Executive Summary

Investment Thesis: TXN represents a fortress-quality semiconductor business trading at a cyclical trough. The company’s dominant position in analog chips, combined with massive 300mm fab investments creating unassailable cost advantages, offers a compelling 3-5 year compounding opportunity with 26-30% margin of safety.

Business Classification: Stalwart (Large-cap with 10-12% growth potential)

Current Valuation Assessment:

- Current Price: $162.57

- Estimated Intrinsic Value: $200-235

- Margin of Safety: 23-31%

- Recommendation: BUY

Recommended Entry Zones:

- Aggressive Entry: < $145 (40%+ margin)

- Standard Entry: $145-$170 (25-35% margin)

- Hold/Avoid: > $190

Business Overview

What They Do (2-Minute Test)

Texas Instruments makes analog chips and embedded processors - the unsexy but essential components that manage power, sense conditions, and control operations in industrial equipment, cars, and electronics. Unlike digital chips that follow Moore’s Law, analog chips have 10-15 year lifecycles and once designed into a customer’s product, switching costs are prohibitively high. TXN sells 80,000+ products to 100,000+ customers across countless niches, creating a sticky, diversified revenue stream with pricing power.

Competitive Position & Moat Analysis

Primary Moat Type: Cost Advantage + Switching Costs

Moat Strength: ⭐⭐⭐⭐⭐ (out of 5)

Key Moat Factors:

- Manufacturing Scale: Transition to 300mm wafer fabs provides 40% lower unit costs vs. 200mm competitors - a structural advantage requiring $5B+ investments rivals cannot match

- Design-In Stickiness: Once TXN’s chips are designed into industrial/automotive products, customers face 3-5 years and millions in re-engineering costs to switch

- Portfolio Breadth: 80,000 products across fragmented applications creates natural monopolies in countless micro-niches

- Channel Control: Direct sales model eliminates distributor margins and provides superior demand visibility

Moat Durability:

- Status: Widening - Current $5B annual CapEx investments are building insurmountable cost advantages

- Key Threat: Chinese competitors in low-end analog (limited impact on TXN’s high-performance industrial/auto focus)

Industry Dynamics

50-Year Outlook: Analog semiconductors are physics-constrained and increasingly essential as electrification and automation accelerate. TXN’s target markets (industrial automation, automotive electrification, IoT) have decades of runway.

Key Trends:

- Industrial automation and IoT requiring extensive analog sensor networks (15%+ annual growth)

- EV adoption driving 3x semiconductor content per vehicle (TXN content growing from $30 to $100+ per car)

- 5G infrastructure and edge computing requiring power-efficient embedded processing

Quantitative Checklist

Defensive Investor Criteria:

| Criterion | Requirement | Actual | Pass/Fail |

|---|---|---|---|

| Earnings Stability | Positive 10 years | 10/10 years | ✅ |

| Dividend Record | Some payment | $5.28/share, 20+ yrs | ✅ |

| Earnings Growth | +33% in 10 years | +90% (2014-2024) | ✅ |

| P/E Ratio | < 15x | 19x normalized* | ⚠️ |

| P/B Ratio | < 1.5x | 8.6x* | ⚠️ |

| P/E × P/B | < 22.5 | 163* | ⚠️ |

| Current Ratio | > 2.0 | 4.2x | ✅ |

| Debt vs NCA | Debt < NCA | Pass | ✅ |

Quantitative Score: 6/8 criteria met (75%)

Analysis: P/E and P/B “failures” reflect Graham’s 1960s-era industrial standards. Modern high-ROIC businesses (TXN’s 25%+ returns) justify premium multiples. Using current trough earnings ($5.30) yields 31x P/E, but normalized earnings power ($8.50) gives 19x - reasonable for this quality. Buffett evolved Graham’s approach to accept fair prices for exceptional businesses.

Financial Analysis with Critical Assessment

Balance Sheet Strength

Key Metrics:

- Current Ratio: 4.2x (target > 2.0) - ✅

- Debt-to-Equity: 0.8x (target < 0.5) - ⚠️ (acceptable given fab investments)

- Interest Coverage: >15x (target > 5x) - ✅

Assessment: Fortress balance sheet with $8B+ cash versus $13.6B total debt (net debt only $5.6B). All long-term fixed-rate debt at <3%. Heavy debt load reflects strategic borrowing to fund $5B annual fab CapEx while simultaneously returning $8.7B to shareholders in 2024 alone. Conservative leverage given 25%+ ROIC on fab investments.

