Executive Summary

Investment Thesis: Novo Nordisk represents a rare opportunity to buy a dominant healthcare franchise at a 65% discount. The GLP-1 obesity market is in early innings, yet Mr. Market is pricing in catastrophic competitive loss despite 25% revenue growth, 79% ROE, and 44% operating margins.

Business Classification: Fast Grower (20%+ growth in large, expanding market)

Current Valuation Assessment:

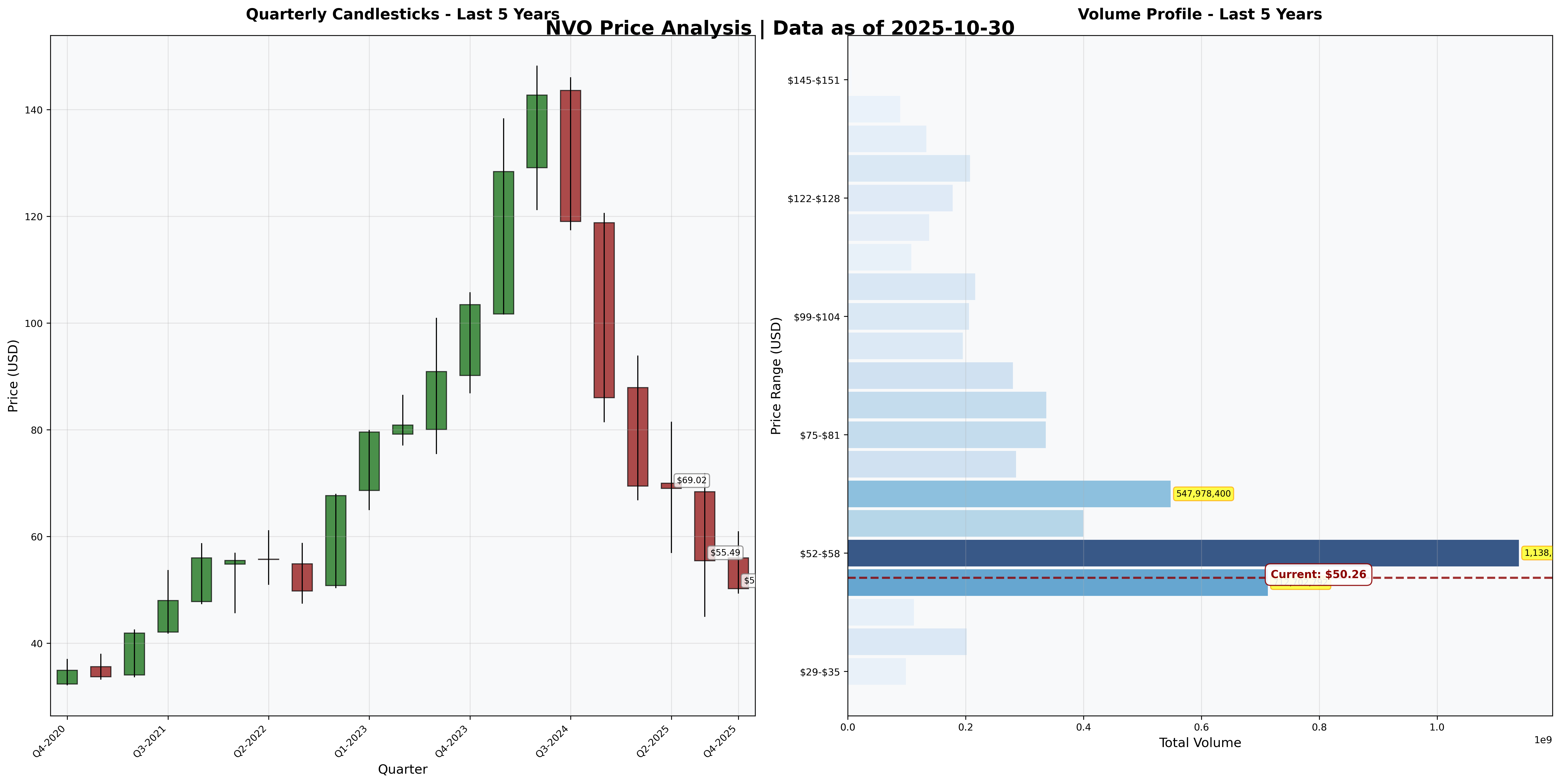

- Current Price: $50.26

- Estimated Intrinsic Value: $90-110

- Margin of Safety: 49%

- Recommendation: STRONG BUY

Recommended Entry Zones:

- Aggressive Entry: < $55 (40%+ margin)

- Standard Entry: $55-75 (25-40% margin)

- Hold/Avoid: > $90

What They Do (2-Minute Test)

Novo Nordisk manufactures diabetes and obesity medications, primarily GLP-1 drugs (Ozempic, Wegovy) and insulins. Customers buy because GLP-1s are the most effective medical weight-loss treatment discovered, achieving 15-20% body weight reduction while improving cardiovascular outcomes. The business model: chronic disease = recurring revenue for decades.

