Executive Summary

Investment Thesis: TSMC is the world’s dominant pure-play semiconductor foundry with an impregnable moat in leading-edge chip manufacturing, benefiting from AI/HPC secular tailwinds. However, valuation offers minimal margin of safety at current prices despite exceptional business quality.

Business Classification: Stalwart (large, established company with 10-15% growth potential)

Current Valuation Assessment:

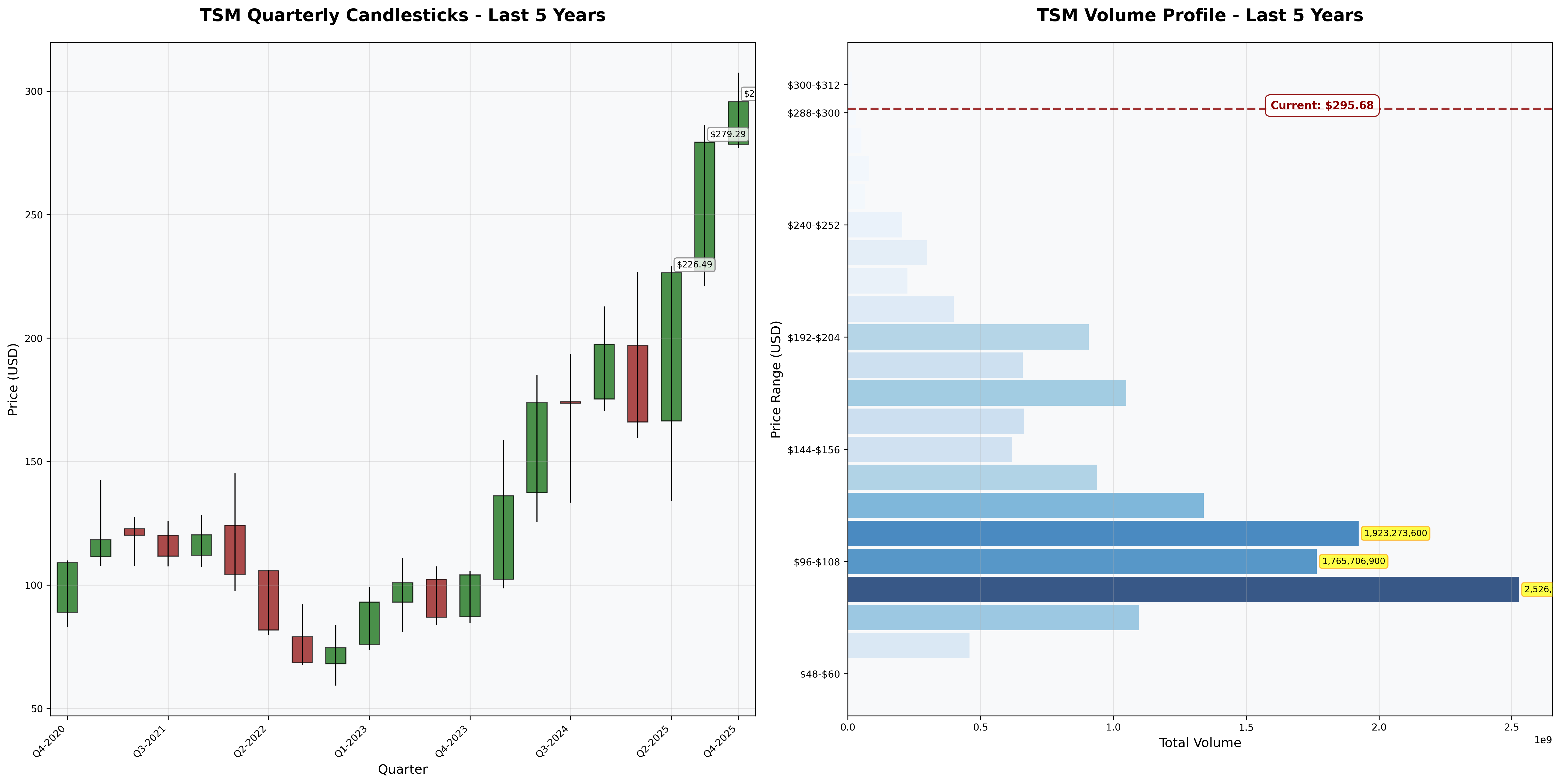

- Current Price: $295.68

- Estimated Intrinsic Value: $210 - $255

- Margin of Safety: -16% to -39% (NEGATIVE)

- Recommendation: HOLD / WAIT FOR PULLBACK

Recommended Entry Zones:

- Aggressive Entry: < $200 (40%+ margin)

- Standard Entry: $200 - $225 (25-30% margin)

- Hold/Avoid: > $250

Business Overview

What They Do (2-Minute Test)

TSMC manufactures semiconductor chips for other companies—they own no brands consumers recognize. Apple, NVIDIA, AMD, and others design chips; TSMC fabricates them. They’re the world’s most advanced foundry, producing chips at 3nm and progressing to 2nm nodes that competitors can’t match. Think of them as the world’s most sophisticated contract manufacturer with technology barriers so high that only one or two companies globally can even attempt to compete.

