Executive Summary

Investment Thesis: Meta owns the world’s largest social network ecosystem (Facebook, Instagram, WhatsApp) with 3+ billion users, generating $164B revenue with elite 38% net margins. The business benefits from powerful network effects and delivers exceptional $54B annual free cash flow. However, Reality Labs burns $15B+ yearly with no clear path to profitability, and Zuckerberg’s absolute control via dual-class shares prevents shareholder intervention on capital allocation.

Business Classification: Fast Grower (transitioning to Stalwart)

Current Valuation Assessment:

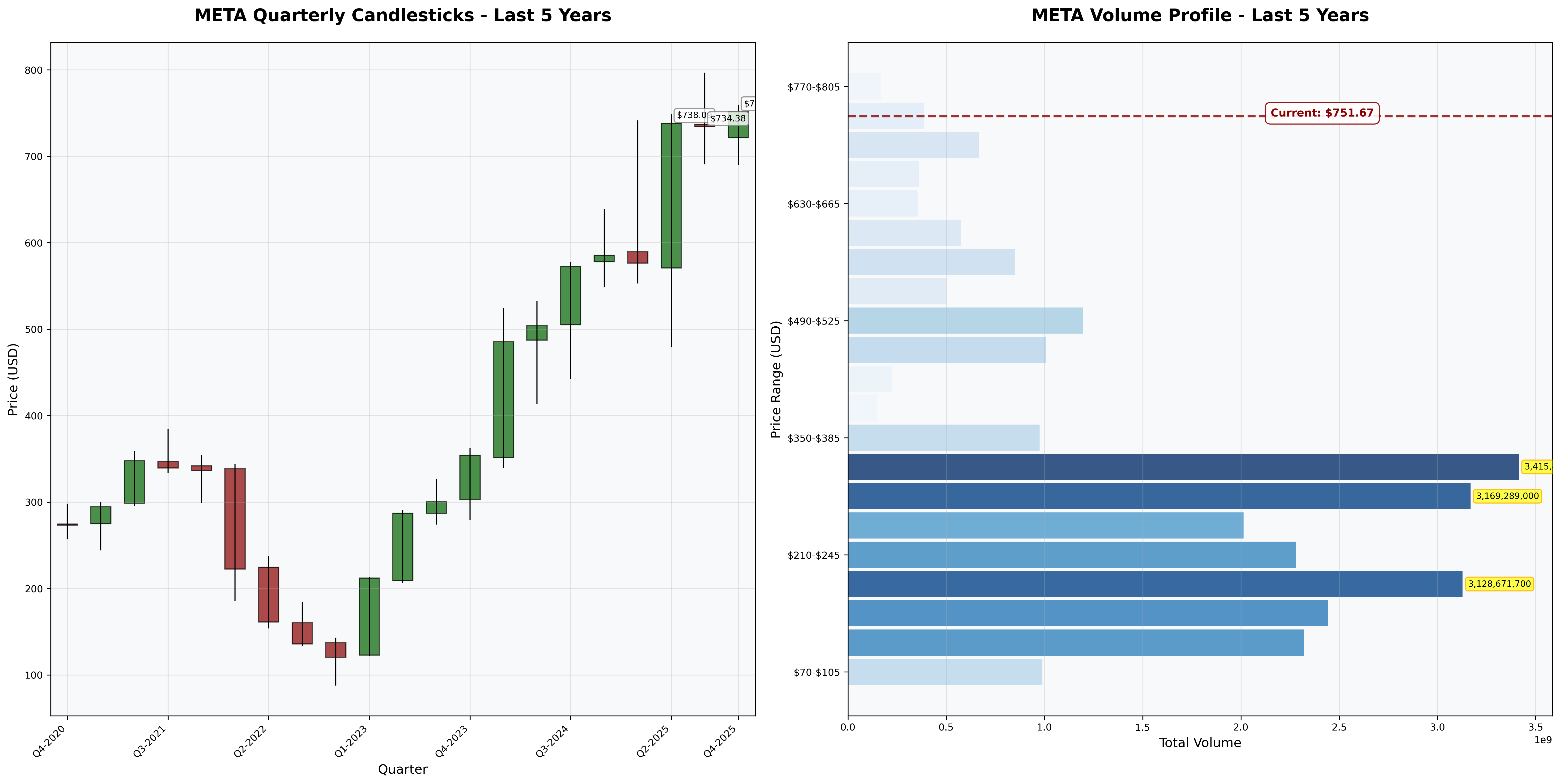

- Current Price: $751.67

- Estimated Intrinsic Value: $600 - $850

- Margin of Safety: 13% (insufficient for Graham standards)

- Recommendation: HOLD / WAIT FOR BETTER ENTRY

Recommended Entry Zones:

- 🟢 Strong Buy: < $510 (40%+ margin)

- 🟡 Buy: $510 - $595 (30% margin)

- 🟠 Hold: $680 - $850 (fair value)

- 🔴 Avoid: > $850 (overvalued)

Business Overview

What They Do (2-Minute Test)

Meta owns the world’s largest gathering places online. Facebook has 3 billion users, Instagram 2 billion, WhatsApp connects billions globally. They make money by selling targeted advertising—businesses pay to reach specific audiences. The more users join, the more valuable the platform becomes for everyone (network effects). They’re also spending heavily on virtual reality hardware (Meta Quest) and AI, betting these become the next major computing platforms.