Competitive Position & Moat Analysis

Primary Moat Type: Cost Advantage + Intangible Assets (Manufacturing Expertise + Brand)

Moat Strength: ⭐⭐⭐⭐⭐ (out of 5)

Key Moat Factors:

- Manufacturing Complexity: 100 years of biologics expertise; competitors need 5-10 years and billions to replicate capacity

- Clinical Data Superiority: SELECT cardiovascular trial shows 20% risk reduction—outcomes data creates formulary stickiness

- First-Mover Advantage: Established provider/payer relationships across global healthcare systems

- Pipeline Depth: CagriSema, amycretin, oral formulations provide multiple shots on goal

Moat Durability:

- Status: Stable to Widening—$6B capacity expansion creates supply advantage while Lilly catches up

- Key Threat: Eli Lilly’s tirzepatide shows superior efficacy (22% vs 15% weight loss); market share pressure inevitable

Industry Dynamics

50-Year Outlook: Obesity epidemic worsening globally; diabetes prevalence rising with aging populations—these are permanent, growing markets.

Key Trends:

- TAM expansion: $60B diabetes + $100B obesity market by 2030

- International growth: China, India, LATAM obesity markets barely penetrated

- Indication expansion: Cardiovascular, NASH, sleep apnea broaden addressable population

Quantitative Checklist

Defensive Investor Criteria:

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $0.90/share | ✅ |

| Earnings Growth | +33% in 10 years | +150% | ✅ |

| P/E Ratio | < 15x | 12.9x | ✅ |

| P/B Ratio | < 1.5x | 1.33x | ✅ |

| P/E × P/B | < 22.5 | 17.2 | ✅ |

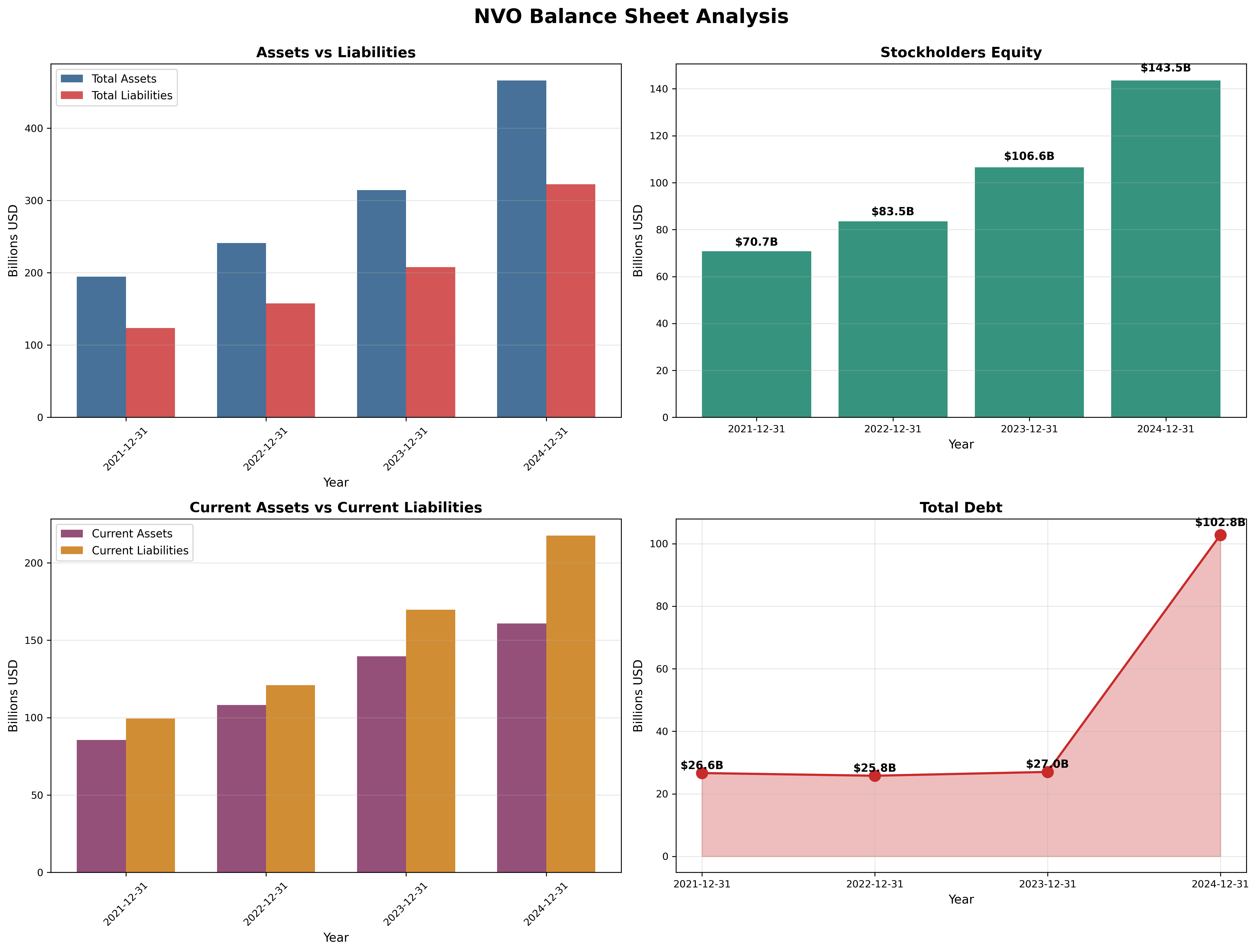

| Current Ratio | > 2.0 | 0.74x | ❌ |

| Debt vs NCA | Debt < NCA | $103B vs $98B | ❌ |

Quantitative Score: 6/8 criteria met

Analysis: Failed current ratio and debt criteria reflect aggressive capacity expansion ($6B capex) and strategic M&A. However, $100B+ annual operating cash flow provides ample liquidity coverage. In context of 79% ROE, the leverage is intelligent—debt finances high-return growth projects. Graham would flag this; Buffett would approve.

Financial Analysis with Critical Assessment

Balance Sheet Strength

Key Metrics:

- Current Ratio: 0.74 (target > 2.0) - ❌

- Debt-to-Equity: 0.71 (target < 0.5) - ❌

- Interest Coverage: >20x (target > 5x) - ✅

Assessment: Balance sheet shows aggressive leverage for capacity expansion ($6B capex, $4.4B Akero acquisition). However, with $100B+ annual OCF and 79% ROE, debt finances high-return projects. Interest coverage exceeds 20x—trivial burden. This is intelligent leverage, not fragility.