Competitive Position & Moat Analysis

Primary Moat Type: Cost Advantage + Switching Costs + Intangible Assets (Process Technology)

Moat Strength: ⭐⭐⭐⭐⭐ (5 out of 5)

Key Moat Factors:

- Process leadership: 3-5 years ahead of competitors at leading-edge nodes (3nm/2nm); customers cannot replicate these capabilities internally

- Scale economies: $30B+ annual capex creates insurmountable barriers; no new entrant can afford this investment

- Switching costs: Customers invest billions in design tools, yield optimization, and IP libraries specific to TSMC’s processes

- Ecosystem lock-in: Advanced packaging (CoWoS), design services, and supply chain integration create stickiness beyond just manufacturing

Moat Durability:

- Widening: AI accelerator demand and advanced packaging requirements strengthen TSMC’s lead versus struggling competitors (Intel foundry, Samsung)

- Key Threat: Geopolitical risk from Taiwan concentration—though global diversification underway, it’s expensive and margin-dilutive

Industry Dynamics

50-Year Outlook: Semiconductors will remain critical infrastructure; computing demand is secular. However, node economics may plateau as physics limits approach.

Key Trends:

- AI/HPC driving high-value, leading-edge demand with premium pricing power

- Packaging becoming as important as front-end manufacturing (moat extension)

- Government subsidies creating geographic diversification but at cost of margin compression

Quantitative Checklist

Defensive Investor Criteria:

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $2.67/share (50% payout) | ✅ |

| Earnings Growth | +33% in 10 years | +250%+ | ✅ |

| P/E Ratio | < 15x | 32.3x | ❌ |

| P/B Ratio | < 1.5x | 1.67x | ❌ |

| P/E × P/B | < 22.5 | 53.94 | ❌ |

| Current Ratio | > 2.0 | 2.37 | ✅ |

| Debt vs NCA | Debt < NCA | Fails (Debt $1,047B, NCA ~$1,790B) | ⚠️ |

| Size | Revenue > $100M | $2,903B | ✅ |

Quantitative Score: 5.5/9 criteria met

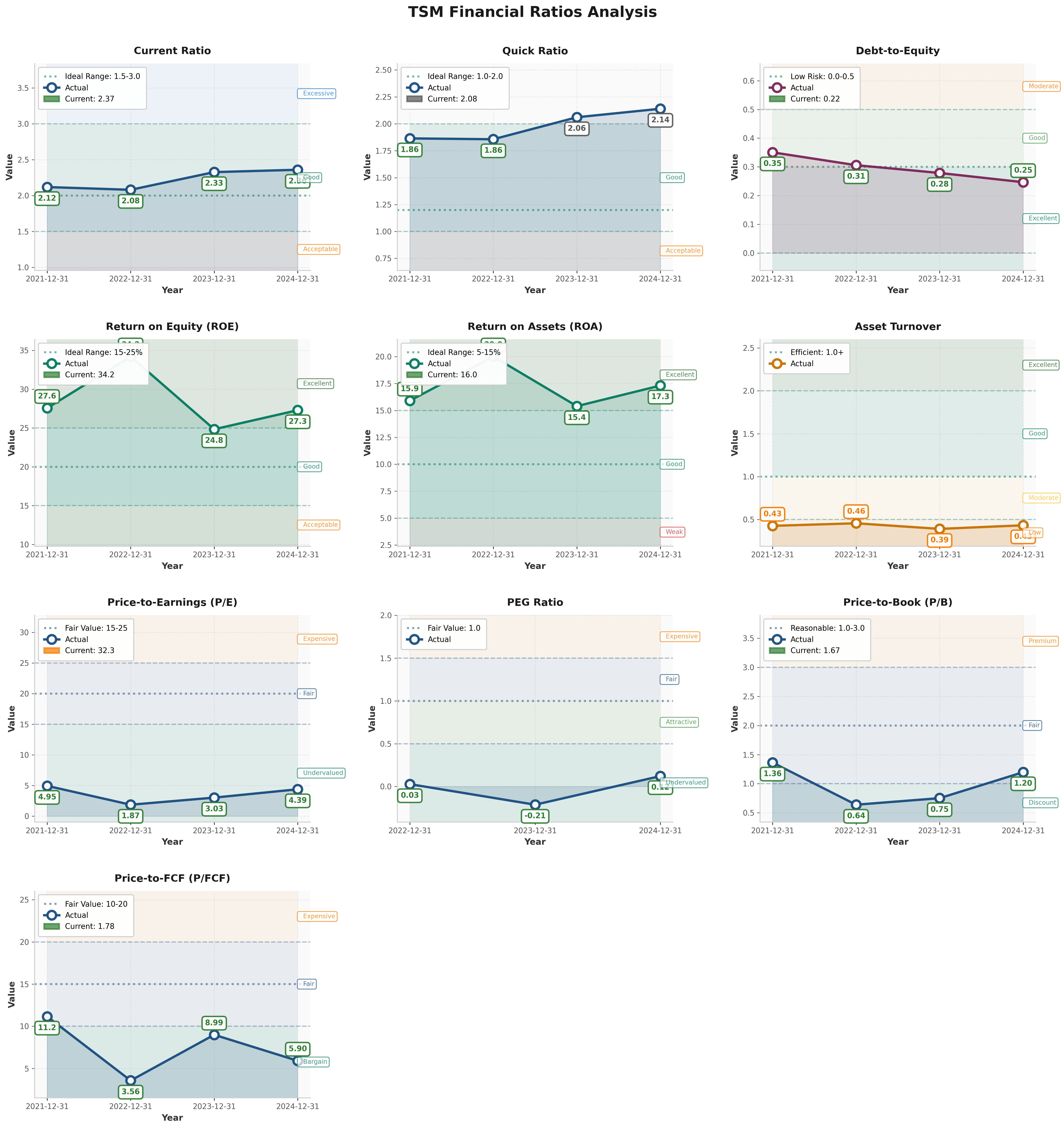

Analysis: TSM passes business quality tests (earnings stability, growth, balance sheet strength) but fails all valuation criteria. The P/E × P/B of 53.94 is more than double Graham’s 22.5 limit, indicating significant overvaluation by classical standards. This is a wonderful business at a fair-to-rich price.