Competitive Position & Moat Analysis

Primary Moat Type: Network Effects + Intangible Assets (Brand)

Moat Strength: ⭐⭐⭐⭐⭐ (5 out of 5)

Key Moat Factors:

- Network effects at massive scale: 3B+ users create insurmountable switching costs—your social graph, photos, and connections are locked in

- Brand dominance: Instagram, Facebook, WhatsApp are top-of-mind in their categories across 100+ countries

- Data advantages: Despite privacy regulations, Meta’s understanding of user behavior remains unmatched for ad targeting

- Cost advantages: Infrastructure investments ($120B in PP&E) spread across billions of users create economies of scale competitors cannot match

Moat Durability:

- Widening: AI investments, Reels competing with TikTok, WhatsApp Business monetization beginning

- Narrowing: Privacy regulations (Apple ATT, GDPR), younger users preferring TikTok, regulatory breakup risk

Moat Threat: No competitor can replicate Meta’s entire ecosystem at this scale, but TikTok proved new platforms can gain traction. The biggest risk is generational shift away from traditional social media.

Industry Dynamics

50-Year Outlook: Human connection is fundamental—social networking will exist, but formats will evolve dramatically. Meta must continuously innovate to remain relevant as platforms shift from public sharing to private messaging, from text to video, from human-created to AI-generated content.

Key Trends: Digital advertising still taking share from traditional media globally. Privacy regulations reducing targeting precision. Attention economy fragmenting across TikTok, YouTube, gaming. Meta maintains strong position but facing structural headwinds.

Quantitative Checklist

Defensive Investor Criteria:

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $2.00/share | ✅ |

| Earnings Growth | +33% in 10 years | +438% | ✅ |

| P/E Ratio | < 15x | 27.2x | ❌ |

| P/B Ratio | < 1.5x | 9.69x | ❌ |

| P/E × P/B | < 22.5 | 263.6 | ❌ |

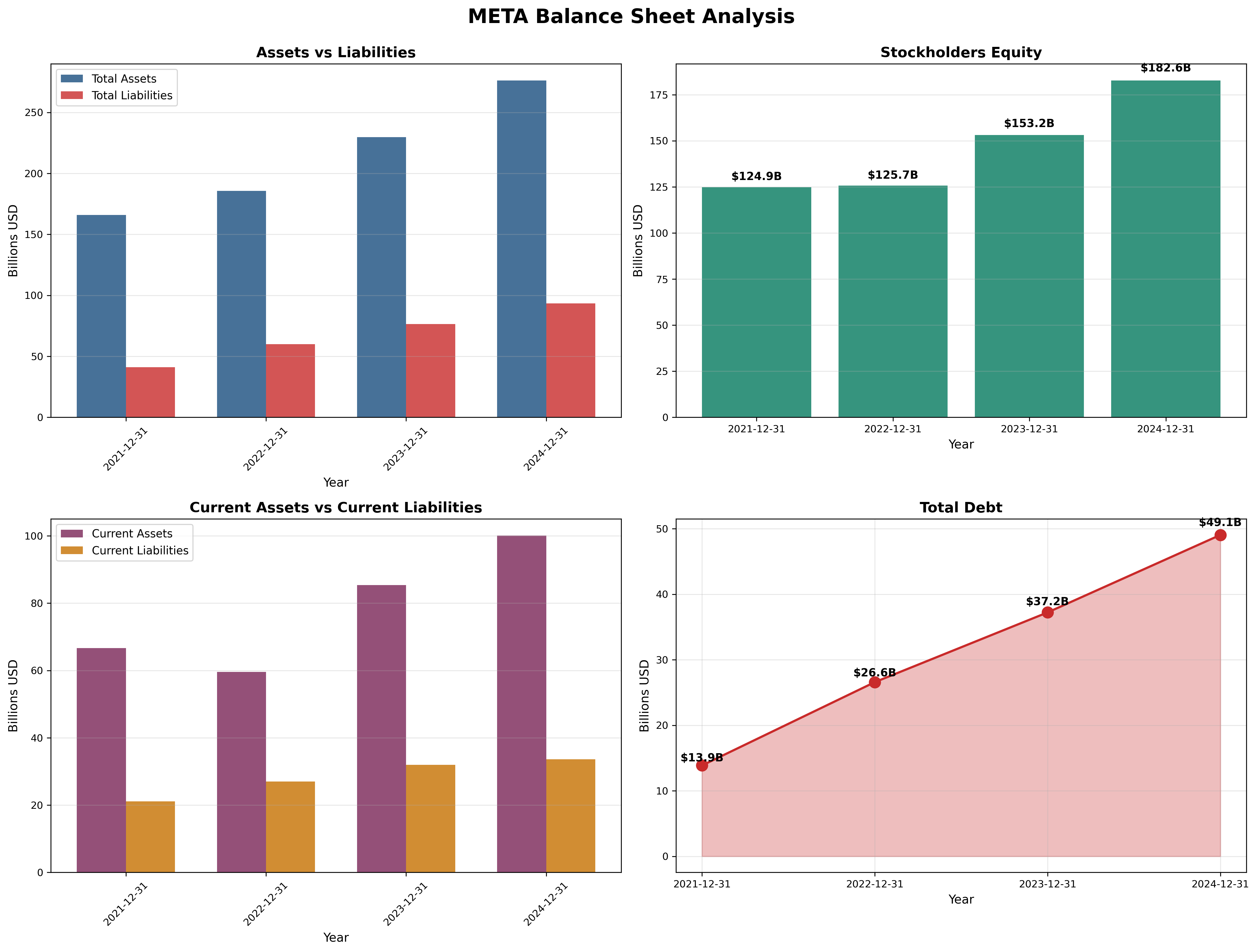

| Current Ratio | > 2.0 | 2.98x | ✅ |

| Debt vs NCA | Debt < NCA | $49B vs $66B | ✅ |

Quantitative Score: 6/9 criteria met

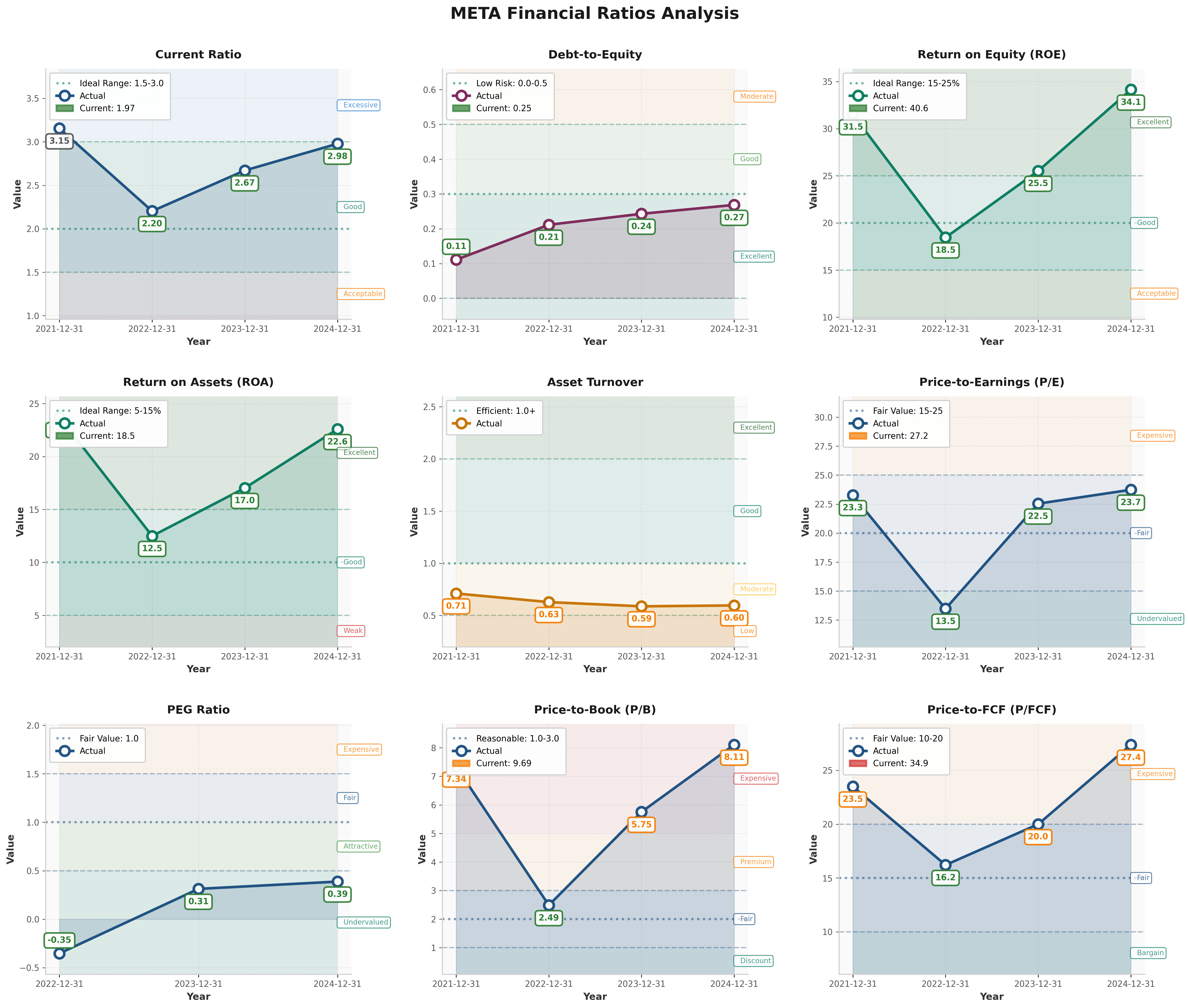

Analysis: Meta passes operational quality tests (stability, growth, balance sheet) but fails valuation tests. P/E of 27x and P/B of 9.7x reflect premium pricing for high-quality growth. Graham would wait for better entry, but acknowledges this isn’t a “defensive investor” stock—it requires business understanding and growth assumptions.

Financial Analysis

Balance Sheet Strength

Key Metrics:

- Current Ratio: 2.98 (target > 2.0) ✅ Excellent

- Debt-to-Equity: 0.25 (target < 0.5) ✅ Conservative

- Interest Coverage: ~70x EBIT/Interest ✅ Exceptional

- Cash & Securities: $85B vs $49B total debt

Assessment: Fortress balance sheet. Meta could pay off all debt tomorrow and still have $36B cash. No refinancing risk, self-funding growth through $54B FCF. The $120B PP&E (data centers) could become stranded if platforms decline or AI bets fail, but financial risk remains low.

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years ✅

Owner Earnings Calculation (2024):

Net Income: $62.4B

+ Depreciation: $18.0B

+ Stock Comp: $12.0B

- Maintenance Capex: ($15.0B)

- Working Capital: ($2.0B)

= Owner Earnings: $75.4B

Owner Earnings Yield: $29.22/share ÷ $751.67 = 3.9% (below Buffett’s 10% target, suggesting limited margin of safety)

