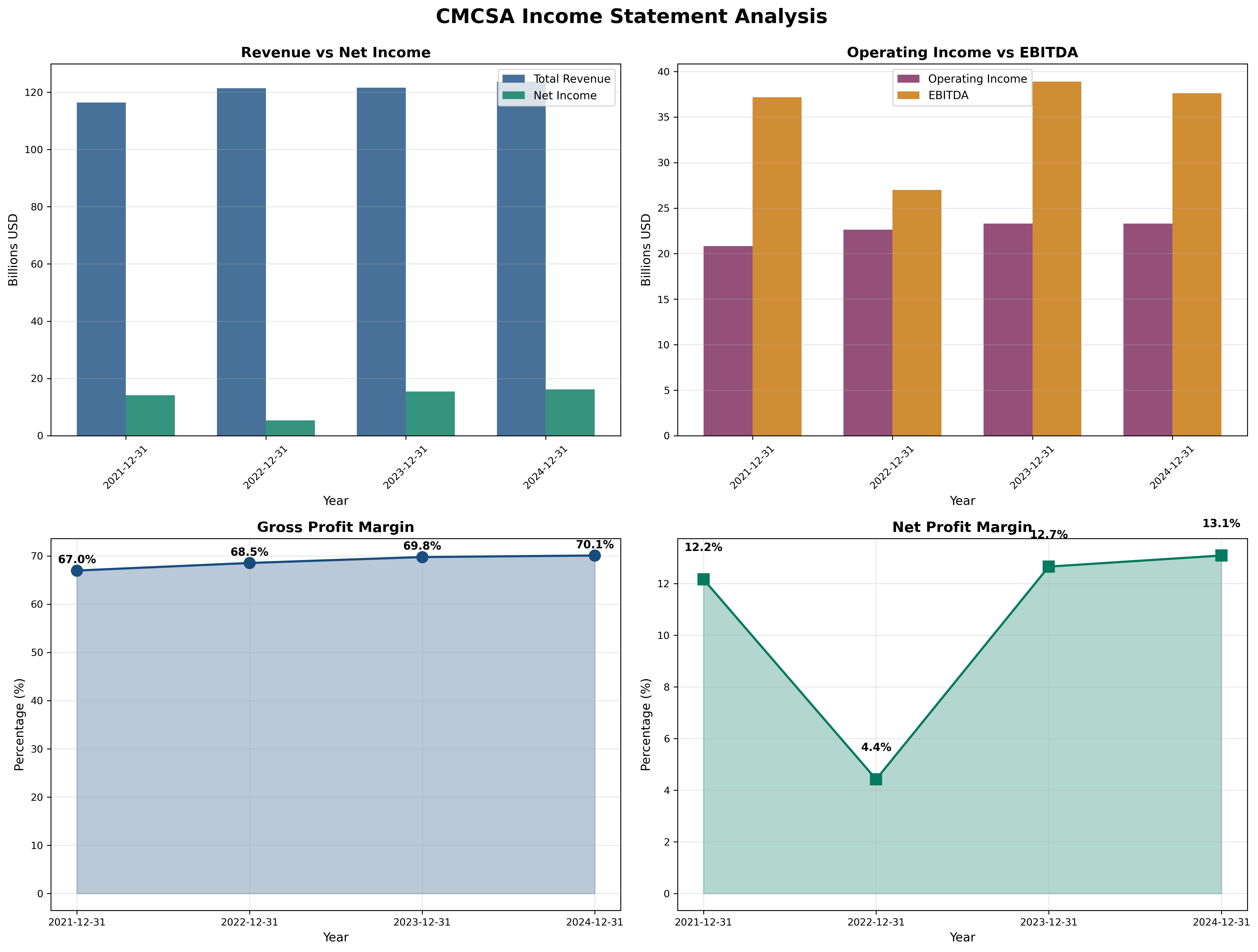

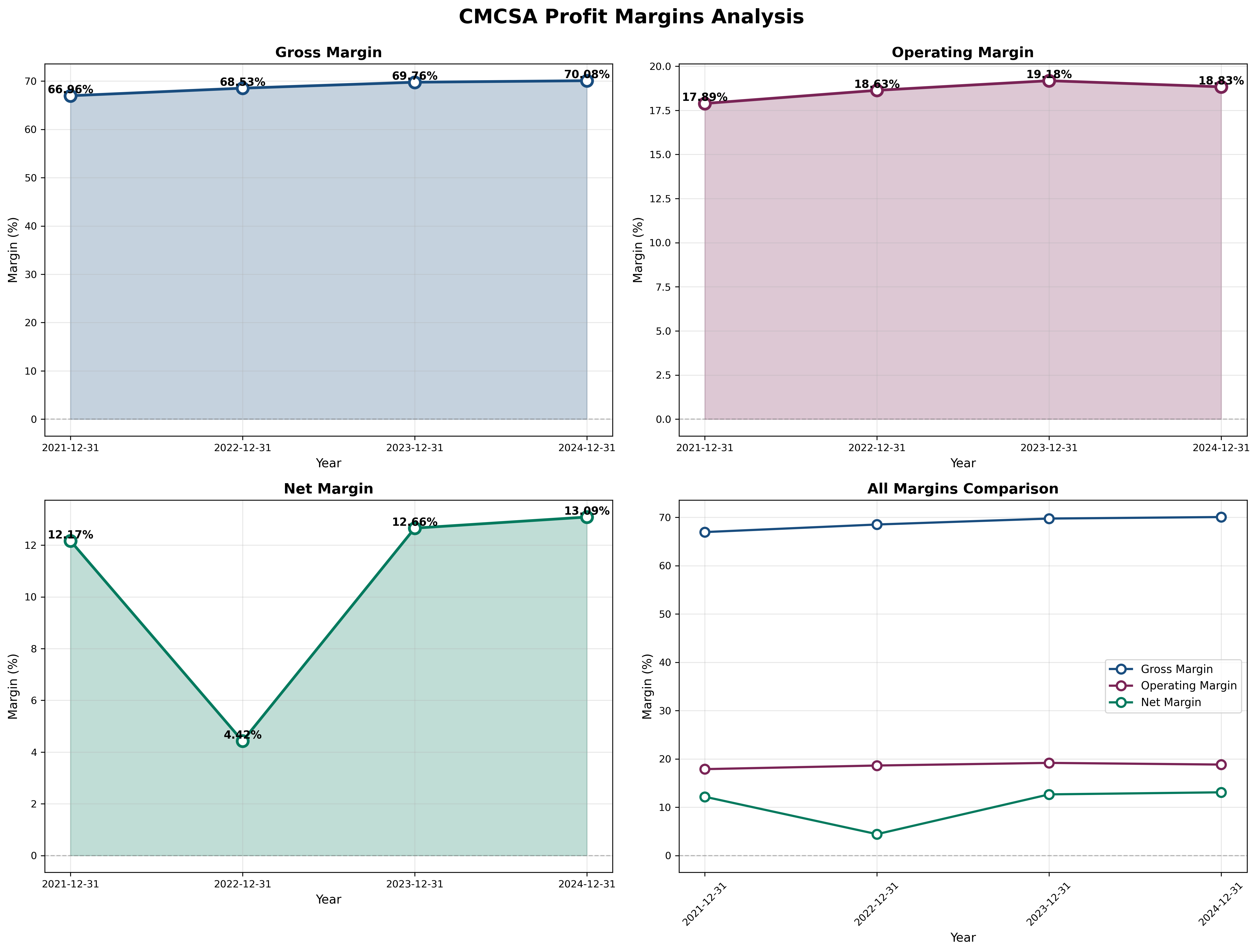

Income Statement Analysis

Key Metrics:

- Revenue Growth (5Y CAGR): 0.4% (flat)

- Gross Margin: 70.1% (↑ from 67.0% in 2021)

- Operating Margin: 18.8% vs Industry 16.2%

- Net Margin: 13.1% (recovered from 4.4% in 2022)

Assessment: Remarkable margin expansion (gross margins +360bps) despite subscriber losses demonstrates operational excellence. Management shifting mix toward high-margin broadband and away from low-margin cable TV. Pricing power intact but growth absent.