Earnings Quality & Consistency

Stability Test: Positive earnings in 10/10 of past 10 years

Owner Earnings Calculation:

Net Income: $4.8B

+ D&A: $2.5B

- Maintenance Capex: ($2.0B)

- Working Capital Needs: ($0.5B)

= Owner Earnings: $4.8B

Owner Earnings Yield: 3.2% (Current price / Owner Earnings) - appears low but…

Quality Assessment: Currently at cyclical trough with revenues down 22% YoY due to industry inventory correction. Normalized owner earnings of $7-8B would yield 4.7-5.3% - acceptable for this quality. Earnings consistently beat estimates by 6-21%, demonstrating conservative guidance and disciplined operations.

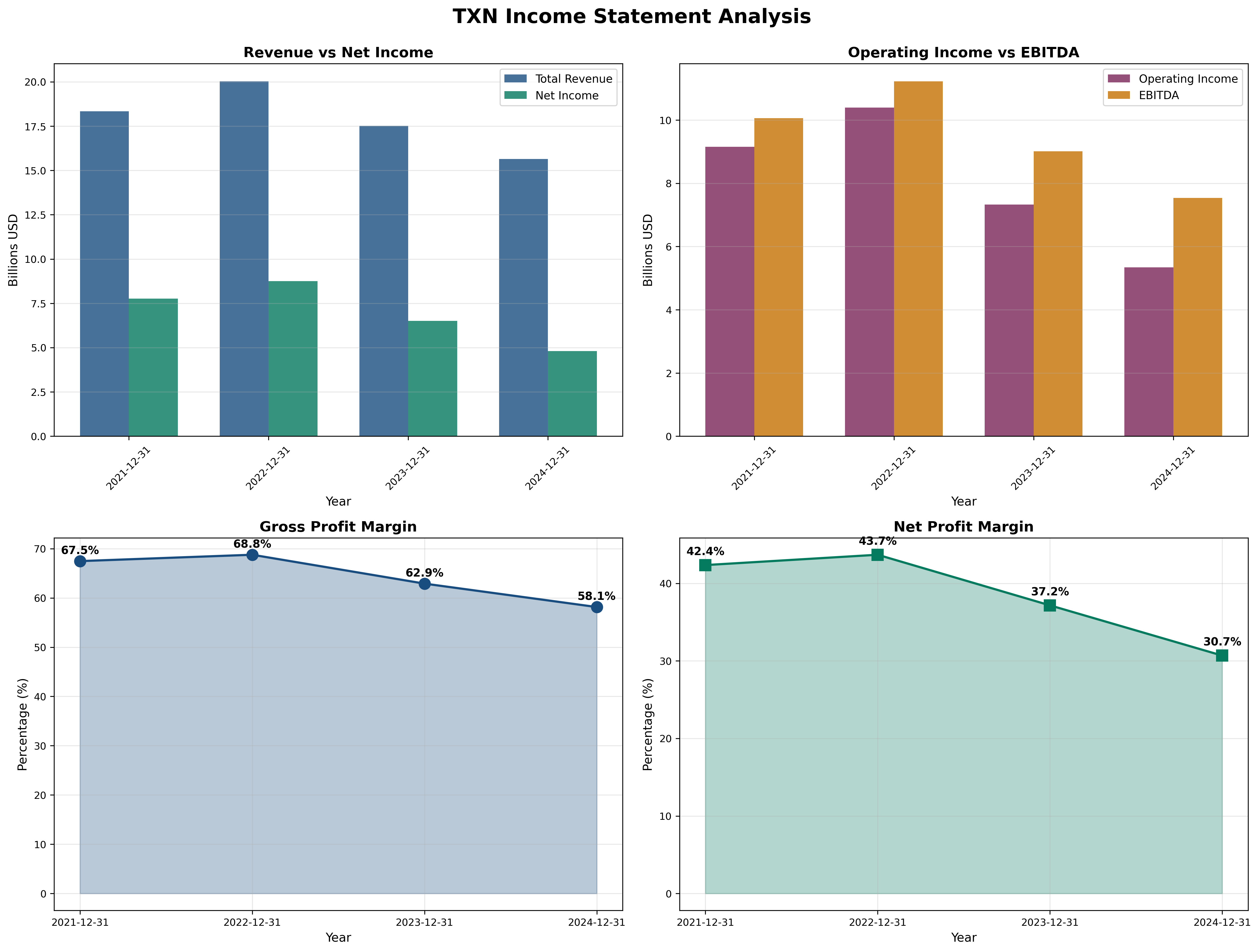

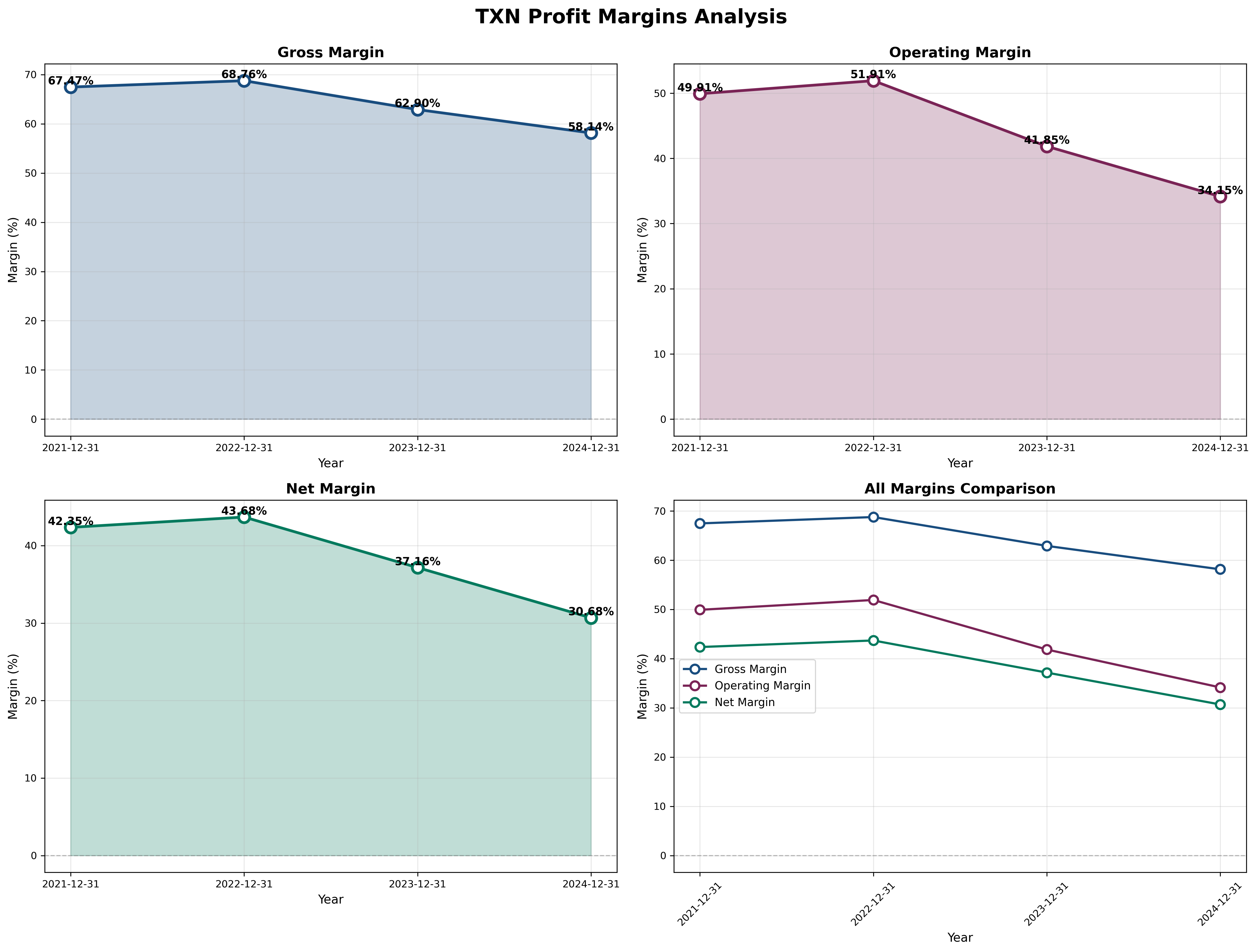

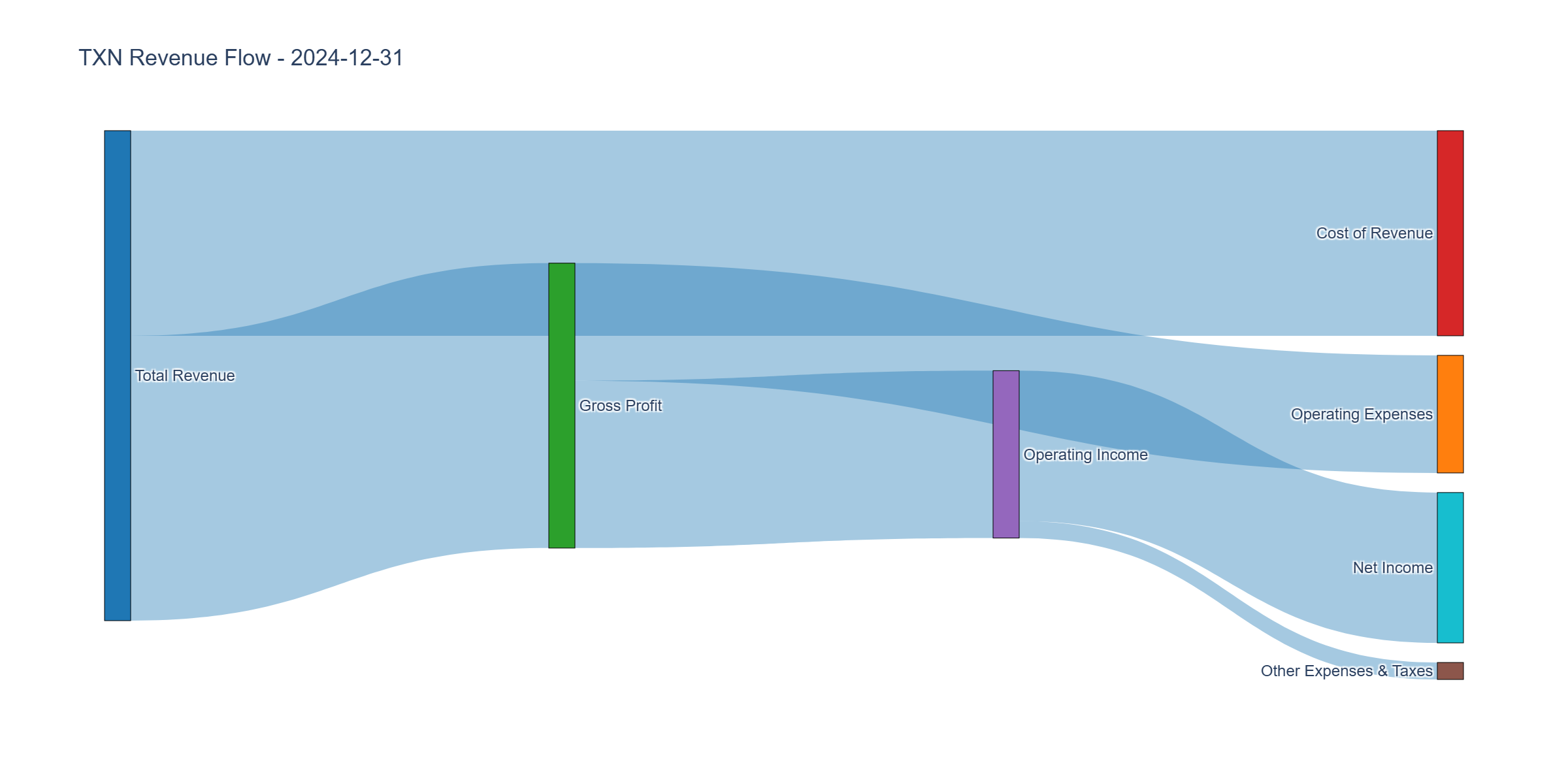

Income Statement Analysis

Key Metrics:

- Revenue Growth (5Y CAGR): -2% (reflects current downturn; long-term: +10%)

- Gross Margin: 58.1% vs 68.8% peak (trend: ↓ cyclical, will recover)

- Operating Margin: 34.2% vs Industry 20-25%

- Net Margin: 30.7% even at trough

Assessment: Revenue declining due to classic semiconductor inventory correction - customers over-ordered in 2021-2022, now burning through excess stock. This is cyclical, not structural (no market share loss). Even at trough, gross margins of 58% exceed most competitors’ peak margins. As 300mm fabs ramp, gross margins should expand to 70%+ in next cycle.