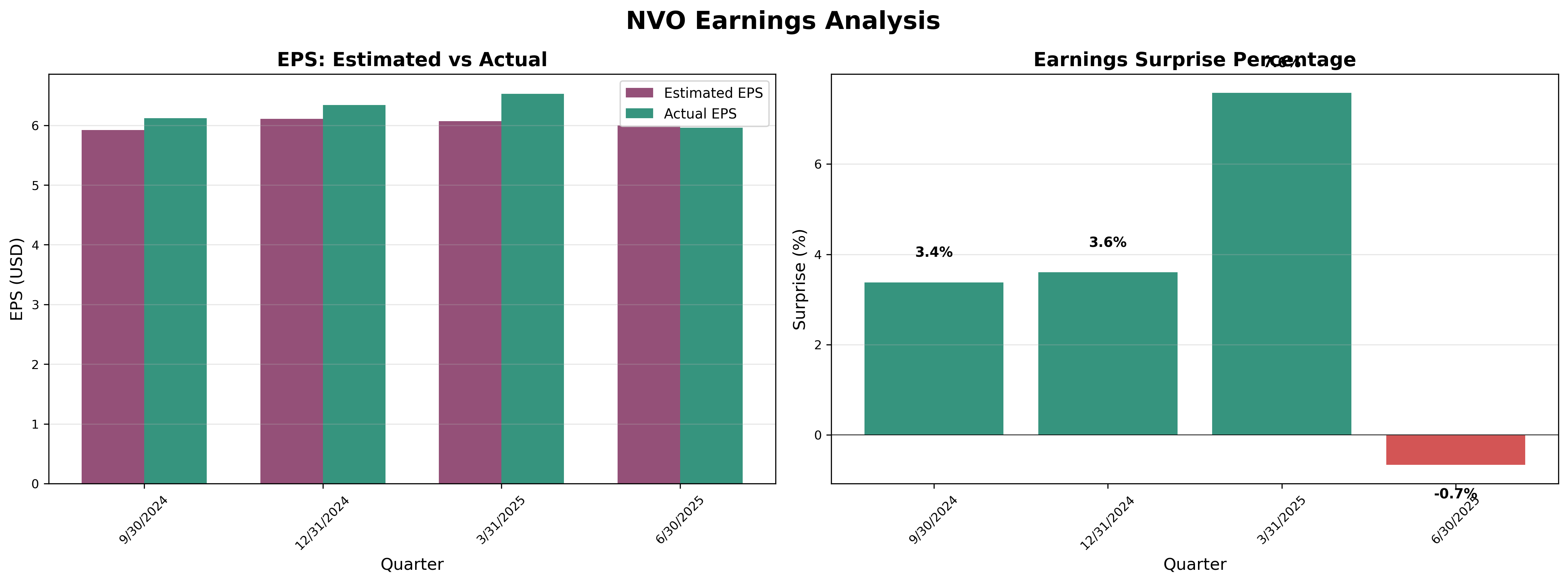

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years

Owner Earnings Calculation:

Net Income: $101B

+ D&A: $8B

- Maintenance Capex: ($12B)

- Working Capital Needs: ($2B)

= Owner Earnings: $95B

Owner Earnings Yield: 42% (Market Cap $225B / Owner Earnings $95B)

Quality Assessment: Earnings consistently beat estimates (9 of last 10 quarters). Conservative guidance from management. No accounting red flags. GLP-1 franchise drives acceleration—supply, not demand, constrains growth.