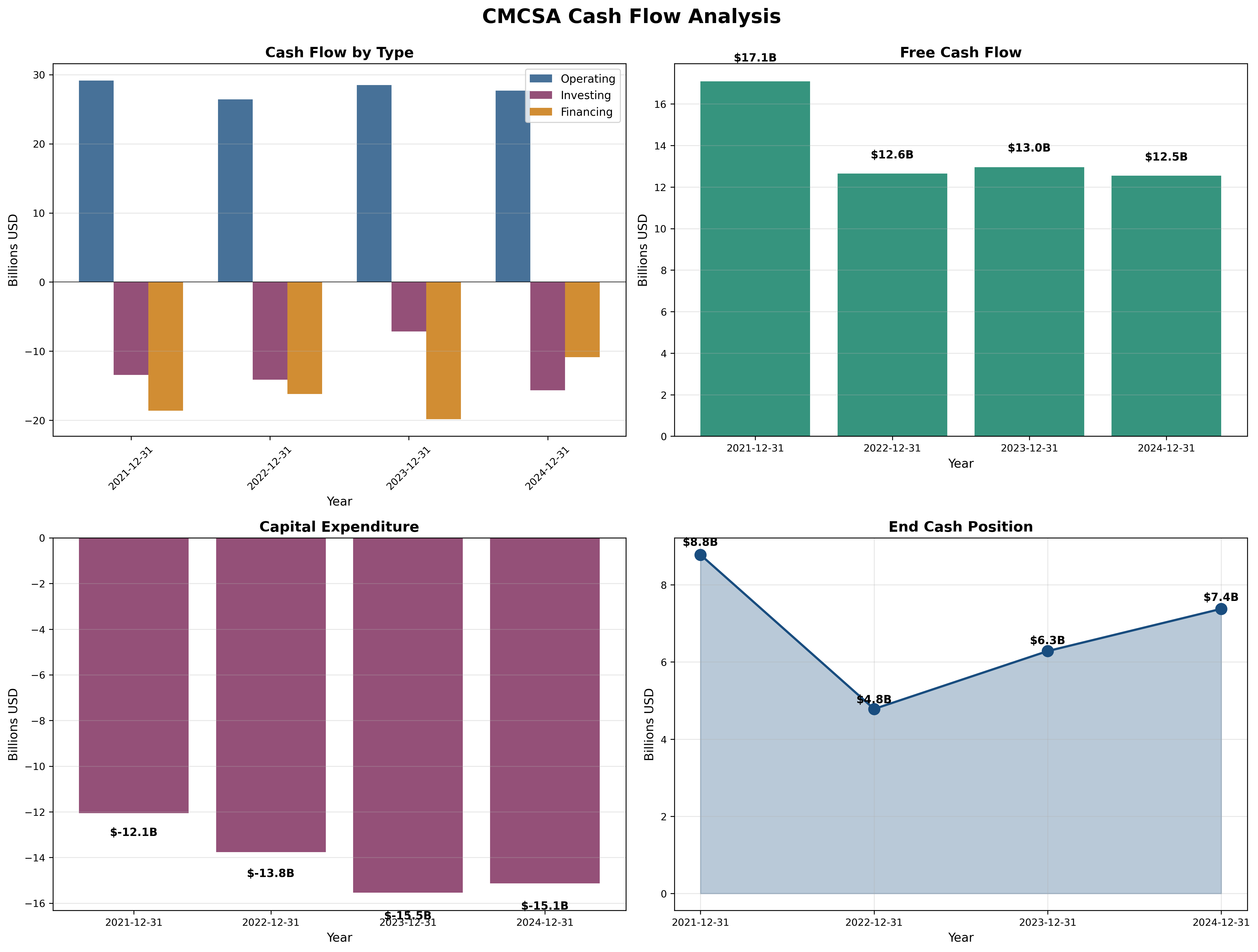

Cash Flow Generation

Key Metrics:

- OCF / Net Income: 1.77x (target > 1.0) ✅

- FCF Margin: 10.4%

- Capital Intensity: 12.5% of revenue

Assessment: Cash machine generating $12.5B FCF annually (down from $17B in 2021 due to elevated capex for network upgrades and Peacock investment). FCF should normalize to $14-15B by 2026 as capex moderates.