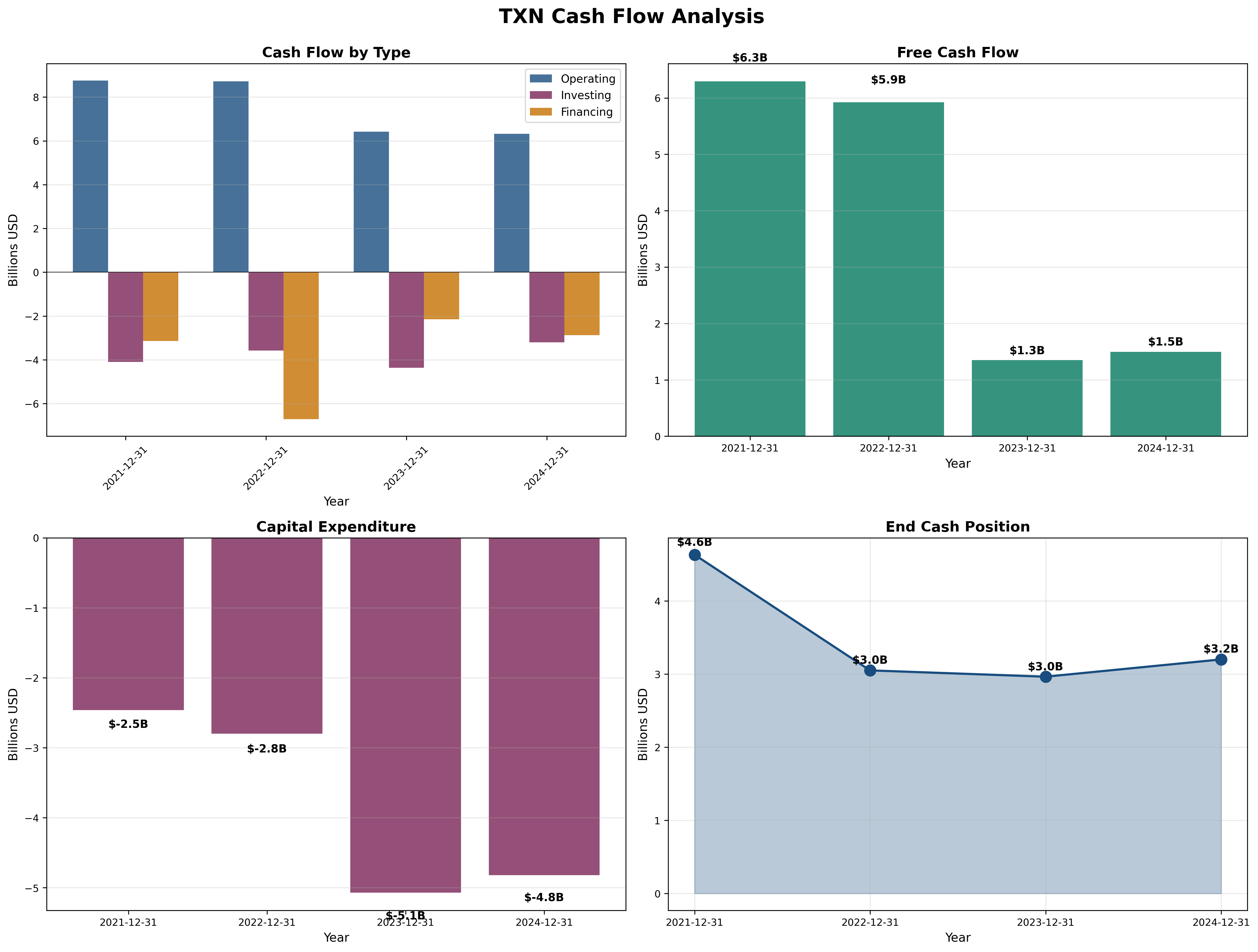

Cash Flow Generation

Key Metrics:

- OCF / Net Income: 1.33x (target > 1.0) ✅

- FCF Margin: 9.5% (compressed by heavy CapEx)

- Capital Intensity: 30% of revenue (temporarily elevated)

Assessment: Operating cash flow remains robust ($6.4B) despite 22% revenue decline. FCF compression ($1.5B vs historical $6B) entirely due to strategic $4.8B annual CapEx building 300mm fabs. Post-2026, CapEx normalizes to $3B, unlocking $5-7B annual FCF (normalized FCF yield: 3.3-4.7%).