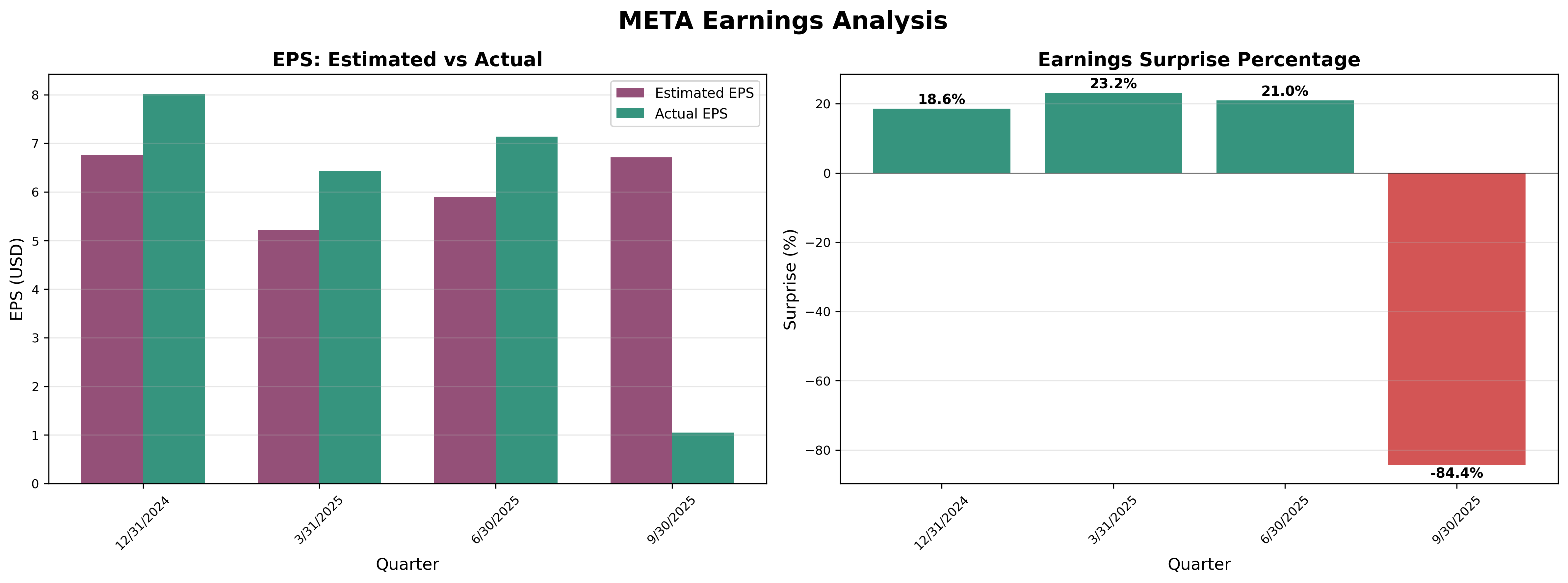

Quality Assessment: Earnings highly cyclical (dropped 41% in 2022, then +69% recovery) but backed by real cash (OCF/NI ratio of 1.46). Reality Labs is permanent $15B+ annual drag. Core advertising business demonstrates pricing power with consistent beats (18-23% earnings surprises).