Financial Analysis with Critical Assessment

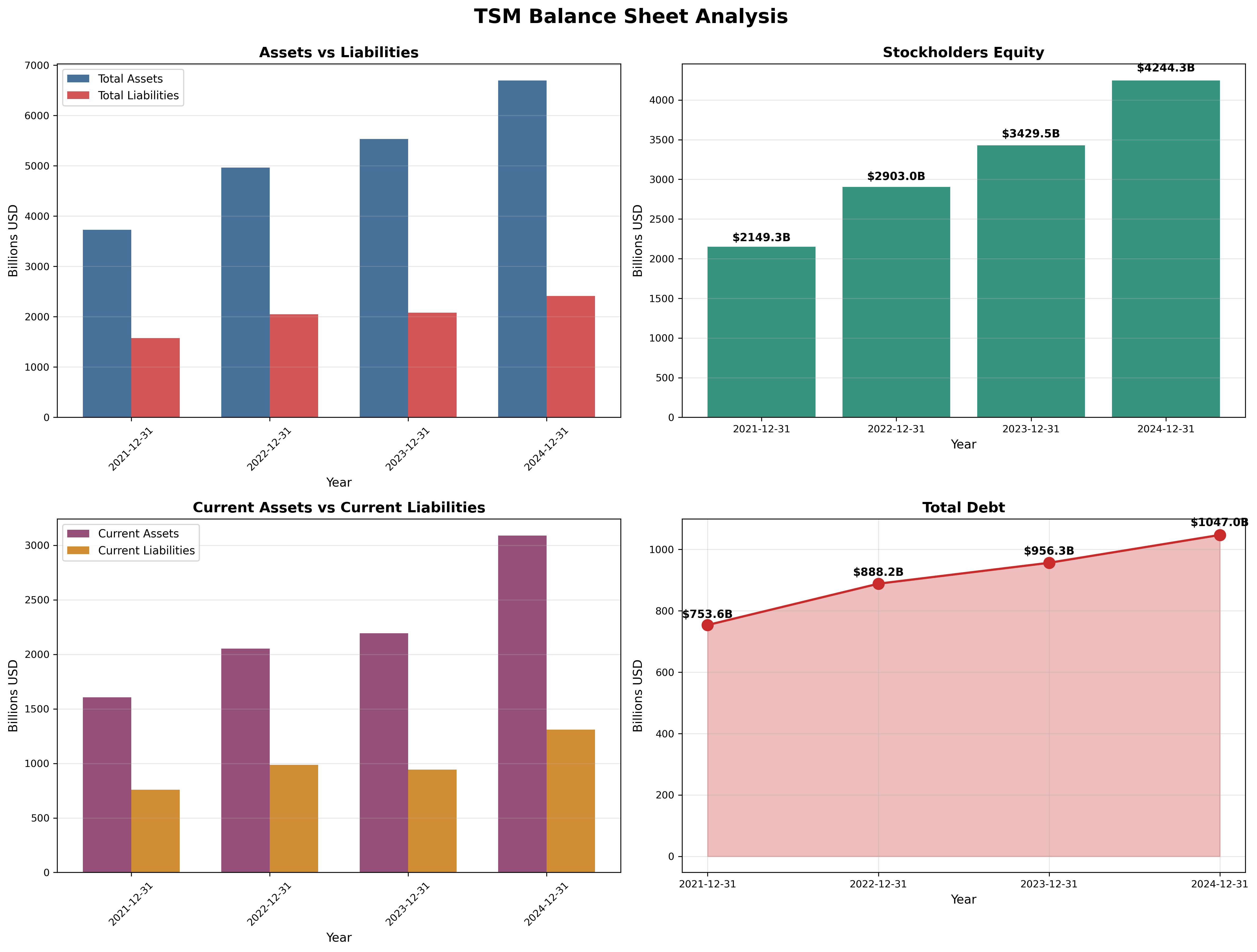

Balance Sheet Strength

Key Metrics:

- Current Ratio: 2.37 (target > 2.0) - ✅

- Debt-to-Equity: 0.22 (target < 0.5) - ✅

- Interest Coverage: 60x+ (EBITDA/Interest) - ✅

- Cash Position: $2,128B vs. Debt $1,047B = Net Cash $1,081B

Assessment: Fortress balance sheet. Conservative leverage despite massive capex requirements demonstrates pricing power and cash generation quality. Management could lever up significantly but chooses discipline—a hallmark of shareholder-friendly capital allocation.