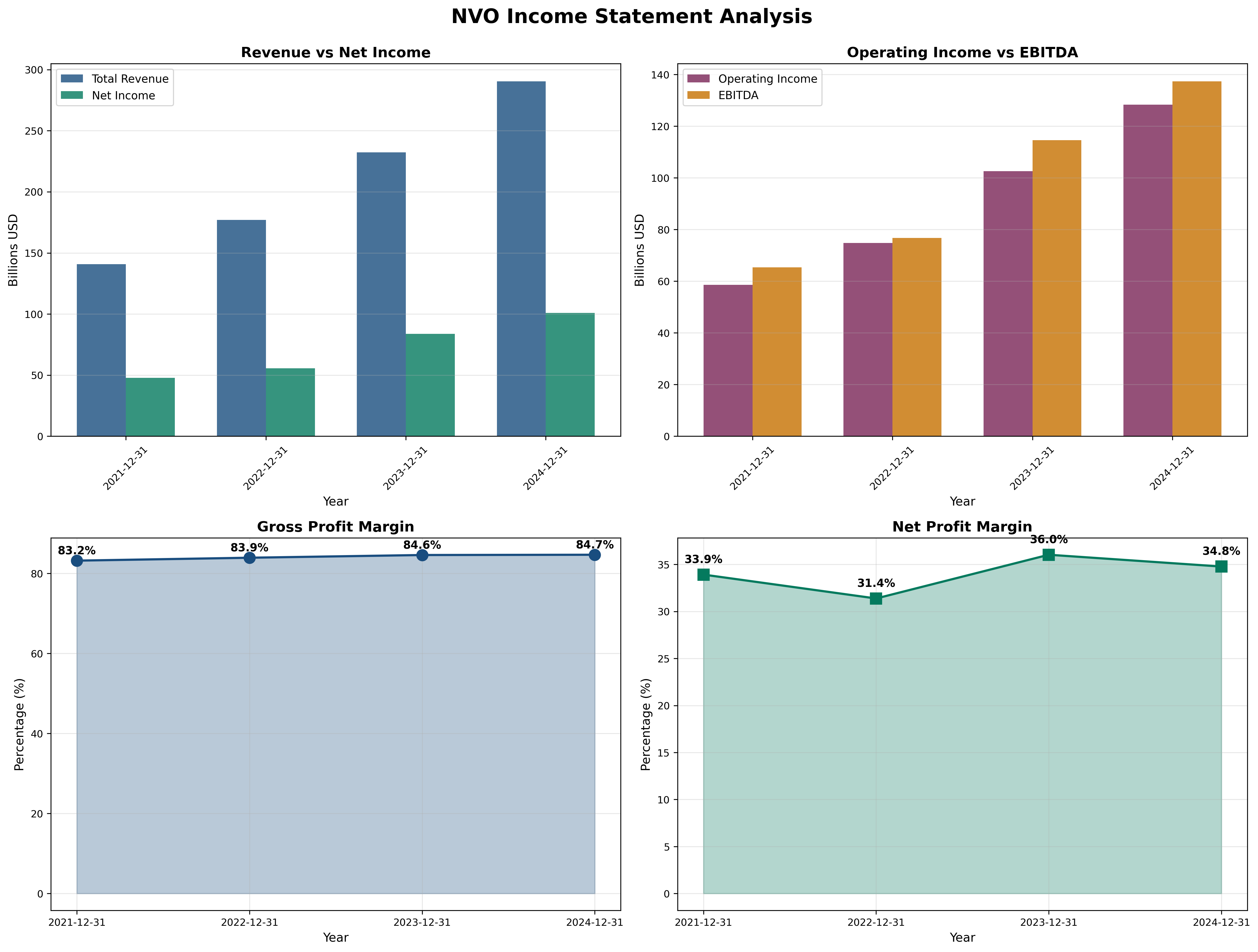

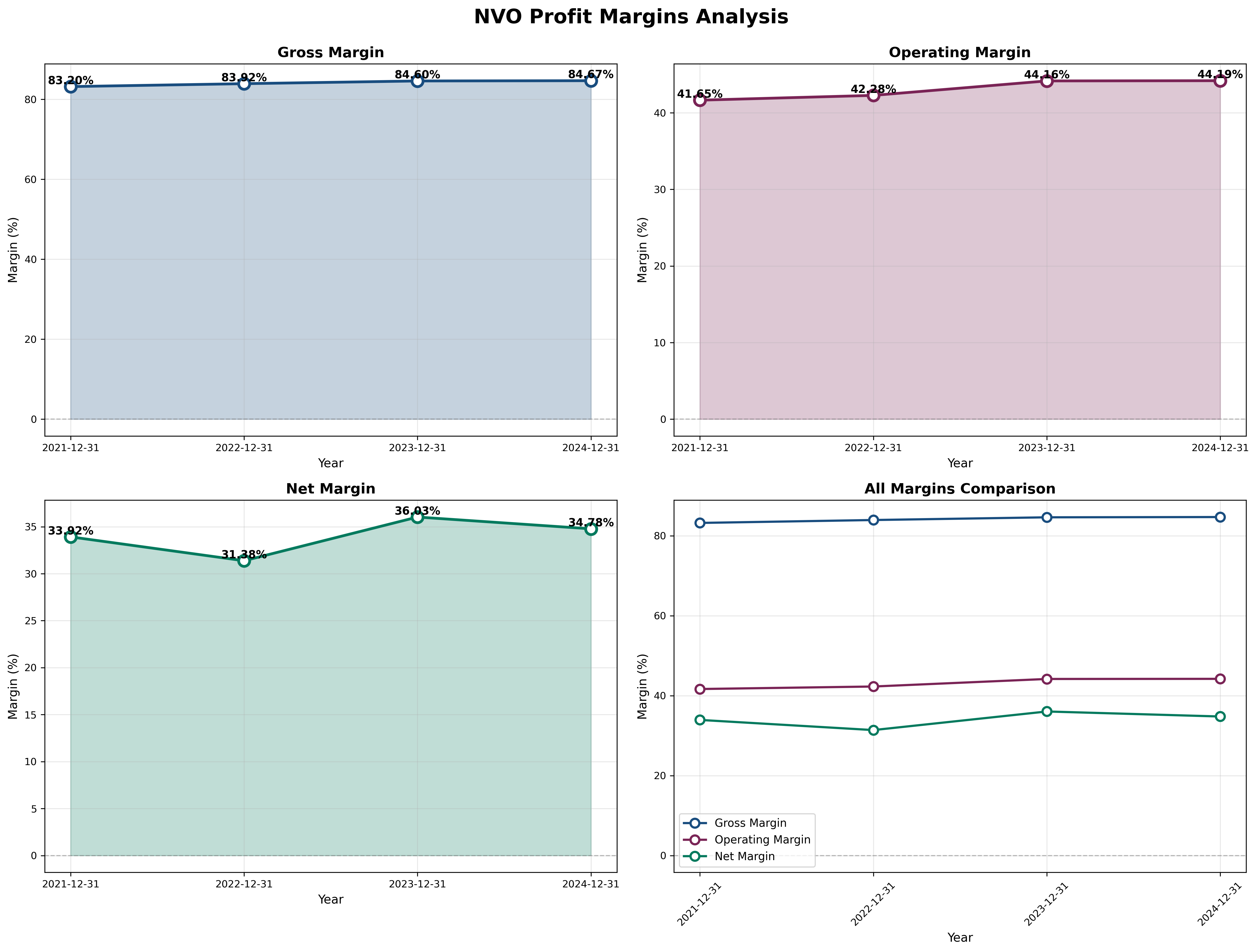