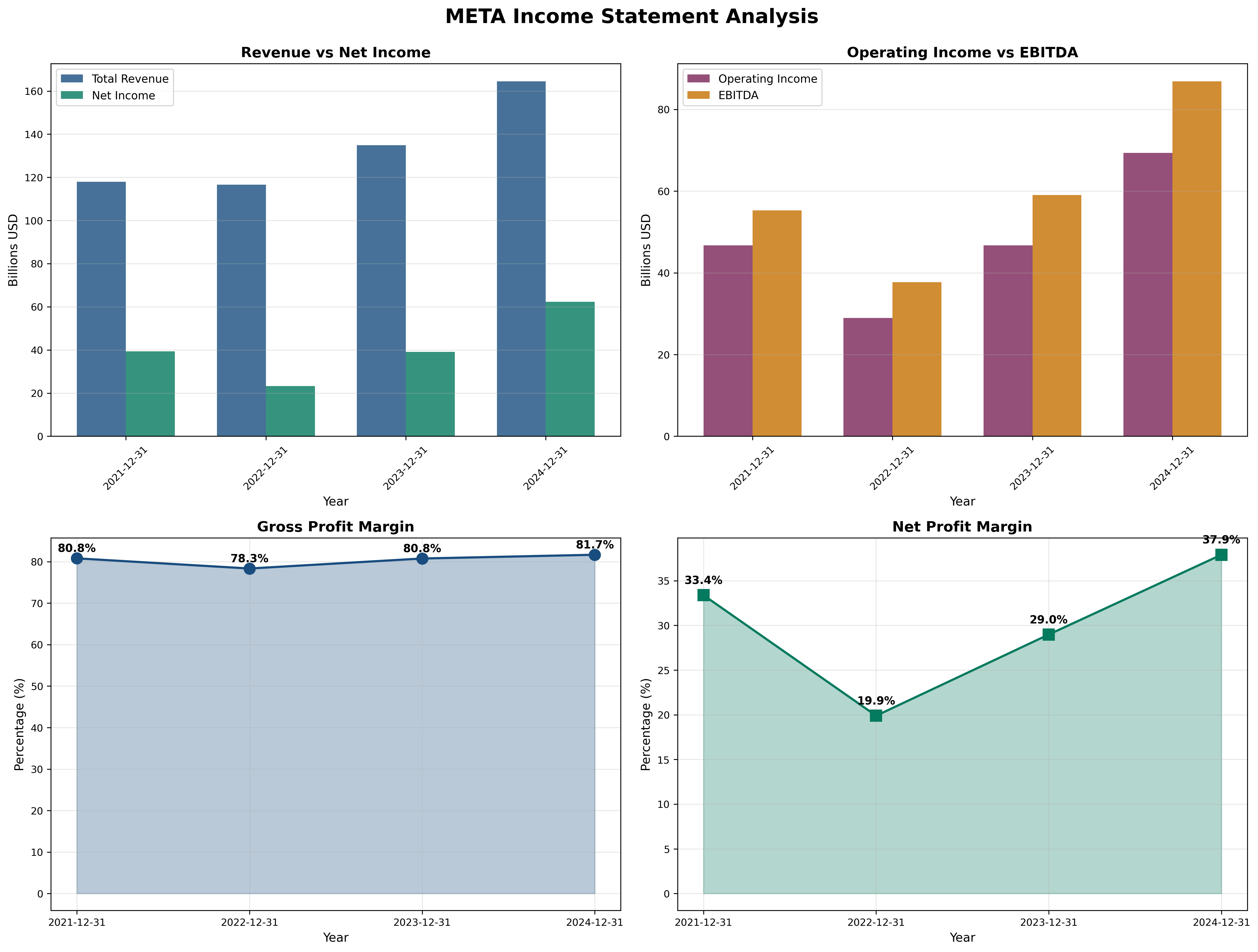

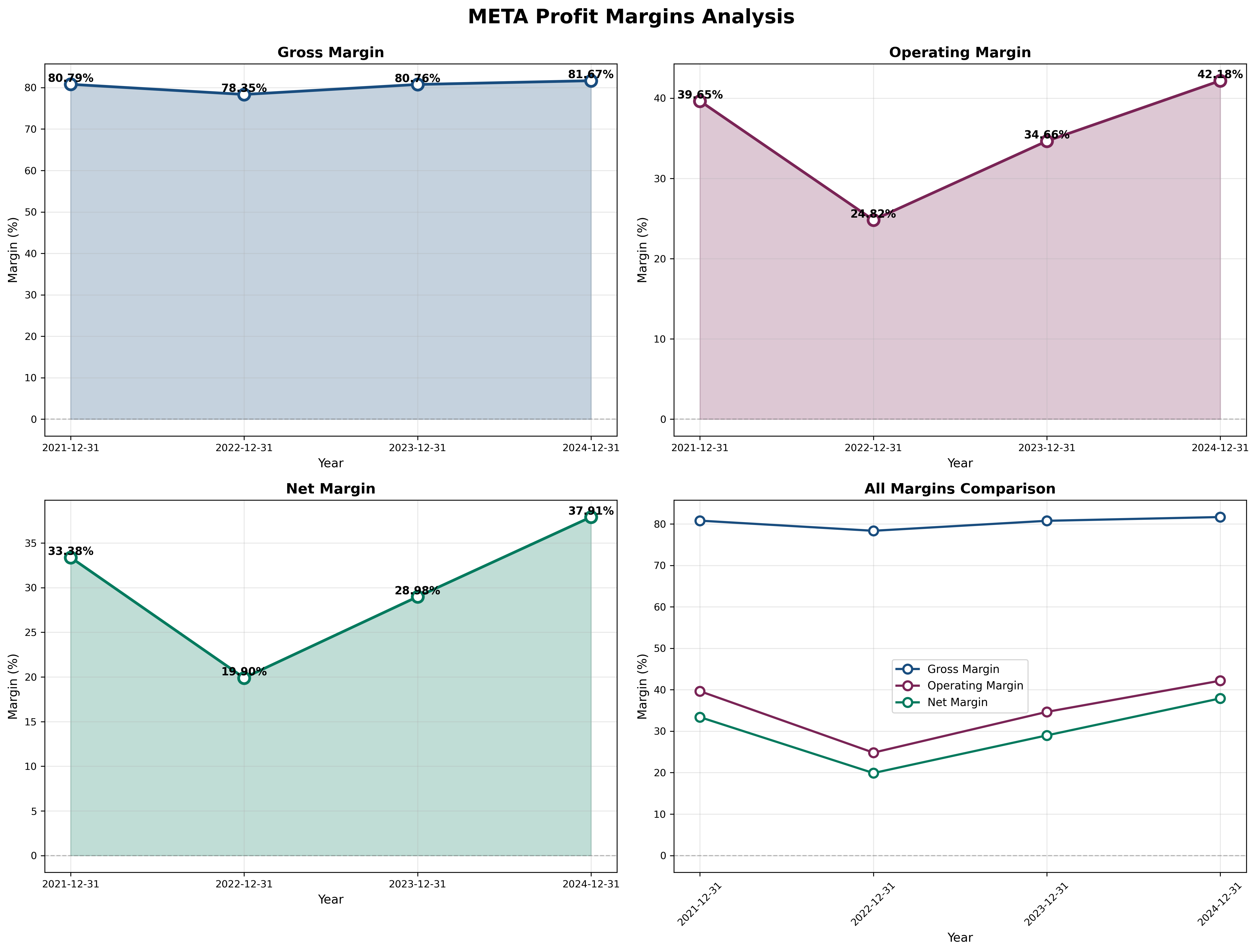

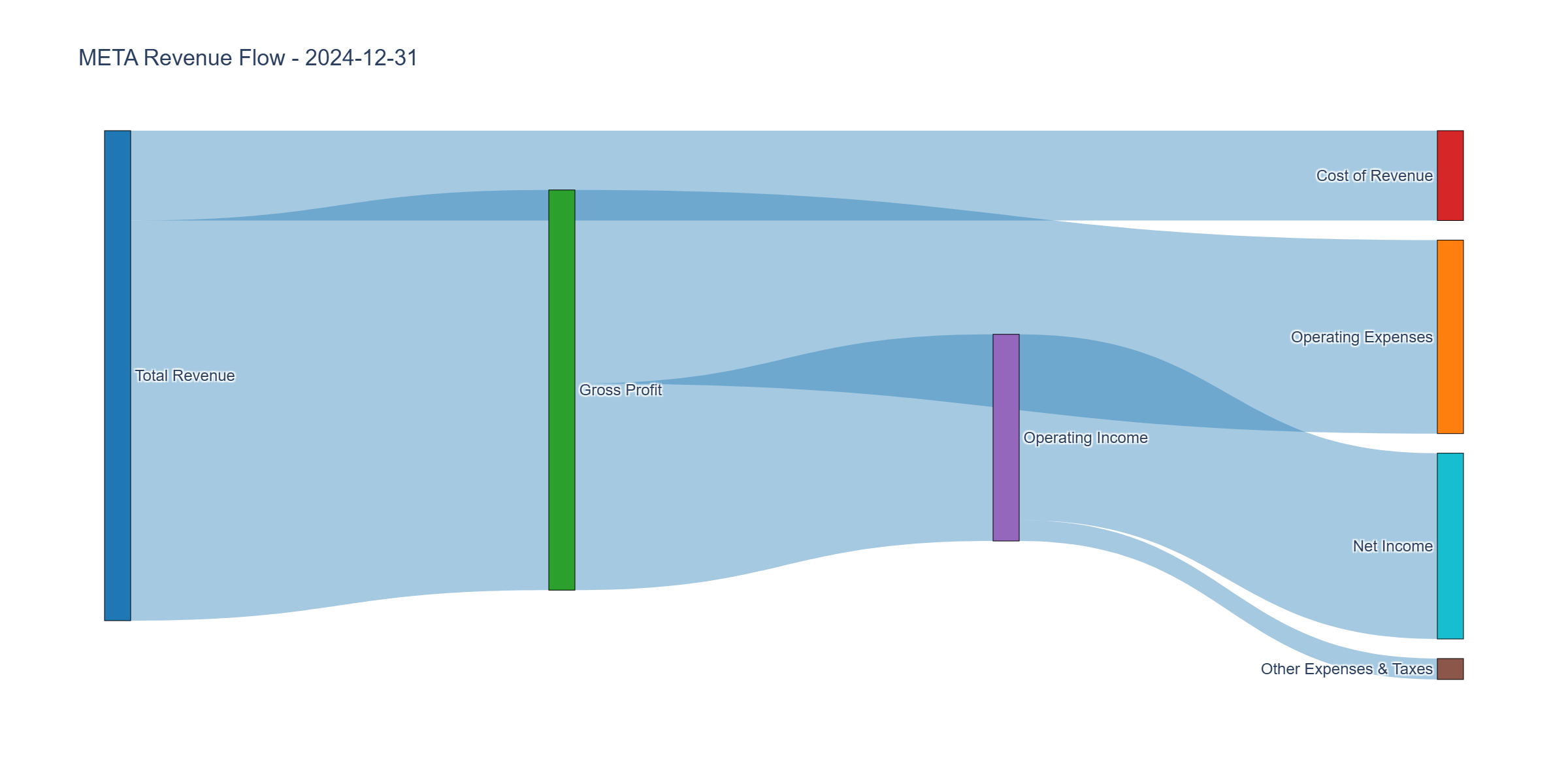

Income Statement Analysis

Key Metrics:

- Revenue Growth (4Y CAGR): 11.3%

- Gross Margin: 81.7% (world-class, stable)

- Operating Margin: 42.2% (elite tier, recovered from 24.8% in 2022)

- Net Margin: 37.9% (top 5% of S&P 500)

Assessment: Single business model risk—98% revenue from advertising creates cyclical exposure. Margins among highest in technology, comparable to Microsoft (36%), far exceeding Alphabet (26%). Operating leverage evident: 22% revenue growth drove 60% net income growth (2023-2024). Sustainability depends on controlling Reality Labs losses and maintaining competitive positioning against TikTok.