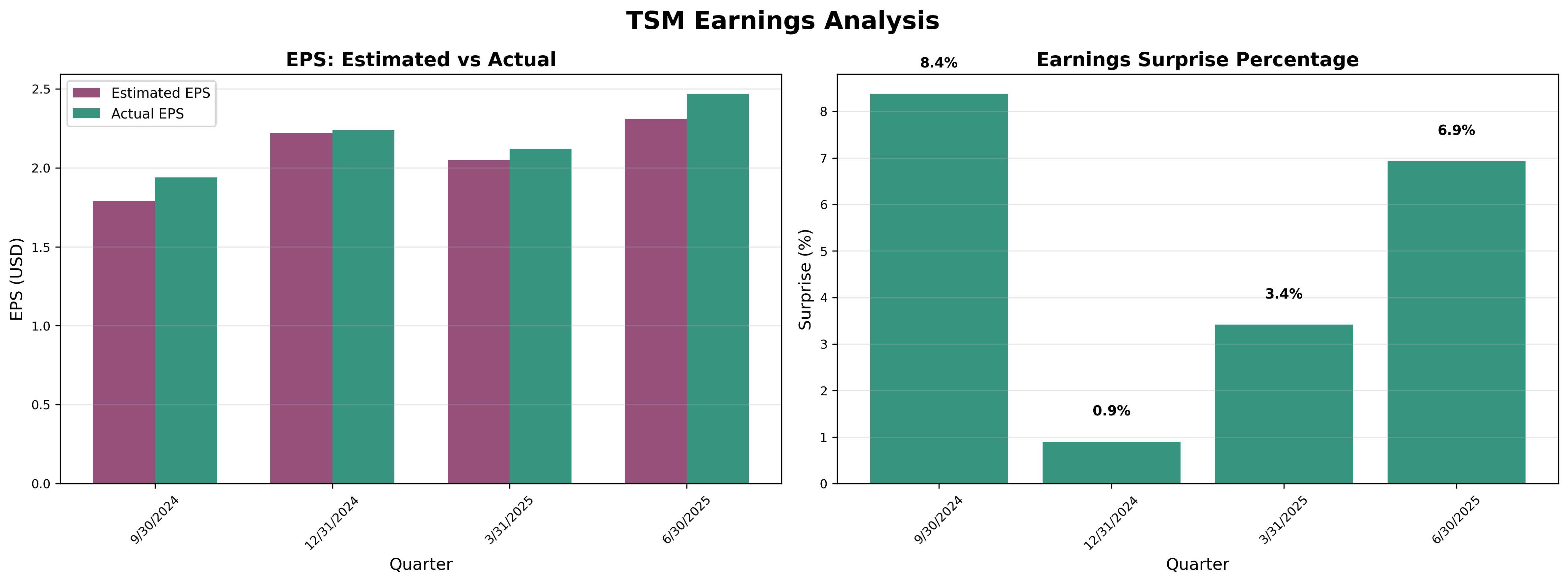

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years

Owner Earnings Calculation:

Net Income (2024): $1,162B

+ D&A: ~$600B (est.)

- Maintenance Capex: ($300B) (30% of total capex)

- Growth Capex: ($665B)

- Working Capital Needs: ($50B)

= Owner Earnings (Normalized): ~$747B

Owner Earnings Yield: ~13.7% (assuming $5.5T market cap)

Quality Assessment: Earnings are exceptionally stable with consistent positive surprises. Capital intensity is high, but returns on invested capital (34% ROE) far exceed cost of capital, justifying reinvestment. The cyclicality seen in 2022-2023 was industry-wide, not TSM-specific.