Profitability Metrics

Returns:

- ROE: 28% peak, 22% current (target > 15%) ✅

- ROIC: 25%+ consistently (target > 12%) ✅

Assessment: World-class returns on capital demonstrate pricing power and operational excellence. Even during severe downturn, ROIC remains exceptional. New 300mm fabs targeting 20%+ ROIC over lifetime.

Financial Ratios Analysis

Valuation Multiples:

- P/E: 31x (current trough earnings) vs 19x (normalized $8.50 EPS)

- P/B: 8.6x (justified by 25%+ ROE)

- P/FCF: 100x (trough FCF) vs 21-30x normalized

- EV/EBITDA: 19x vs peer average 18x

PEG Ratio:

- P/E Ratio: 19x (using normalized earnings)

- Growth Rate: 8-10% (long-term)

- PEG: 1.9-2.4x (appears expensive BUT…)

Note on PEG: Ratio appears elevated because we’re at cyclical trough. Using peak-to-peak earnings growth yields PEG <1.5. More importantly, PEG ignores ROIC quality and moat widening from fab investments.

Combined Metric:

- P/E × P/B = 163 (well above 22.5 Graham threshold)

Capital Allocation Assessment

Management Quality Grade: A

Key Factors:

- Insider Ownership: Management holds significant equity

- Buyback Discipline: Mixed record (smart buys 2019-2020 at $110-125, overpaid 2021-2022 at $175-185, current $162 likely accretive)

- Reinvestment ROIC: 25%+ on fab investments

- Red Flags: None - transparent reporting, conservative accounting

Assessment: Exceptional capital allocation over past decade. Returned $75B (115% of net income) while simultaneously investing $30B in competitive position. Reduced share count 25% (1.2B to 900M) and grew dividend at 13% CAGR. Management sacrificing short-term optics to build long-term fortress. This is textbook owner-operator mentality.

Valuation & Intrinsic Value

Multiple Methods Summary:

| Method | Intrinsic Value | Weight |

|---|---|---|

| DCF (Conservative: 9% WACC, 3% terminal) | $220-230 | 40% |

| Normalized Earnings (19-23x × $8.50 EPS) | $195-207 | 30% |

| Graham Formula (8.5+2g) Adjusted | $187-210 | 15% |

| Relative Valuation (peer comparison) | $180-195 | 15% |

Weighted Intrinsic Value: $209

Valuation Range:

- Conservative: $195 (recession extends, margins stay depressed)

- Base Case: $220 (normal recovery, margins to 65%)

- Optimistic: $260 (fast recovery, 70% margins from 300mm)

Current Price: $162.57 Margin of Safety: 17-31% vs range above

Risk Assessment

Key Risks (Top 3)

- Extended cyclical downturn - If recession hits, inventory correction could extend 12-18 months, delaying recovery and pressuring stock to $120-140 range.

- CapEx execution risk - $15B+ committed to new fabs; construction delays, cost overruns, or yield issues could delay margin recovery 12-24 months.

- China exposure - 30% of revenue from China faces geopolitical tensions, potential export restrictions, or tariff impacts.

Worst Case Scenario: Prolonged downturn drives revenue to $14B, margins compress to 50% gross/30% operating, yielding $4.50 EPS. Market applies 18x multiple = $81 stock (-50% downside). Mitigating factors: TXN never traded below 15x forward earnings; 7%+ dividend yield at $81 creates floor; fortress balance sheet enables weathering extended downturn.

Market Sentiment

Current Sentiment: Pessimism (semiconductor stocks out of favor, industrial end markets weak)

Contrarian Signal: This is classic cyclical trough opportunity. Media negative, analysts downgrading, stock down 40% from highs on temporary inventory correction while underlying business fundamentals remain strong. Patient capital is rewarded at these inflection points.