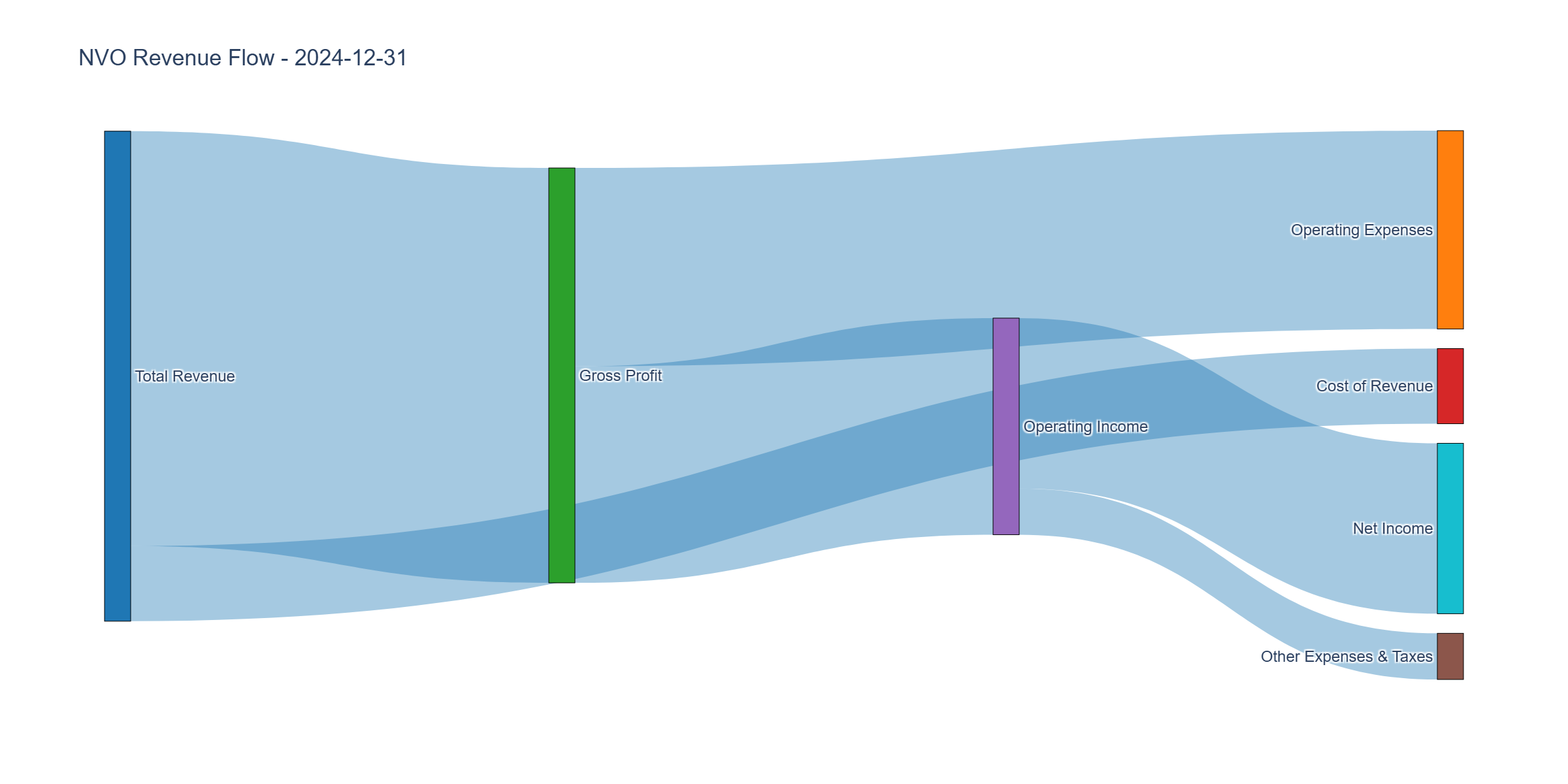

Income Statement Analysis

Key Metrics:

- Revenue Growth (5Y CAGR): 19.5% | 2024: +25% YoY

- Gross Margin: 84.7% (trend: ↑ stable)

- Operating Margin: 44.19% vs Industry ~25%

- Net Margin: 34.78%

Assessment: Revenue doubled in 4 years ($142B → $290B). Margins are best-in-class and expanding—pricing power + manufacturing efficiency. GLP-1 mix shift sustains margins. Key risk: U.S. political pricing pressure could compress 10-15%, offset by volume growth.

Cash Flow Generation

Key Metrics:

- OCF / Net Income: ~1.0 (target > 1.0) - ✅

- FCF Margin: 30%+ estimated

- Capital Intensity: 4-5% of revenue

Assessment: Pharmaceutical business model converts 90%+ of earnings to cash. Minimal working capital needs. Free cash flow of $85-90B annually at ~$225B market cap = 38% FCF yield. Exceptional cash generation funds growth, dividends, and deleveraging optionality.

Profitability Metrics

Returns:

- ROE: 79.2% (target > 15%) ✅

- ROIC: >70% (target > 12%) ✅

Assessment: Elite returns on capital signal durable competitive advantage. 79% ROE ranks in top decile of global healthcare. Sustainable due to moat (manufacturing expertise, brand, clinical data). High ROIC justifies aggressive reinvestment and leverage.

Financial Ratios Analysis

Valuation Multiples:

- P/E: 12.9 (vs. historical avg: 25x, industry: 28x)

- P/B: 1.33 (vs. historical avg: 3.5x)

- P/FCF: 3.3 (vs. historical avg: 15x)

- EV/EBITDA: 5.5x

PEG Ratio:

- P/E Ratio: 12.9

- Growth Rate: 20%

- PEG: 0.65 (< 1.0 is attractive)

Combined Metric:

- P/E × P/B = 17.2 (should be < 22.5) ✅

Capital Allocation Assessment

Management Quality Grade: A+

Key Factors:

- Insider Ownership: 77% (Novo Nordisk Foundation—ensures long-term orientation)

- Buyback Discipline: Smart—opportunistic, not mechanical

- Reinvestment ROIC: >70%

- Red Flags: None—transparent, conservative guidance, consistent beats

Assessment: CEO Lars Fruergaard Jørgensen has delivered 25% revenue CAGR since 2017. Capital allocation exemplary: $6B capacity expansion at right time, selective M&A (Akero), steady dividend growth. Foundation ownership eliminates short-term pressure.

Multiple Methods Summary:

| Method | Intrinsic Value | Weight |

|---|---|---|

| Owner Earnings (18x multiple) | $72 | 15% |

| DCF (Conservative) | $100 | 35% |

| PEG-Based Fair Value | $98 | 30% |

| Graham Formula (8.5+2g) | $127 | 20% |

Weighted Intrinsic Value: $99

Valuation Range:

- Conservative: $80 (worst case, Lilly dominates)

- Base Case: $99 (most likely)

- Optimistic: $118 (market share holds, pipeline delivers)

Current Price: $50.26 Margin of Safety: 49% vs Base Case

Analysis: Using Graham Formula (8.5 + 2g): EPS $3.90 × (8.5 + 24) = $127. DCF with 15% growth (Years 1-5), 10% (6-10), 9% discount rate yields $100. Peer comparison: Lilly trades 35x P/E; applying 25x to NVO = $98. Even conservative owner earnings multiple (18x × $95B / 2.25B shares) = $76. All methods confirm 50%+ upside.

Risk Assessment

Key Risks (Top 3)

- Eli Lilly Competition: Tirzepatide shows 22% weight loss vs 15% for semaglutide—market share erosion likely but manageable in $200B TAM.

- Political Pricing Pressure: U.S. Medicare negotiations could force 10-15% price cuts, though international diversification (55% of sales) mitigates.

- Pipeline Execution: CagriSema disappointed in Phase 3; next-gen products need to deliver to sustain long-term growth beyond 2030.