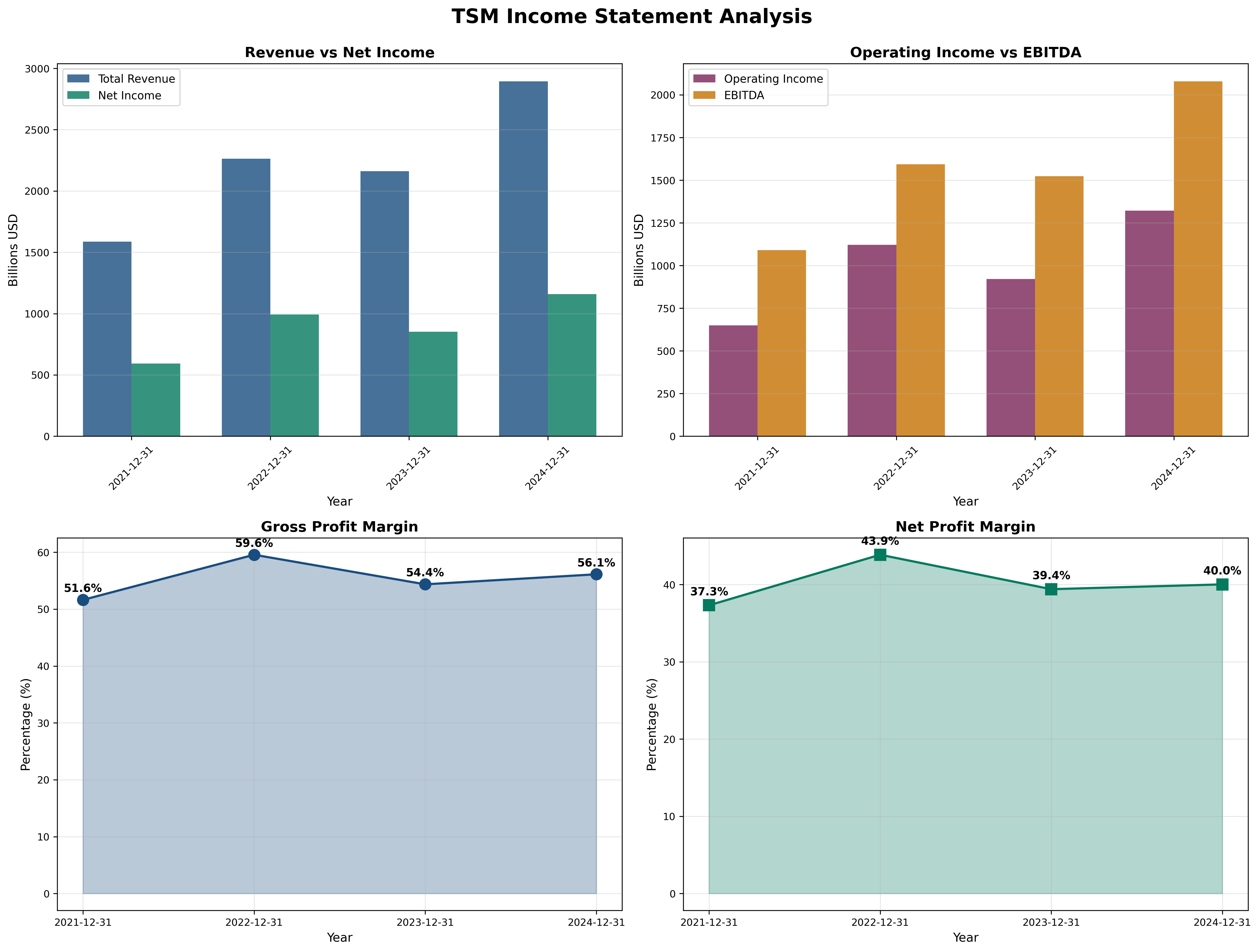

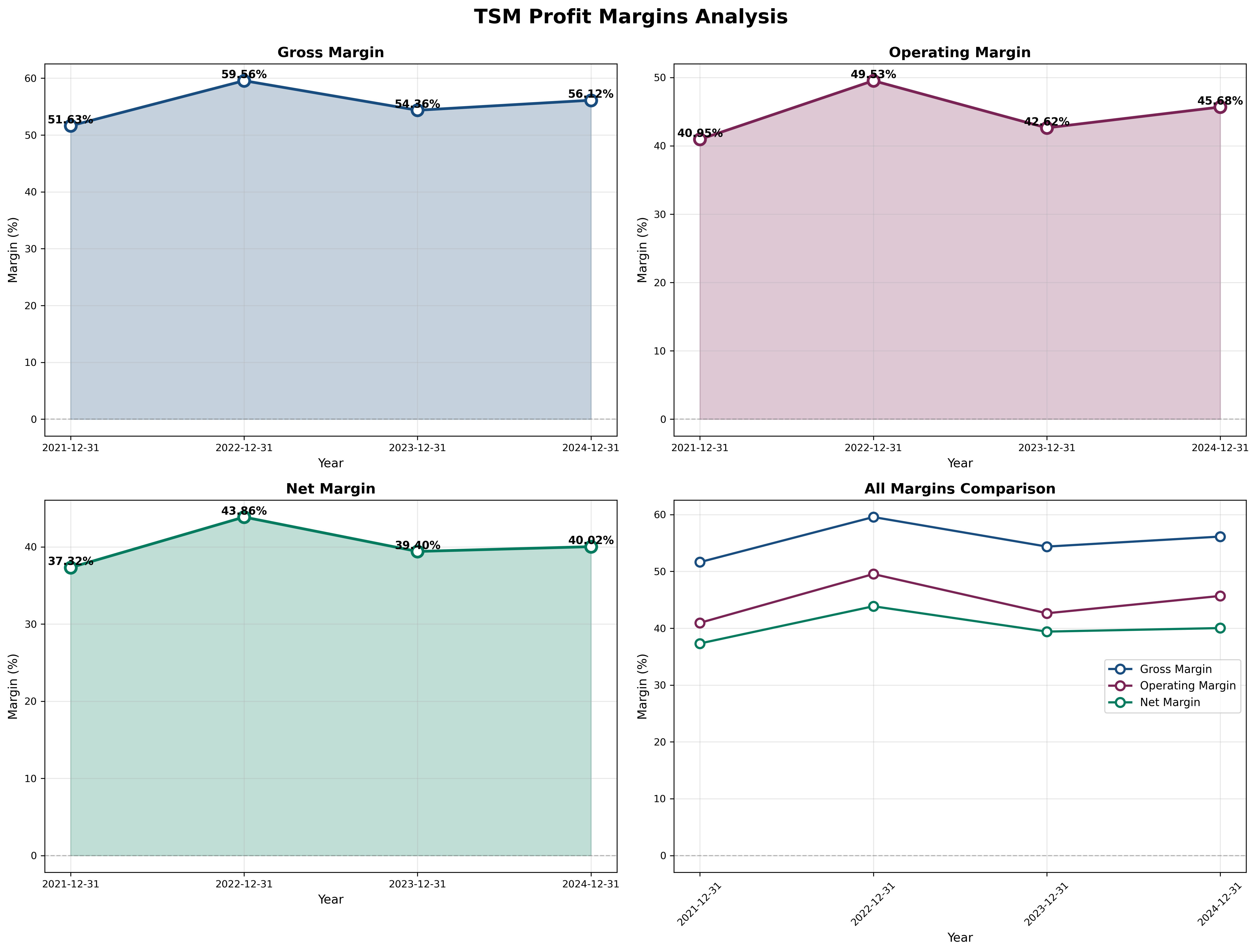

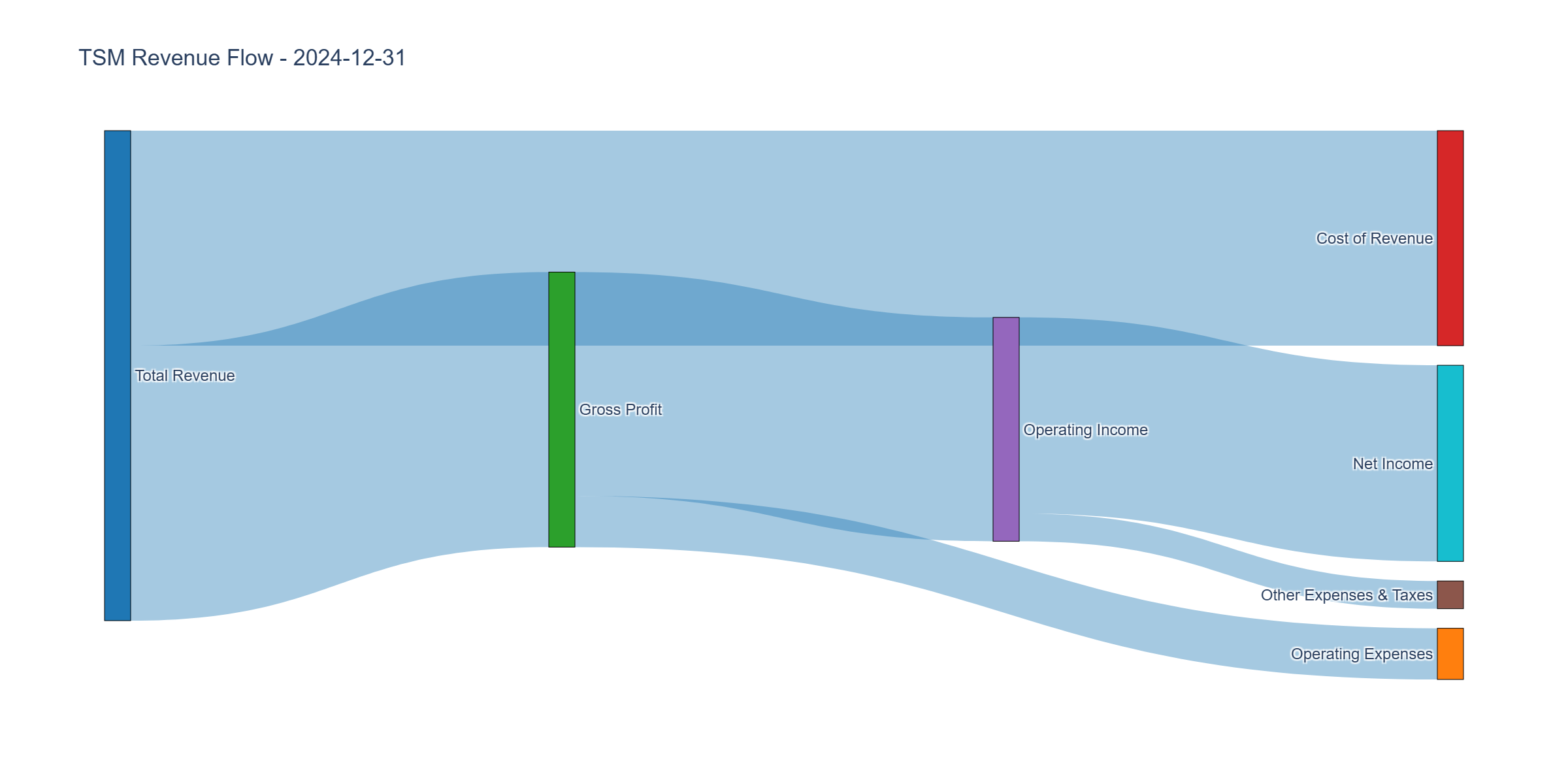

Income Statement Analysis

Key Metrics:

- Revenue Growth (4Y CAGR): 17.4%

- Gross Margin: 56.1% (trend: stable despite mix)

- Operating Margin: 45.7% vs Industry ~35%

- Net Margin: 40.0% (world-class for manufacturing)

Assessment: Margins are best-in-class and remarkably stable despite capex cycles. The 2022 dip reflects industry correction, not structural erosion. Overseas fab ramps (Arizona, Europe) will compress gross margins 2-3 points near-term—a strategic price worth paying for geopolitical diversification.