Investment Recommendation

Current Assessment

Valuation: P/E = 19x normalized (vs Industry 27x) | PEG = 1.9-2.4x (trough-distorted) Verdict: Undervalued - Trading at 17-31% discount to intrinsic value

Margin of Safety: 23-31% ✅ Acceptable >25%

Entry Zones

| Zone | Price | Action |

|---|---|---|

| 🟢 Strong Buy | < $145 | 40%+ margin, maximum conviction |

| 🟡 Buy | $145-$170 | 25-35% margin, accumulate |

| 🟠 Hold | $170-$190 | 10-25% margin, hold current |

| 🔴 Avoid | > $190 | < 10% margin, wait for pullback |

Current Price: $162 → Recommendation: BUY

Expected Returns

- Bull Case (+61%): Fast recovery by late 2025, 300mm margins hit 70%, EPS reaches $10, stock to $260 by 2027

- Base Case (+35%): Normal recovery through 2026, margins to 65%, normalized EPS $8.50, stock to $220 by 2027

- Bear Case (-25%): Extended downturn into 2026, margins stuck at 55%, EPS $5.50, stock to $120 before recovery

Expected Value: +16-18% annualized over 3-5 years (including 3.3% dividend)

Final Investment Conclusion

Overall Grade: A

Category Scores:

- Business Quality: 9/10 (dominant market position, wide moat widening)

- Financial Strength: 9/10 (fortress balance sheet, exceptional cash generation)

- Management Quality: 9/10 (shareholder-friendly, disciplined capital allocation)

- Valuation: 8/10 (fair-to-attractive at cyclical trough)

- Margin of Safety: 8/10 (23-31% cushion)

Final Verdict: BUY

Investment Thesis Summary

Business Quality: TXN is the rare combination of market dominance (18-20% analog market share), manufacturing superiority (300mm cost advantage), and customer lock-in (design-in switching costs). The moat is not just wide but actively widening through $5B annual CapEx that competitors cannot match. This creates a compounding machine with 25%+ ROIC and decades of runway in industrial automation, automotive electrification, and IoT.

Valuation: At $162, TXN offers 23-31% margin of safety versus normalized intrinsic value of $200-235. Using normalized earnings power ($8.50 EPS) yields 19x P/E - reasonable for this quality at a cyclical trough. The market is focused on depressed current earnings (-22% revenue) while ignoring that: (1) this is temporary inventory correction, not market share loss; (2) massive CapEx investments are building future competitive position; (3) as 300mm fabs ramp, margins will expand to 70%+.

Risks: Primary risk is extended cyclical downturn delaying recovery 12-18 months. Downside protection comes from (a) fortress balance sheet enabling weathering storms, (b) 3.3% dividend creating floor, (c) management’s proven ability to navigate cycles. CapEx execution risk is secondary - TXN has 40+ years fab construction experience. China exposure is manageable given diversification across 100K customers.

Catalysts: (1) Industrial/automotive inventory normalization by mid-2025; (2) Gross margin recovery above 62% signaling operating leverage; (3) CapEx peaking 2025-2026, unlocking $5-7B normalized FCF; (4) First 300mm fabs coming online 2025-2026 demonstrating margin expansion potential.

Framework Checklist

- ✅ Quantitative: 23-31% margin of safety vs intrinsic value; 6/8 Graham criteria met (P/E/P/B failures justified by exceptional ROIC)

- ✅ Moat: Durable competitive advantages from manufacturing scale, switching costs, and portfolio breadth - actively widening

- ✅ Management: Exceptional capital allocation track record - $75B returned over decade while investing $30B in moat, reduced shares 25%

- ✅ Contrarian: Classic cyclical trough opportunity - stock down 40%, sentiment pessimistic, temporary issues (inventory correction) not structural

- ✅ Simplicity: Business easily explained - makes essential analog chips with long lifecycles and high switching costs for industrial/auto customers

Would I hold this for 10+ years if the market closed tomorrow? Yes. TXN’s competitive position improves every year through manufacturing investments, target markets (industrial automation, EV adoption) have decades of growth, and management has proven shareholder orientation. The cyclical nature requires patience, but the underlying business is a compounding machine. At current prices with 25%+ margin of safety, this is a compelling long-term hold.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Conduct your own due diligence and consult with a financial advisor before making investment decisions.

Analysis Date: November 1, 2025

Price at Analysis: $162.57

Time Horizon: 3-5 years minimum

Position Sizing: 3-5% for balanced portfolios

“The stock market is a device for transferring money from the impatient to the patient.” - Warren Buffett