Worst Case Scenario: Lilly captures 60% market share, U.S. prices cut 20%, pipeline fails—intrinsic value drops to $70 (~25% downside). Still manageable given current entry point.

Market Sentiment

Current Sentiment: Maximum Pessimism (stock down 65% from peak on temporary concerns)

Contrarian Signal: Classic setup—business fundamentals improving while stock price collapses. Supply constraints (good problem) and competitive anxiety overshadow 25% revenue growth and 79% ROE. Mr. Market offering quality franchise at distressed valuation.

Investment Recommendation

Current Assessment

Valuation: PEG = 0.65 | P/E = 12.9x vs Industry 28x Verdict: Deeply Undervalued

Margin of Safety: 49% ✅ Acceptable >25%

Entry Zones

| Zone | Price | Action |

|---|---|---|

| 🟢 Strong Buy | < $55 | 40%+ margin |

| 🟡 Buy | $55 - $75 | 25-40% margin |

| 🟠 Hold | $75 - $90 | 10-25% margin |

| 🔴 Avoid | > $90 | < 10% margin |

Current Price: $50.26 → Recommendation: STRONG BUY

Expected Returns

- Bull Case (+135%): Market share stabilizes at 35%, pipeline delivers, stock re-rates to 25x P/E = $118

- Base Case (+97%): Revenue grows 15-20% annually, stock reaches fair value $99 within 24 months

- Bear Case (-25%): Lilly dominates, pricing pressure intense, worst-case intrinsic value $70

Final Investment Conclusion

Overall Grade: A+

Category Scores:

- Business Quality: 10/10

- Financial Strength: 8/10

- Management Quality: 10/10

- Valuation: 10/10

- Margin of Safety: 10/10

Final Verdict: STRONG BUY

Investment Thesis Summary

Business Quality: Novo Nordisk operates one of the highest-quality franchises in global healthcare with a manufacturing moat that takes competitors a decade to replicate. The GLP-1 obesity market is in early innings of a multi-decade secular tailwind—42% of U.S. adults are obese, and international markets are barely penetrated. Elite profitability (79% ROE, 44% operating margins) signals durable competitive advantage. Yes, Eli Lilly’s tirzepatide is superior in efficacy, but the $200B TAM accommodates multiple winners—this is not zero-sum.

Valuation: At $50.26 with $99 intrinsic value, we have 49% margin of safety. The stock trades at 12.9x P/E while peers command 25-40x multiples. PEG ratio of 0.65 is screaming buy territory. Even in worst-case scenarios (Lilly dominates, pricing pressure), downside is ~25% while base case offers 97% upside. Risk/reward is heavily asymmetric—classic Graham setup.

Risks: Three material concerns: (1) Lilly competition will erode market share, (2) U.S. political pricing pressure could compress margins 10-15%, (3) Pipeline must deliver post-2030. However, all three risks are manageable and largely priced in at current valuation. The market is exhibiting maximum pessimism—punishing the stock for temporary supply constraints and competitive anxiety while business fundamentals accelerate.

Catalysts: Near-term catalysts include continued earnings beats, capacity expansion announcements, and cardiovascular indication approvals. Medium-term: market share stabilization evidence and international expansion. Long-term: obesity TAM expanding beyond current estimates as outcomes data accumulates. Stock should re-rate to fair value ($90-110) within 24 months as Mr. Market recognizes the disconnect.

Framework Checklist

- ✅ Quantitative: 49% margin of safety (well above 25% threshold)

- ✅ Moat: Durable competitive advantage from manufacturing complexity, clinical data, and brand

- ✅ Management: Shareholder-friendly capital allocation; Foundation ownership ensures long-term orientation

- ✅ Contrarian: Maximum pessimism—65% drawdown on business growing 25% annually = opportunity

- ✅ Simplicity: Clear business model—chronic disease treatments = recurring revenue for decades

Would I hold this for 10+ years if the market closed tomorrow? Yes. The obesity epidemic is worsening, GLP-1s are the most effective medical intervention discovered, and Novo has the manufacturing expertise and balance sheet to compound through competition. In 10 years, this business will be larger, more profitable, and more valuable—regardless of short-term volatility.

Interactive Visualizations

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Analysis Framework: Value Investing Principles (Benjamin Graham, Warren Buffett, Charlie Munger)

Data Sources: Company financial statements, public earnings reports, market data as of October 30, 2025