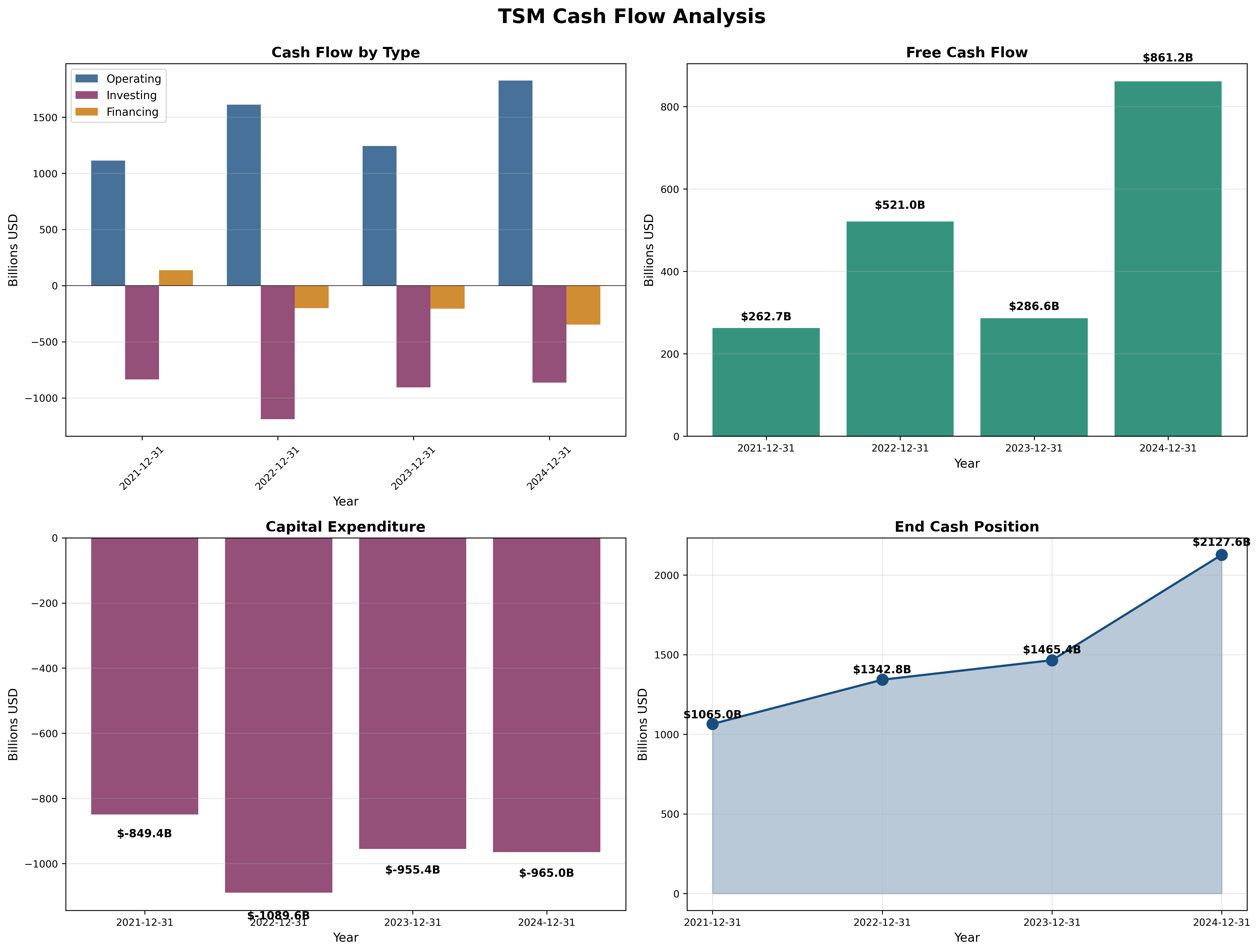

Cash Flow Generation

Key Metrics:

- OCF / Net Income: 1.48 (target > 1.0) ✅

- FCF Margin: 29.7% (volatile due to capex timing)

- Capital Intensity: 33% of revenue (high but industry-normal for leading-edge)

Assessment: Operating cash flow is robust and exceeds net income consistently—a sign of earnings quality. Free cash flow volatility reflects lumpy capex investments; normalized FCF is strong. The $861B FCF in 2024 (post-record capex) demonstrates pricing power.

Profitability Metrics

Returns:

- ROE: 34.2% (target > 15%) ✅

- ROIC: ~28% (estimated, target > 12%) ✅

- ROA: 17.3%

Assessment: Returns are exceptional and sustainable. ROIC far exceeds WACC (~8-9%), indicating value-creating reinvestment. These are not financial engineering returns—they reflect genuine competitive advantage and pricing power.

Financial Ratios Analysis

Valuation Multiples:

- P/E: 32.3x (vs. historical avg: ~18x, industry: ~25x)

- P/B: 1.67x (vs. historical avg: ~4x)

- P/FCF: 1.78x (depressed by high capex)

- EV/EBITDA: ~18x (premium but justified by quality)

PEG Ratio:

- P/E Ratio: 32.3x

- Expected Growth Rate: 10-12%

- PEG: 2.7 - 3.2 (OVERVALUED >2.0)

Combined Metric:

- P/E × P/B = 53.94 (should be < 22.5) ❌ FAILS

Assessment: Valuation multiples are elevated versus history and Graham’s criteria. The market is pricing in perfection. Even assuming 12% growth, the PEG ratio signals overvaluation. Investors are paying for quality but may be overpaying.

Capital Allocation Assessment

Management Quality Grade: A

Key Factors:

- Insider Ownership: ~6% (controlling stake via shareholding structure)

- Buyback Discipline: Modest, opportunistic—prioritizes reinvestment over buybacks (appropriate for growth phase)

- Reinvestment ROIC: 28%+ (excellent)

- Dividend Policy: 50% payout ratio, sustainable and growing

- Red Flags: None (overseas expansion dilutes margins but is strategically rational)

Assessment: Management is exceptional. They reinvest heavily when ROIC exceeds cost of capital, maintain conservative leverage, and avoid value-destructive buybacks at inflated prices. The overseas fab investments sacrifice near-term margins for long-term strategic resilience—a Buffett-endorsed tradeoff.

Valuation & Intrinsic Value

Multiple Methods Summary:

| Method | Intrinsic Value | Weight | Calculation Basis |

|---|---|---|---|

| Owner Earnings (8.5+2g) | $225 | 35% | EPS $9.15, g=12%, Y=5% |

| DCF (Conservative) | $240 | 30% | 10% discount rate, 8% growth |

| PEG-Based Fair Value | $210 | 20% | PEG=1.5, justified P/E=18x |

| Graham Number √(22.5×EPS×BVPS) | $198 | 15% | EPS $9.15, BVPS $177 |

Weighted Intrinsic Value: $227

Valuation Range:

- Conservative: $195 (worst case, margin compression + multiple contraction)

- Base Case: $227 (normalized growth and margins)

- Optimistic: $270 (AI supercycle + margin expansion)

Current Price: $295.68 Margin of Safety: -30% vs Base Case (INSUFFICIENT)

Verdict: Trading 30% ABOVE intrinsic value. This violates the fundamental principle of value investing—no margin of safety exists.

Risk Assessment

Key Risks (Top 3)

Geopolitical Risk (Taiwan): Any military conflict or blockade could destroy 60%+ of global leading-edge capacity overnight—catastrophic scenario with incalculable impact.