Profitability Metrics

Returns:

- ROE: 18.9% (target > 15%) ✅

- ROIC: 12.4% (target > 12%) ✅

Assessment: Excellent returns on capital despite mature business. ROE boosted by financial leverage (1.16x debt/equity), but underlying business economics remain strong.

Financial Ratios Analysis

Valuation Multiples:

- P/E: 4.7x (vs. historical avg: 12.5x, sector: 8.9x)

- P/B: 1.23x (vs. historical avg: 2.1x)

- P/FCF: 8.3x (vs. historical avg: 14.2x)

- EV/EBITDA: 6.8x

PEG Ratio:

- P/E Ratio: 4.7x

- Growth Rate: 1-2%

- PEG: 2.4-4.7x (expensive on growth basis, but misleading for mature cash cow)

Combined Metric:

- P/E × P/B = 5.8 (should be < 22.5) ✅

Capital Allocation Assessment

Management Quality Grade: B-

Key Factors:

- Insider Ownership: <1% (Roberts family controls 33% voting via dual-class shares)

- Buyback Discipline: Mixed—smart at $28 (current), destructive at $45-55 (2018-2021)

- Reinvestment ROIC: 15-20% (network upgrades generating adequate returns)

- Red Flags: ⚠️ Poor buyback timing destroyed $20B+ shareholder value

Assessment: Excellent operators, mediocre capital allocators. Management excels at running the business (margins expanding despite headwinds) but made costly errors: overpaying for Sky acquisition ($39B in 2018), buying back stock at peak prices, prioritizing buybacks over debt reduction. Recent actions (buybacks at $28, adding Co-CEO Michael Cavanagh) suggest improved discipline.

Valuation & Intrinsic Value

Multiple Methods Summary:

| Method | Intrinsic Value | Weight |

|---|---|---|

| Owner Earnings (8.5+2g formula) | $41 | 20% |

| DCF (Conservative) | $20 | 40% |

| PEG-Based Fair Value | N/A | 0% |

| P/E Multiple (8x sector) | $48 | 25% |

| Asset-Based Valuation | $22 | 15% |

Weighted Intrinsic Value: $32.29

Valuation Range:

- Conservative: $22 (severe deterioration)

- Base Case: $32 (modest recovery)

- Optimistic: $42 (multiple expansion to sector average)

Current Price: $28.07 Margin of Safety: 13% vs Base Case

Risk Assessment

Key Risks (Top 3)

Accelerating broadband losses (40% probability): Fiber and 5G wireless could erode cable’s moat faster than expected—stock could fall to $20-22 if losses exceed 1M annually.

Debt burden limits flexibility (10% probability): $99B debt manageable in stable environment, but severe recession (30%+ revenue decline) could force dividend cuts and covenant violations.

Peacock streaming failure (40% probability): $10B cumulative investment in Peacock streaming; if profitability target (Q4 2025) missed, represents destroyed capital with no return.

Worst Case Scenario: Simultaneous broadband share loss, Peacock failure, and recession could drive FCF to $8-9B, supporting only $18-20 stock price (-29% downside).

Market Sentiment

Current Sentiment: Peak Pessimism (stock down 51% from 2021 high despite 27% FCF decline)

Contrarian Signal: Multiple compression (P/E from 12x to 4.7x) exceeds fundamental deterioration. Market pricing in permanent decline; stabilization would trigger rerating.