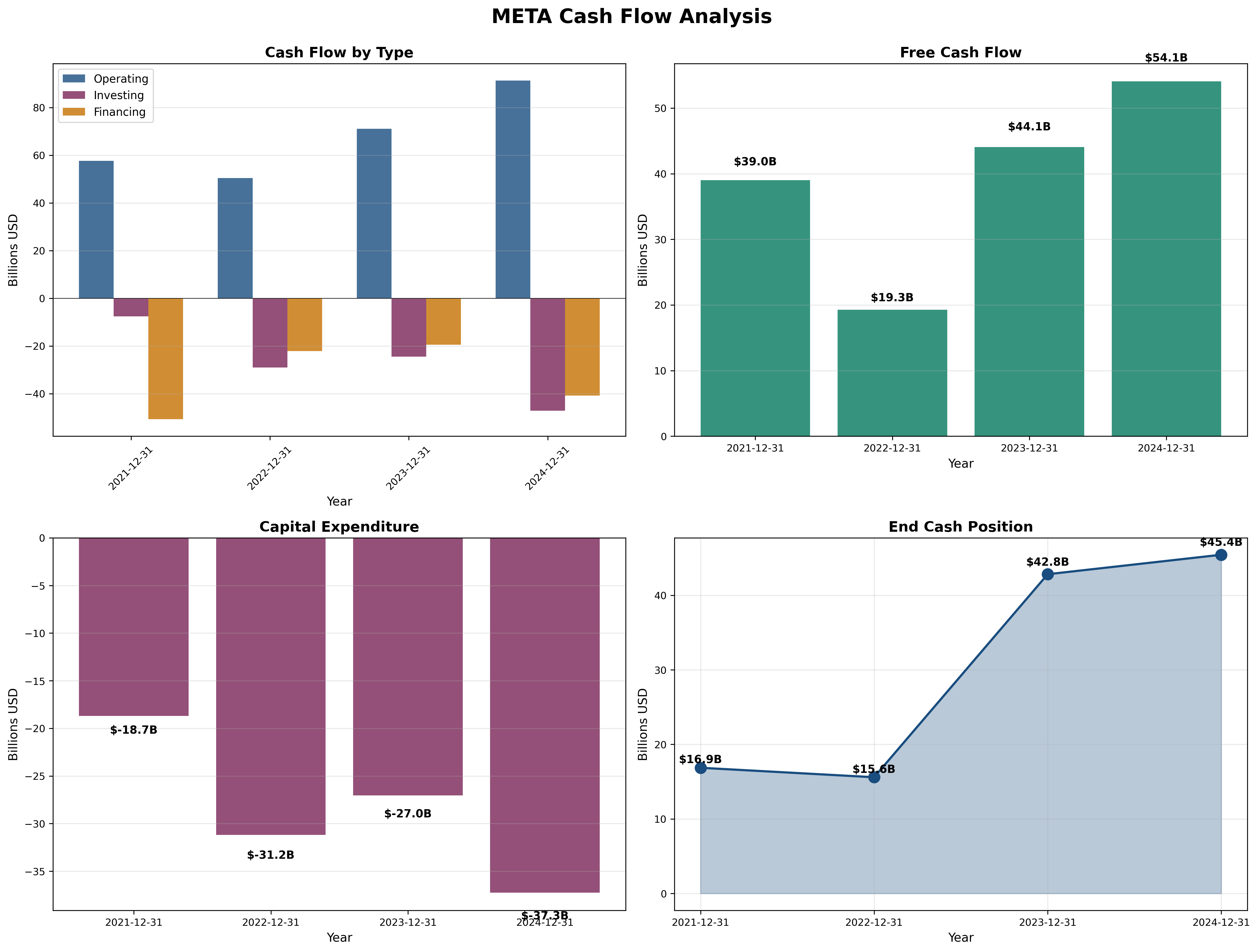

Cash Flow Generation

Key Metrics:

- OCF / Net Income: 1.46x (target > 1.0) ✅ High quality

- FCF Margin: 33% ($54B FCF / $164B revenue) Exceptional

- Capital Intensity: 23% (high for software, reflects AI infrastructure race)

Assessment: Meta is a cash machine with negative working capital (collects ads immediately, pays vendors later). FCF grew from $39B (2021) to $54B (2024) despite tripling capex to $38B. Concern: Elevated capex will persist ($37-40B guided for 2025+) as AI arms race intensifies. Reality Labs burns $15B+ annually. Despite this, Meta returns ~$49B to shareholders annually through buybacks and dividends.

Profitability Metrics

Returns:

- ROE: 40.6% (target > 15%) ✅ Top 5% of S&P 500

- ROIC: ~35% (target > 12%) ✅ Elite

- ROA: 23.6% vs industry 5-10% ✅

Assessment: Every dollar retained earns $0.40+ annually. Meta can reinvest at very high rates, creating compounding machine. Returns recovered from 18.1% ROE nadir in 2022 to current 40.6%. Sustainability depends on maintaining advertising pricing power and competitive moat.

Financial Ratios Analysis

Valuation Multiples:

- P/E: 27.2x (vs historical 20-30x, industry 25-35x) - Fair to slightly expensive

- P/B: 9.69x - Premium, but book value understates intangible assets

- P/FCF: 34.9x - Expensive

- EV/EBITDA: ~22x - Fair for high-margin grower

PEG Ratio:

- P/E Ratio: 27.2

- Growth Rate: 15-20% (conservative forward estimate)

- PEG: 27.2 / 20 = 1.36

Lynch’s Assessment: PEG of 1.36 indicates fairly valued—paying full price for growth. PEG < 1.0 would be attractive (need pullback to $600 or growth acceleration to 25%+). Current valuation assumes 15-20% sustained growth; if wrong, stock is expensive.

Combined Metric: P/E × P/B = 263.6 (Graham target < 22.5) - Fails, but this metric is obsolete for asset-light businesses.

Capital Allocation Assessment

Management Quality Grade: B+

Scorecard:

- Reinvestment ($100B over 4 years): Grade A - Investing in AI infrastructure at appropriate scale, though Reality Labs ($50B+ cumulative spend) shows zero ROI

- Buybacks ($120B over 4 years): Grade B+ - Excellent timing buying at $175 bottom in 2022, but less attractive at current $750+. Share count down 9.5% despite heavy stock comp.

- Dividends ($15B cumulative): Grade B - Symbolic $2/share (0.27% yield) signals confidence but too small to matter

- Acquisitions: Grade A - Disciplined, avoiding large M&A at this scale

- Debt Management: Grade C - Increased debt 3.5x ($14B → $49B) unnecessarily given cash generation

Management Red Flags:

- Zuckerberg’s dual-class voting gives absolute control—can waste $100B+ on Reality Labs without shareholder recourse

- Reality Labs is massive capital allocation error: $15B+ annual losses, no path to profitability, no clear market demand

- $12B annual stock-based compensation partially offsets buyback benefits

Green Flags:

- Zuckerberg owns $175B+ stock (massive alignment)

- “Year of Efficiency” (2023) showed willingness to cut costs when needed

- Track record of adapting (Stories from Snapchat, Reels from TikTok)

Valuation & Intrinsic Value

Multiple Methods Summary:

| Method | Intrinsic Value | Current vs Target |

|---|---|---|

| Owner Earnings (15% growth) | $1,125/share | -33% undervalued |

| Graham Revised Formula | $812/share | -8% undervalued |

| DCF (Conservative 10% discount) | $635/share | +18% overvalued |

| Reverse DCF (Market Implied) | $750/share | Fair value |

Valuation Range:

- Conservative: $635/share (strict DCF)

- Base Case: $850/share (blended methods)

- Optimistic: $1,125/share (if 15%+ growth sustained)

Probability-Weighted Fair Value:

- 25%: Bear case $600/share

- 50%: Base case $850/share

- 25%: Bull case $1,100/share

- Expected value: $850/share

Current Price: $751.67

Margin of Safety: +13.1% (insufficient—Graham requires 30%+ minimum)

Valuation Verdict: Meta is fairly valued. Not a bargain (like $90-130 in late 2022), but not egregiously expensive. PEG of 1.36 means you’re paying full price for growth with no discount for risk. Valuation hinges entirely on achieving 15-20% growth for 3-5 years.