Margin Dilution from Global Expansion: Arizona/Europe fabs run at 2-3 percentage point lower gross margins; if scale doesn’t improve, this becomes structural headwind lasting 5+ years.

Technology Transition Risk: N2/A16 node transitions are extraordinarily complex; any yield issues or delays could hand market share to Samsung or cause customer roadmap disruptions.

Worst Case Scenario: Geopolitical crisis combined with manufacturing execution issues could send stock to $150-180 (40-50% downside). Even without crisis, multiple compression to historical average (P/E ~22x) implies $200 price target (-32%).

Market Sentiment

Current Sentiment: Optimism (not euphoria, but elevated)

Contrarian Signal: Stock has tripled from 2022 lows. AI enthusiasm has driven semiconductor valuations to frothy levels. This is NOT the time of maximum pessimism—it’s approaching maximum optimism. Graham would counsel patience.

Investment Recommendation

Current Assessment

Valuation: PEG = 2.9 | P/E = 32.3x vs Fair 20-22x | P/E × P/B = 53.94 vs Target <22.5 Verdict: OVERVALUED by 30%+

Margin of Safety: -30% ❌ INSUFFICIENT (need +25% minimum)

Entry Zones

| Zone | Price | Action | Margin of Safety |

|---|---|---|---|

| 🟢 Strong Buy | < $200 | Aggressive accumulation | 40%+ margin |

| 🟡 Buy | $200 - $225 | Gradual accumulation | 25-30% margin |

| 🟠 Hold | $225 - $270 | Hold existing, don’t add | 10-20% margin |

| 🔴 Avoid/Trim | > $270 | Reduce exposure | < 10% margin |

Current Price: $295.68 → Recommendation: HOLD / AVOID NEW PURCHASES

Expected Returns

- Bull Case (+15%): AI supercycle accelerates, packaging bottlenecks ease, N2 ramps flawlessly → $340 (fair value stretches to 25x earnings)

- Base Case (-15% to +5%): Normal growth, margin pressures persist, multiple compression → $250 (reversion to normalized P/E ~22x)

- Bear Case (-35%): Geopolitical shock or recession + tech spending cuts → $195 (conservative valuation floor)

Risk/Reward: Asymmetric to downside at current price. 15% upside vs 35% downside = poor investment setup.

Final Investment Conclusion

Overall Grade: B+ (Excellent business, mediocre price)

Category Scores:

- Business Quality: 10/10 (unmatched moat and execution)

- Financial Strength: 10/10 (fortress balance sheet)

- Management Quality: 9/10 (capital allocators, strategic vision)

- Valuation: 4/10 (30% overvalued by multiple methods)

- Margin of Safety: 2/10 (none exists; downside exceeds upside)

Final Verdict: HOLD EXISTING / WAIT FOR $200-225 TO BUY

Investment Thesis Summary

Business Quality: TSMC is arguably the world’s best-run semiconductor company with an unassailable competitive position. The moat is widening, not narrowing, as AI and advanced packaging demands play to TSMC’s strengths. Management is rational, conservative with leverage, and focused on long-term value creation. This is a 10/10 business.

Valuation: The problem is price, not quality. At $296, investors pay 32x earnings for a company growing 10-12%—a PEG ratio of 2.9x. Classical value metrics scream overvaluation: P/E × P/B is 54 versus Graham’s 22.5 limit. Even generous DCF models struggle to justify current prices without heroic assumptions. The market has priced in a perfect scenario with no room for error.

Risks: Geopolitical concentration in Taiwan is the elephant in the room. While global expansion mitigates this, it simultaneously compresses margins. The stock trades at peak-cycle valuations despite margin headwinds ahead. Any combination of: (1) geopolitical incident, (2) tech spending slowdown, (3) execution missteps, or (4) multiple normalization would produce painful losses.

Catalysts: The only positive catalyst would be a significant pullback. A 30-35% correction to $200-225 would create a compelling entry point with adequate margin of safety. Alternatively, if earnings grow into the valuation over 2-3 years while price stagnates, the setup improves—but why tie up capital waiting?

Framework Checklist

- ❌ Quantitative: No margin of safety (trading 30% above intrinsic value)

- ✅ Moat: Exceptional and widening competitive advantage

- ✅ Management: World-class capital allocators

- ❌ Contrarian: Market optimism, not pessimism—wrong time to buy

- ✅ Simplicity: Business model is clear and understandable

Would I hold this for 10+ years if the market closed tomorrow? Yes, but only if I owned it at $200-225. At $296, the answer is no—I’m paying for perfection with no margin of safety. As Graham said: “The risk of paying too high a price for good-quality stocks… is the chief hazard confronting the investor.”

The Contrarian Value Investor’s Perspective

What Graham Would Say: “This is a wonderful business, but your return depends on the price you pay. At 32x earnings and 54 on the combined ratio, you’re speculating on multiple expansion, not investing with a margin of safety. Wait for Mr. Market’s inevitable pessimism.”

What Buffett Would Say: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. But even wonderful companies can be overpriced. The best thing to do when there’s nothing to do is to do nothing. Wait for the fat pitch.”

The Templeton Principle: “Buy at the point of maximum pessimism, sell at the point of maximum optimism.” TSM is closer to the latter. The 2022 low around $70-80 was maximum pessimism—that was the buy signal we missed. Today’s setup lacks the fear required for exceptional returns.

Action Plan: Add to watchlist. Set alerts at $225 (buy zone). If geopolitical fears spike or tech spending slows, be ready to act aggressively below $200. Until then, respect the discipline that separates investors from speculators: price matters.