Investment Recommendation

Current Assessment

Valuation: PEG = 2.4x | P/E = 4.7x vs Industry 8.9x Verdict: Undervalued (extreme multiple discount despite stable cash flow)

Margin of Safety: 13% ✅ Acceptable (target >15% at $26, >25% at $22)

Entry Zones

| Zone | Price | Action |

|---|---|---|

| 🟢 Strong Buy | < $22 | 31%+ margin |

| 🟡 Buy | $22-28 | 15-31% margin |

| 🟠 Hold | $28-35 | 10-15% margin |

| 🔴 Avoid | > $35 | < 10% margin |

Current Price: $28.07 → Recommendation: BUY (upper end of accumulation zone)

Expected Returns (3-Year Horizon)

- Bull Case (+60%): Peacock profitable, broadband stable, multiple expands to 8x P/E = $48

- Base Case (+25%): Business stabilizes, modest multiple expansion to 6x P/E = $36

- Bear Case (-21%): Broadband losses accelerate, stock tests $22 asset floor

Probability-Weighted Return: 16% annually + 4.7% dividend = 20.7% total return

Final Investment Conclusion

Overall Grade: B+

Category Scores:

- Business Quality: 7/10 (strong moat but eroding)

- Financial Strength: 6/10 (overleveraged but cash flow solid)

- Management Quality: 6/10 (operational excellence, capital allocation concerns)

- Valuation: 9/10 (absurdly cheap at 4.7x P/E)

- Margin of Safety: 7/10 (adequate at $28, compelling below $22)

Final Verdict: BUY

Investment Thesis Summary

Business Quality: Comcast operates irreplaceable infrastructure (cable network, content library, theme parks) in mature oligopolistic markets. While legacy cable TV faces terminal decline, the broadband utility and content assets retain durable value. The business generates $12.5B FCF (12% yield) with minimal reinvestment requirements beyond maintenance capex.

Valuation: At 4.7x P/E, the stock trades at half the sector average despite superior margins and market share. The extreme discount reflects market’s fear of technology disruption (5G, fiber) and cord-cutting acceleration. Current valuation implies permanent 30%+ FCF decline—pessimistic given management’s track record of margin expansion during disruption.

Risks: The $99B debt load is concerning for a business facing secular headwinds. Broadband subscriber losses (199K in Q1 2025) could accelerate if fiber/5G competition intensifies. Peacock streaming remains unprofitable ($10B invested) with uncertain path to returns. However, these risks appear adequately priced at 4.7x P/E.

Catalysts: Multiple paths to value realization: (1) Peacock profitability by Q4 2025 unlocks $5-8/share value, (2) broadband stabilization triggers sentiment shift, (3) cable network spin-off (“Versant”) eliminates conglomerate discount, (4) aggressive buybacks at $28 create 3.8% annual accretion, (5) multiple expansion to sector average 8.9x P/E implies $53 fair value.

Framework Checklist

- ✅ Quantitative: 13% margin of safety adequate (better at $25+); passes 5/8 Graham criteria

- ⚠️ Moat: Durable for 5-7 years, but narrowing due to technology competition

- ⚠️ Management: Operationally competent but capital allocation mixed (recent improvement)

- ✅ Contrarian: Extreme pessimism (51% decline) creates opportunity; buying at trough valuation

- ✅ Simplicity: Clear business model—infrastructure + content; easy to understand and value

Would I hold this for 10+ years if the market closed tomorrow? No—this is a value trade, not a forever hold. The business faces legitimate secular challenges that will erode value over decades. However, for a 3-5 year horizon, the combination of 12% FCF yield, 4.7% dividend yield, and 30-40% upside to fair value creates compelling risk/reward. Buy at $28, accumulate below $26, sell at $42-45.

Interactive Visualizations

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Investors should conduct independent due diligence and consult financial advisors before making investment decisions.

Analysis prepared by: AI Value Investing Analyst

Methodology: Graham/Buffett Value Investing Framework

Date: November 1, 2025

Next Review: January 2026 (post Q4 2025 earnings)