Risk Assessment

Key Risks (Top 3)

Reality Labs Money Pit (60% probability, -15% impact): $15-20B annual losses with no clear path to profitability. If losses accelerate or persist another decade, $200B+ value destruction. Zuckerberg’s control means shareholders cannot stop this.

Privacy Regulations Crushing Ad Targeting (40% probability, -30% impact): Apple ATT was just the beginning. Further restrictions could reduce CPM rates 20-30%, compressing margins to 25-30% and slowing growth to single digits.

Platform Obsolescence / TikTok Disruption (20% probability, -60% impact): Younger generations preferring TikTok’s AI-driven content over Meta’s friend-based feeds. If Gen Z and younger reject “parents’ social networks,” Meta faces secular decline in 10-15 years.

Worst Case Scenario: Simultaneous hits from TikTok competition, regulatory breakup, privacy devastation, recession—could drive stock to $200-300 (-60% to -75%). Liquidation value only ~$30B ($12/share), but acquisition by Microsoft/Google more likely than liquidation.

Investment Recommendation

Current Assessment

Valuation: PEG = 1.36 | P/E = 27.2x | Margin of Safety = 13% Verdict: Fairly valued, insufficient safety margin for new purchases

Margin of Safety: 13% vs Graham’s 30% minimum ❌

Entry Zones

| Zone | Price | Margin of Safety | Action |

|---|---|---|---|

| 🟢 Strong Buy | < $510 | 40%+ | Back up the truck |

| 🟡 Buy | $510 - $595 | 30-40% | Build position |

| 🟠 Hold | $680 - $850 | 10-30% | Wait for pullback |

| 🔴 Avoid | > $850 | < 10% | Take profits |

Current Price: $751 → Recommendation: 🟠 HOLD / WAIT

Expected Returns (3-Year)

- Bull Case (30%): $1,200-1,500 → +60% to +100% if AI succeeds, WhatsApp monetizes, Reels wins

- Base Case (50%): $900-1,100 → +20% to +45% if steady 15% growth continues

- Bear Case (20%): $500-650 → -13% to -33% if TikTok wins, regulations bite, recession hits

Expected Annual Return: ~11% (vs S&P 500 ~10%) - modest excess return with higher volatility

Final Investment Conclusion

Overall Grade: B+

Category Scores:

- Business Quality: 9/10 (Network effects moat exceptional, but under pressure)

- Financial Strength: 8/10 (Fortress balance sheet, elite cash flow)

- Management Quality: 7/10 (Brilliant but Reality Labs is massive error)

- Valuation: 6/10 (Fair but not cheap, PEG 1.36)

- Margin of Safety: 5/10 (Only 13%, insufficient)

Final Verdict: HOLD (existing positions) / WAIT FOR BETTER ENTRY (new money)

Investment Thesis Summary

Meta owns the world’s most valuable social network ecosystem with unmatched scale (3B+ users) and industry-leading economics (38% net margins, $54B FCF). The network effects moat remains formidable—no competitor can replicate this at scale. The business quality is excellent.

However, at $751 (27x P/E, PEG 1.36), you’re paying full price for growth with only 13% margin of safety. The 700% rally from $90 (late 2022) to $750 has priced in significant good news. Reality Labs burning $15B+ annually is a glaring capital allocation error, and Zuckerberg’s absolute control means shareholders cannot intervene.

Risks are material: Privacy regulations could devastate ad targeting effectiveness. TikTok competition is real and growing. Regulatory breakup odds are 30%. Meta’s dominance is not guaranteed—platforms can become obsolete (MySpace, Tumblr).

The Masters Would Say:

- Graham: “Margin of safety inadequate at 13%. Wait for $500-600 to buy.”

- Buffett: “Wonderful business, but I want a fat pitch. At $750, I’m paying fair value with no discount.”

- Lynch: “PEG above 1.0 means I’m not loading up. Hold what you own.”

- Templeton: “This is not maximum pessimism (that was November 2022 at $90). Wait for the next crisis.”

- Munger: “What could go catastrophically wrong? Regulatory breakup, $100B wasted on metaverse, TikTok makes Meta irrelevant. Am I compensated at 27x earnings? No.”

Framework Checklist

- ❌ Quantitative: Margin of safety only 13%, need 30%+

- ✅ Moat: Durable competitive advantage from network effects

- ⚠️ Management: Shareholder-friendly buybacks, but Reality Labs is capital destruction

- ❌ Contrarian: Not maximum pessimism—stock near highs after 700% run

- ✅ Simplicity: Can explain business in 2 minutes

Would I hold this for 10+ years if the market closed tomorrow?

YES at $500-600, NO at $750. Meta is a wonderful business at the right price. At $750, I’m paying full price with insufficient margin for error. Better to wait for Mr. Market’s next bout of pessimism—next recession, regulatory scare, or earnings miss will provide entry at $500-600 with adequate safety margin.

Investing is about buying dollars for 60 cents, not paying 95 cents hoping for a dollar tomorrow.

Recommendation Summary:

- If you own META: HOLD, trim if exceeds 10% of portfolio, set alerts for $850+ to take profits

- If considering buying: WAIT for $600 or below, don’t chase after 700% run

- Position sizing: Conservative 0-3%, Moderate 3-7%, Aggressive 7-10% max

Analysis completed November 1, 2024. Reassess regularly as conditions change.